AMD’s $260 billion market cap means it’s just a fraction of the size of its much larger rival.

Advanced Micro Devices (AMD -0.14%) and Nvidia (NVDA 0.57%) are rival companies, but the former is well behind the latter when it comes to market cap. While Nvidia’s valuation is north of $4 trillion, AMD’s valuation is closer to $263 billion.

AMD is nowhere near the size of the larger chipmaker, but it does possess some incredible potential because of its association with artificial intelligence (AI). The key test is whether its latest chips will provide formidable competition and be able to take market share from Nvidia.

Is the market mispricing AMD’s stock, and could it be a steal of a deal? Or is Nvidia really worth that much more than its smaller rival?

Image source: Getty Images.

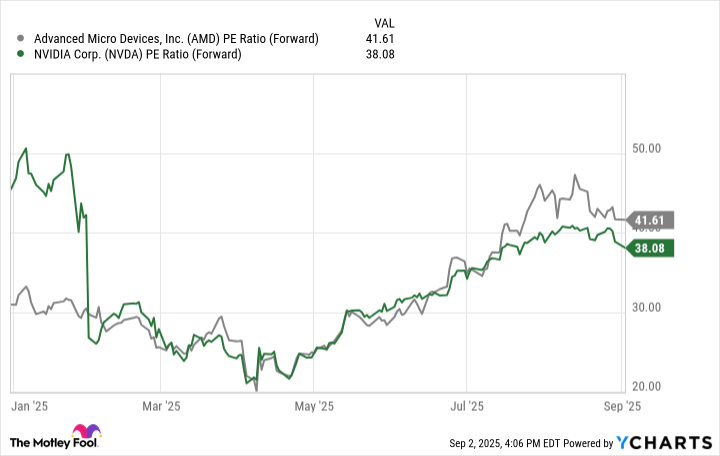

How the stocks compare with respect to earnings

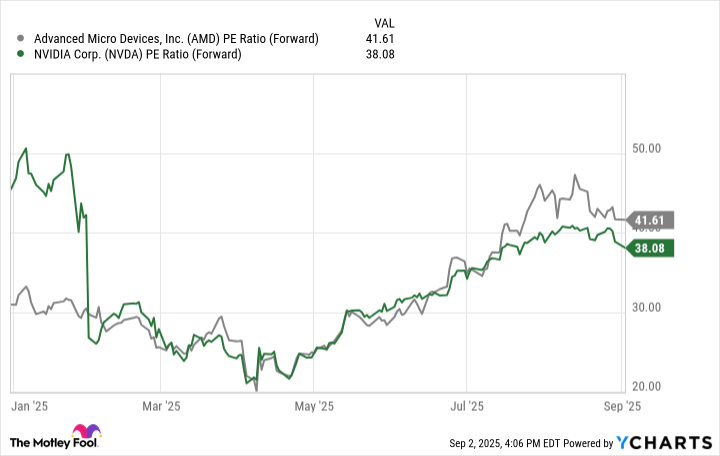

Although Nvidia is the more valuable company overall, it’s also much more profitable than AMD. That’s why comparing stocks based on their respective price-to-earnings (P/E) multiples is a much more effective way to gauge how cheap or expensive one stock is in relation to another. And the chart below shows what their forward P/E multiples are, which are based on analysts’ expectations of their future profits.

Data by YCharts.

While their valuations are significantly different in terms of market cap, based on their forward P/E multiples, they are similarly valued, and AMD is in fact the more expensive stock when looking at this metric.

Why AMD may be a bit underrated

Nvidia is bigger, more profitable, and the safer-looking stock when compared to AMD. But a case can be made for why AMD could still be an underrated investment. It recently rolled out its new Instinct MI400 chip, which will be available next year. And CEO Lisa Su recently told analysts that for its current version, the MI350, “seven of the top 10 model builders and AI companies” already use it.

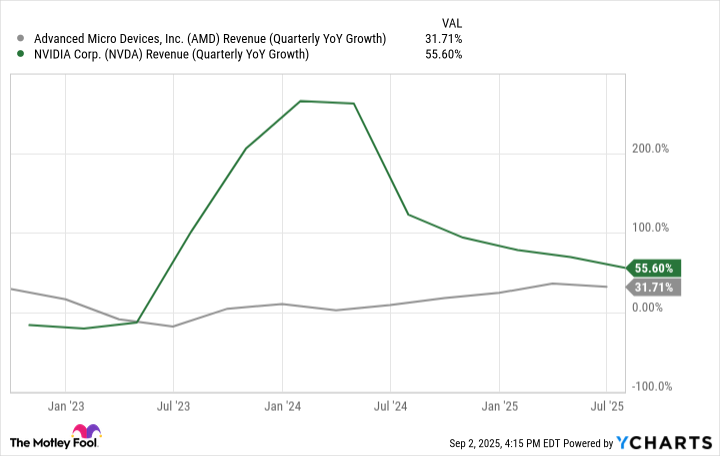

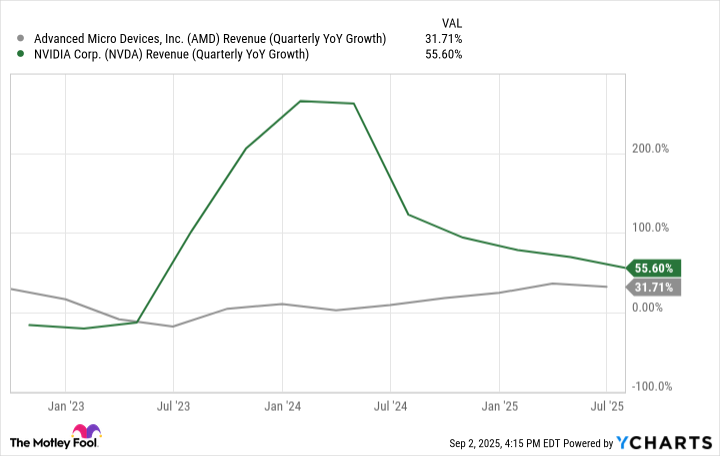

If the MI350 is already attracting top AI companies, then the more advanced MI400 chip may be able to benefit from that and drive even more growth for the business. AMD’s growth rate has been climbing in recent quarters while Nvidia’s has been going in the opposite direction.

Data by YCharts.

Should these patterns continue, then it may not be difficult to envision a scenario in which analysts hike their forecasts for AMD, which may make it appear to be a cheaper buy down the road. As a bit of a laggard in the AI chip market, AMD hasn’t been nearly as exciting a growth stock as Nvidia, but that could soon change.

Which stock should you buy?

Although these two stocks are similarly valued based on their projected earnings multiples, AMD still looks like it may have more upside in the long run, simply because its results haven’t been as impressive as Nvidia’s thus far. However, if its growth rate continues to improve as Nvidia’s slows down, it may be due for a big rally. So far this year, AMD’s stock is up over 34% while Nvidia’s has risen by 27%, as investors are starting to feel a bit more bullish on AMD.

Nvidia remains the safer stock to go with in the long run, given its dominance in the AI chip market. But if you’re looking for a bit more upside and don’t mind taking on some risk and a bit more uncertainty, then AMD could be the better option at this stage. Even though it may not be a bargain buy and still has to deliver some stronger financials to show that it can offer significant competition to Nvidia, I think it’s on the right path and has the potential to be the better AI stock to buy at this point.