Picking a stake in this high-quality artificial intelligence (AI) networking stock can supercharge your portfolio.

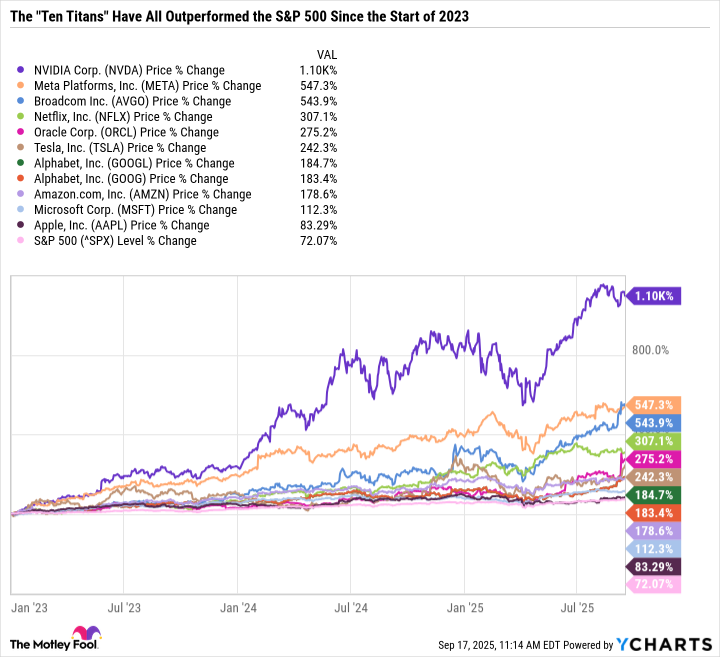

The benchmark S&P 500 has recovered dramatically from a tariff-driven shock in April 2025, and is now trading close to record highs. “Magnificent Seven” stocks, in particular, have been the key driver of this mid-year rally. Increasing adoption of artificial intelligence (AI) globally, coupled with strong earnings performance, has been fueling investor confidence for these technology giants.

Semiconductor giant Nvidia continues to be the paragon of this ongoing AI boom. However, another company may soon become a Wall Street darling, as it is helping enable GPUs to work together efficiently in large AI clusters. That company is Arista Networks (ANET -8.77%).

Image source: Getty Images.

While most investors have been focusing on AI chips, networking is also equally important. AI training and inference (real-time deployment) workloads demand enormous clusters of GPUs, which can cost tens of thousands of dollars each. However, without fast, low-latency connections between GPUs, both the training of large AI models and inference at scale suffer from slower performance and higher costs. Arista is well positioned to resolve these challenges.

AI data center catalyst

Arista has established itself as a pure-play Ethernet networking company, delivering hardware and software networking solutions for large-scale AI data centers, as well as for campus and routing networks.

Until recently, Ethernet wasn’t considered strong enough for AI workloads. Instead, Nvidia’s InfiniBand technology was the go-to choice for scale-out back-end AI networks, linking racks of servers and accelerators in massive GPU clusters. Even in scale-up back-end AI networks (within a server rack), Nvidia’s proprietary high-bandwidth interconnect technology NVLink is used to connect GPUs for high-performance and low-latency networking. However, that seems to be changing now.

Ultra Ethernet Consortium (UEC) released its first full specification in June 2025, creating an Ethernet-based system designed for AI and high-performance computing (HPC) at scale. Since then, hyperscalers and enterprises have been migrating away from proprietary InfiniBand to open-source Ethernet. Over time, Arista also expects clients to migrate from NVLink to Ethernet/UALink networking in scale-up back-end networks.

Arista stands to benefit dramatically from this transition, as its Ethernet-based Etherlink portfolio (20-plus products launched since 2024), paired with its Extensible Operating System (EOS) operating system, is being increasingly preferred by data centers for scale-out networking.

The company already accounted for nearly 21.3% of the data center Ethernet switch market at the end of the first quarter 2025. As more AI workloads move to Ethernet, Arista is well-positioned to capture an even bigger share of the global data center AI networking market, estimated to be nearly worth $20 billion in 2025.

Customer base

Management is guiding for AI networking revenue to exceed $1.5 billion in 2025. That includes about $750 million from back-end AI networks alone, a dramatic improvement from absolutely nothing in 2022.

A major chunk of this $750 million revenue target is firmly supported by two hyperscaler clients, Microsoft and Meta Platforms, which have deployed 100,000 GPUs in distributed AI clusters. Each of these clients is expected to account for at least 10% of Arista’s revenues in fiscal 2025. The third hyperscaler client is also close to that scale, while the fourth hyperscaler client is on the way. With its sticky hyperscaler customer base, Arista enjoys significant near-term revenue visibility.

Arista is also expanding its customer base beyond hyperscalers. The company now caters to 25 to 30 enterprises and Neocloud customers (new generation of cloud providers) actively deploying AI clusters. While individually smaller than the big four hyperscaler clients, they are helping offset the slowness in ramp-up of the fourth hyperscaler customer and the loss of the fifth sovereign AI customer. The diversified revenue base has also helped reduce Arista’s overreliance on a smaller client base.

Other markets

Besides AI networking, Arista is also strengthening its position in enterprise campus and wide-area network (WAN) segments. The VeoCloud purchase gives Arista an AI-ready WAN portfolio that helps customers connect branch sites securely, while managing traffic flows more efficiently for AI workloads. Arista now expects its campus switching business to add $750 million to $800 million in revenues in fiscal 2025.

What about the valuation?

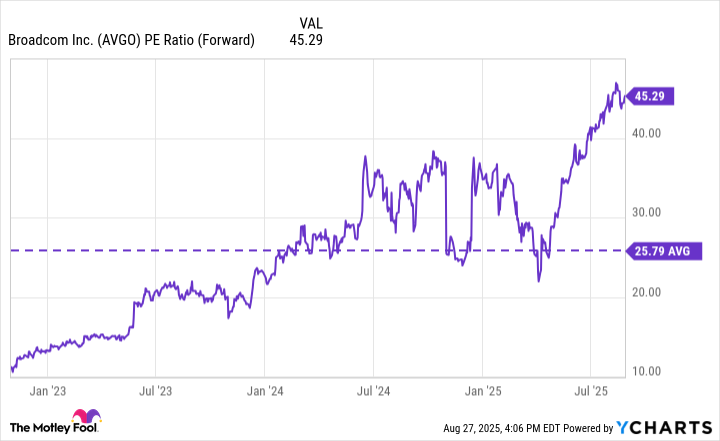

Arista shares trade at 47.4 times forward earnings, which is not cheap. Additionally, the company also faces competition from technology giants such as Nvidia and Broadcom, as well as from hyperscalers exploring in-house options in the networking space.

But Arista can still see its share price grow despite the high valuation multiples. The company’s software offerings, comprising EOS operating system and CloudVision network management and automation platform built atop EOS, helps improve networking performance. Since GPUs use high amounts of power, the networking software plays a critical role in reducing the overall GPU usage. Arista’s Ethernet also works across different accelerators, giving customers more flexibility.

The data center industry is gradually moving from a network connection speed of 400 gigabits per second of data to 800 gigabits per second of data. With its Ethernet-based networking products, robust software stack, and long-term customer relations, the company can capitalize on this opportunity. Hence, Arista can emerge as a major winner in the AI networking boom in the coming years.