Buffett Might Not Buy AI — But He’d Love This Chipmaker’s Margins

Few companies in the world are as profitable as this chipmaker.

The legendary investor Warren Buffett is famous for buying quality businesses with durable competitive advantages. Just take a look at one of his most famous holdings: Coca-Cola. Few businesses in the world have Coke’s name brand recognition, or its level of customer loyalty.

One of the best ways to gauge whether a business has a durable economic moat is to look at its margins. Is the company in question far more profitable than its competitors? And has it maintained these elevated margins for years at a time? If so, then that business looks like a potential addition to Buffett’s personal portfolio.

Right now, there’s one chipmaker that is likely getting Buffett’s attention. The margins for this business are simply off the charts.

Warren Buffett probably loves this AI company

Few companies in the world are benefiting as much from the artificial intelligence revolution as chipmaker Nvidia (NVDA -0.01%). At its core, Nvidia is a chip stock. It manufactures hardware that allows modern computing technologies to function. Artificial intelligence is no exception. That industry requires massive numbers of chips to train, launch, and execute its models.

Due to early investment, Nvidia is the largest chipmaker in the world when it comes to delivering chips designed for the AI industry. Many estimates peg it at a market share of 90% or more. Overall, Nvidia’s chips are generally considered superior in various key performance metrics. But it’s really Nvidia’s software platform that creates most of the magic. Developed way back in 2004 and later released in 2007, Nvidia’s CUDA platform — which stands for Compute Unified Device Architecture — allows customers to customize its chips with parallel computing capabilities that tailor its performance specifications to exactly what that customer needs.

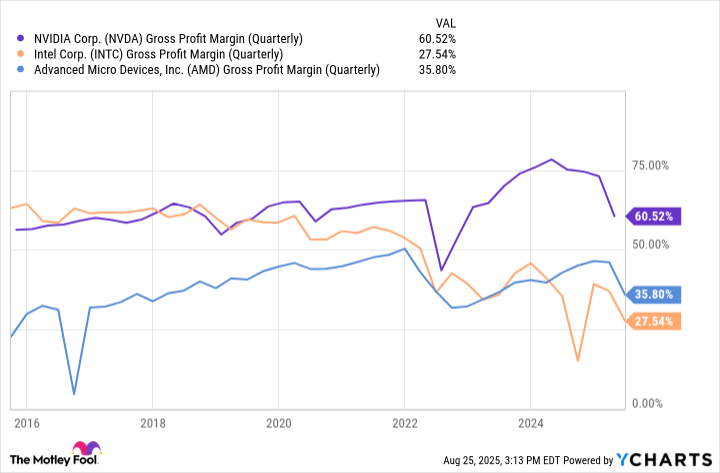

NVDA Gross Profit Margin (Quarterly) data by YCharts.

The result of CUDA’s introduction was twofold. First, Nvidia’s chips could be customized to extract greater performance than competing chips. Second, customers became embedded within Nvidia’s hardware and software flywheel. If customers wanted to switch to another chipmaker’s products, they would need to alter both their hardware and software systems — creating critical friction points that keep these customers within Nvidia’s ecosystem for the long term.

The end result is superior gross margins for Nvidia versus competitors like Intel and AMD. And while profitability has dipped in recent quarters due to trade restrictions in China and onetime manufacturing costs for its new Blackwell chips, Nvidia’s gross margins remain roughly double other chipmakers like Intel and AMD. Nvidia executives expect gross margins to move above the 70% mark again by the end of the year as these near-term headwinds abate.

Image source: Getty Images.

Is it time to load up on Nvidia stock?

In many ways, Nvidia is very similar to Apple. Years ago, analysts were worried about Apple’s elevated gross margins. The company, after all, produced mostly hardware. As we’ve seen time and time again in the technology space, hardware eventually gets copied and commoditized, reducing excess profitability for industry leaders.

But Apple’s profitability didn’t dip heavily over the past decade. That’s because the company integrated a huge amount of software into its hardware, offering to keep customers within the Apple ecosystem. There’s a reason many people not only own iPhones, but also iMacs, AirPods, and iPads. Each device works seamlessly together, and switching from one product makes all of your other products less valuable.

The same can be true of Nvidia today. Yes, it produces some of the best GPUs on the market. But its CUDA software allows the company to capture both the hardware and the software side of the equation. Switching from Nvidia’s hardware, therefore, requires a lot more work than just swapping components.

Trading at 58 times earnings, Nvidia stock is far from cheap. But as Buffett has proven over the decades, paying a bit more for a premium business is worth it if your holding period is long enough. If you’re interested in adding an AI powerhouse stock to your portfolio, Nvidia should top your buy list.

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Intel, and Nvidia. The Motley Fool recommends the following options: short August 2025 $24 calls on Intel. The Motley Fool has a disclosure policy.