CoreWeave’s Valuation Soars on Meta Partnership, But Is It Overheating?

CoreWeave just signed a $14 billion deal with Meta.

Few stocks are as directly exposed to artificial intelligence as CoreWeave (CRWV 0.72%). The AI cloud infrastructure company reinvented itself, transitioning from a crypto mining company by repurposing its GPUs to provide AI computing power to customers like Microsoft, Nvidia, and OpenAI.

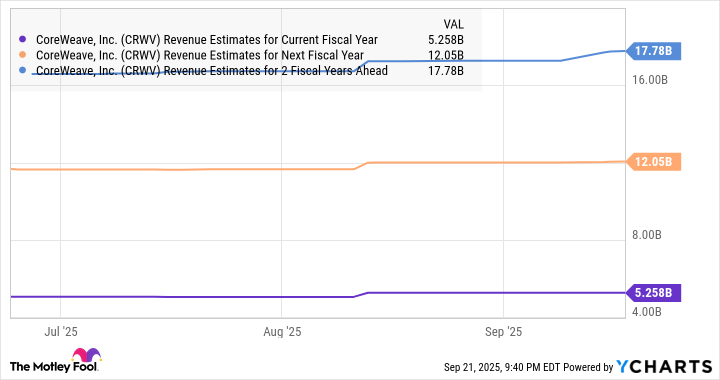

With the AI boom in full swing, that business model has led to jaw-dropping growth. In its second quarter, its revenue jumped 206% to $1.21 billion, showing how fast demand for its services is ramping up.

Now, CoreWeave just got another shot in the arm as the stock jumped 12% on Tuesday after announcing another blockbuster deal, this time with Meta Platforms (META 1.35%).

Image source: Getty Images.

What’s happening with CoreWeave and Meta?

Meta is committing to spend up to $14.2 billion through 2032 on cloud computing capacity from CoreWeave, with an option to expand its commitment.

The deal comes at a time when Meta has been ramping up its spending on AI, seeing it as a must-win for its future. In June, Meta acquired a 49% stake in Scale AI, a data-labeling start-up, and poached its CEO, Alexandr Wang, to run its new AI lab.

On the same day that the CoreWeave news came out, Meta also announced that it’s buying the chip start-up Rivos, which designs chips based on RISC-V architecture, an alternative to those used by leading CPU architecture designers Arm, Intel, and AMD. Rivos is also expected to help Meta build out full-stack AI systems.

For CoreWeave, the deal builds on the earlier momentum it earned when it signed an expanded $6.5 billion agreement with OpenAI in September, bringing its total contract with OpenAI to $22.4 billion.

The drumbeat of positive news for AI includes rival Nebius’s $17 billion deal with Microsoft, Oracle’s huge cloud computing forecast, and CoreWeave’s own wins, including OpenAI, Meta, and a $6.3 billion deal with Nvidia, in which it will buy any of CoreWeave’s unused capacity, effectively backstopping the company’s growth.

Those news items, and improving sentiment around CoreWeave, sparked a recovery in the stock last month. After falling by more than 50% from its peak in June, CoreWeave jumped more than 50% off its lows early in September.

Is CoreWeave overvalued?

CoreWeave is a challenging stock to value. The company is delivering phenomenal top-line growth, but it’s also reporting huge losses. The company’s business model is risky. It’s borrowing billions of dollars to buy Nvidia GPUs and build out the infrastructure to provide next-generation AI computing.

That high-interest debt has also led CoreWeave to pay significant interest expense, set to be above $1 billion this year, essentially preventing CoreWeave from turning a profit.

For most stocks, to determine an appropriate valuation, you just look at the numbers. However, CoreWeave is in a class of its own. Given its growth rate, in which revenue is still tripling, the upside potential for the stock is tremendous, and conventional cloud computing businesses like Amazon Web Services and Microsoft Azure have shown how profitable cloud computing can be at scale.

Rather than parsing the numbers for CoreWeave to determine whether the stock is overvalued, investors are better off considering the future of the AI boom. If the massive capex buildout continues, including on CoreWeave’s infrastructure, the stock is a good bet to be a winner. At a market cap of $66 billion, the stock still has room to move higher.

However, if the AI boom turns into a bubble and spending suddenly slows, CoreWeave is likely to plunge. While it’s locked in multi-billion-dollar deals with the likes of Meta, the company will need more of those to turn profitable and justify its current valuation.

Either way, expect the volatility in the stock to continue.

Jeremy Bowman has positions in Amazon, Arm Holdings, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Amazon, Intel, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool recommends Nebius Group and recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.