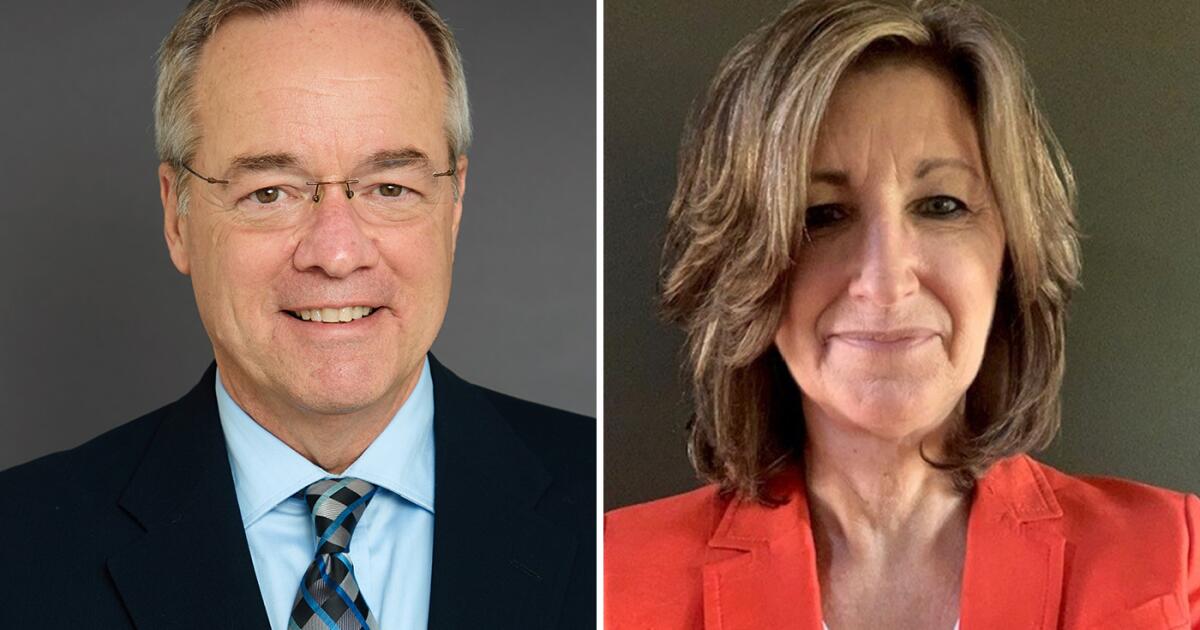

Hedda Felin, boss of the Norwegian firm, has raised concerns about the rapid growth of the cruise industry and has issued a warning of what could happen if changes aren’t made

The cruise industry has to change or it faces being banned out of existence, the CEO of Hurtigruten has warned.

Hedda Felin, boss of the Norwegian firm, has raised concerns about the rapid growth of the cruise industry in an interview with the Mirror. She says more must be demanded of passengers visiting ports, while calling for dirty fuels to be scrapped to ease the significant environmental impact of the industry.

Hedda is particularly worried about the size of cruise ships and the burden their vast numbers of passengers are placing on coastal towns. If restrictions are not put in, anti-cruise ship protests such as those that have broken out in Barcelona and Venice will spread, she predicts.

“I am very concerned about the future. Local communities will react (if we don’t act). We will see more ‘cruise ships go home’ mentality. There will be no future if you don’t leave behind more than you take,” Hedda said.

Hedda spoke to the Mirror at a moment of unprecedented growth in the cruise industry. This year, the world’s largest cruise ship set sail after the industry brought in just shy of $80 billion in a year. That figure will hit $171 billion by 2035, according to one study.

Norway, where Hurtigruten is based, has seen a 70% increase in cruise traffic since 2019 – growth that Hedda calls “kind of overwhelming”.

“I am concerned, I am worried for Norway. It is a long coast, but it has small communities. The communities are overwhelmed by the size of the cruise and the number of visits every day. Local communities are more and more skeptical. 5,000 passengers are trying to fit into villages of 300 people.”

A major gripe among those living and working in busy cruise ship ports is how little passengers spend. Often they visit for a short period of time, see the public sights and then return to their all-inclusive ship.

“We (Norwegians) as a nation demand too little of the visitors and how much they leave behind. There are so many things you could do easily. We could ban heavy oil fuel along the coast. (Hurtigruten) banned it 15 years ago. There could be more restrictions on NOx emissions.

Sign up to the Mirror Anchors Away newsletter

You can get a selection of the most interesting, important and fun cruise travel stories sent to your inbox by subscribing to the Mirror’s Anchors Away newsletter.

“Hurtigruten has chosen to only use local suppliers. We get the local expertise, as well as quality food and drink. It is possible to impose requirements that, for example, 30% of the supplies must come from the nation you’re visiting.

“We have our own seaweed farm, which we use to make protein for food, soup and socks. It is a huge contrast to all-inclusive, vacuum-packed food.”

Hedda argues that the issue isn’t about growth generally but the wrong kind. Hurtigruten’s fleet has grown from seven to 10 ships over the last two years. In the future, the CEO hopes it can become less environmentally damaging. She also backs size limits on future ships.

“We want to create the world’s most energy-efficient product, as close to zero as possible. We want energy-efficient sails, solar panels powered by the midnight sun. My dream is that it will be ready by 2030,” Hedda said.

“We, clearly, need to restrict and reduce the building and size of new ships. We do not need more of the big cruise ships. They need to be a completely different environmental standard. If we managed that, it can be a good way of travelling. It has to be local value creation. If growth continues, it will be some years and then it will be completely banned. It will meet huge resistance.”

Not everyone is so pessimistic about the future of the cruise industry, however. Jonny Peat, head of cruise for Advantage Travel Partnership, is enthusiastic about the growth predicted for the coming years.

“The most striking number is that less than 3% of the leisure travel market is made up of cruise passengers. We’ve not even scratched the surface.”

Right now, 37 million passengers set sail on cruise ships worldwide each year. By 2028, that will hit 42 million. “Despite the fact that some people think there are too many ships, leisure cruise liners make up 1% of the overall maritime industry. Cruise isn’t going anywhere,” Jonny said.

Both cruise ship size and total number have rocketed in recent years. According to a Transport & Environment report, the number of cruise ships has increased more than twentyfold, from only 21 in 1970 to 515 vessels today.