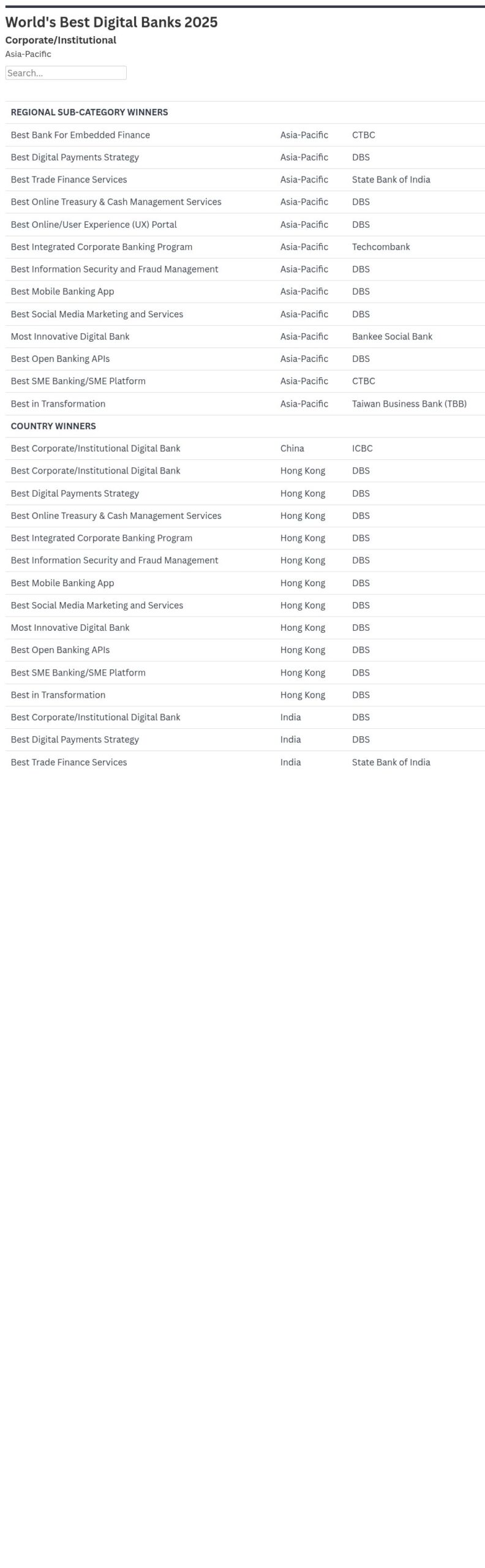

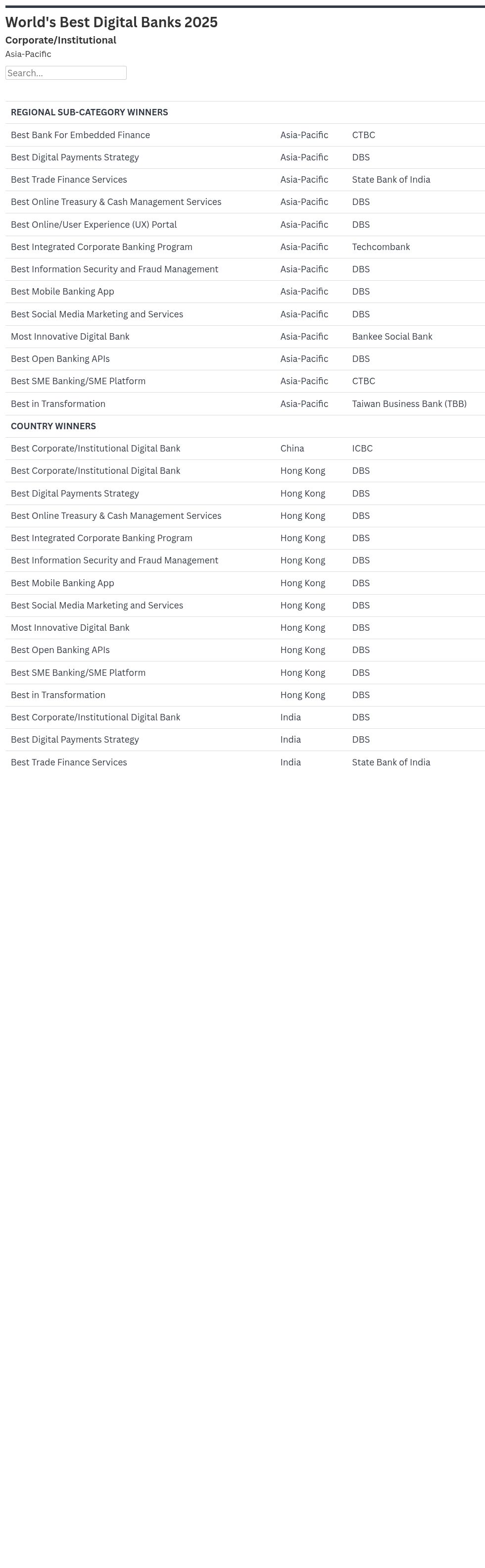

Best Corporate/Institutional Digital Banks in Asia-Pacific 2025

Banks in the Asia-Pacific region are pushing boundaries with bank-to-enterprise API connections, AI-powered insights, and the integration of generative AI (GenAI) as a driver of efficiency.

Taiwan’s CTBC Bank leads with direct bank-to-enterprise API connections for seamless enterprise resource planning transactions, an app that is friendly for SMEs to use for paperless operations, and real-time foreign exchange hedging. This year, CTBC plans to launch supply chain finance software on the SAP Global Store and has developed its AI-powered EI6 enterprise intelligence platform for proactive financial consulting, positioning the bank as a strategic partner beyond traditional banking.

Following suit in digital innovation, Singapore’s DBS has demonstrated leadership in the SME sector. Streamlined onboarding facilitates expedited account opening, while GenAI has reduced know-your-customer (KYC) processing time by 33%. AI-powered personalization has increased outward payments by 29% and boosted balances in current accounts and savings accounts.

Strategic partnerships, such as One-Click Payroll, have increased new customer acquisition by 35%, according to DBS reports. The DBS RAPID API suite has handled 900 million corporate API calls so far, with usage in Hong Kong increasing by 17% in 2024. DBS also uses an AI-powered Digital Twin Customer Service Officer and is testing Joy, a GenAI bot that focuses on technologically advanced customer service and efficiency.

Mirroring this commitment to advanced technology, Bankee Social Bank is Taiwan’s foremost cryptocurrency-friendly banking institution, overseeing over 90% of Taiwan’s virtual-asset cash flows. Bankee combines Web 3.0 and AI, establishing global benchmarks in fraud prevention with its 4D Full-Dimensional AI Intelligent Anti-Fraud System, which has prevented over 300 million New Taiwan dollars (about US$9.8 million) in fraudulent transactions, with a 98.7% accuracy rate.

Founded by Far Eastern International Bank, Bankee operates on a sharing economy paradigm, engaging customers in product development and profit distribution. It functions as both a bank-as-a-platform (BaaP) and bank-as-a-service (BaaS), fostering a comprehensive financial ecosystem through strategic partnerships and open APIs aimed at augmenting its digital customer base.