Why AppLovin Stock Tumbled by 14% Today

It was hit by negative speculation on the regulatory front.

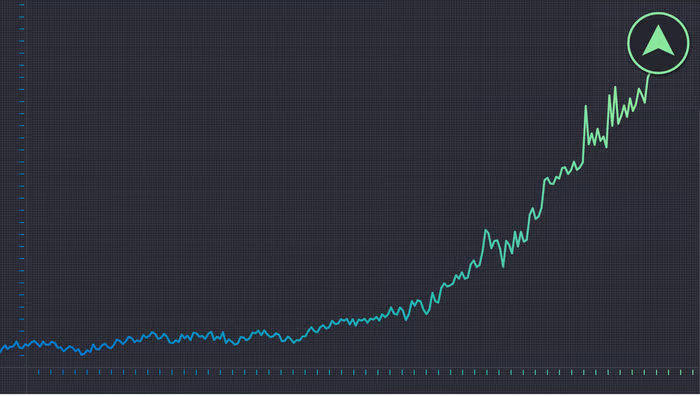

AppLovin (APP -13.71%) stock took quite a fall in late-session action on the market Monday. Investors were clearly spooked by a media report that a top regulator was looking into certain business practices of the mobile marketing specialist. That sudden slide saw the company’s shares fall 14% in value, contrasting quite poorly with the 0.4% gain of the S&P 500 index on Monday.

The wrong kind of attention

Near market close Monday, Bloomberg reported that AppLovin has been the subject of a probe by the Securities and Exchange Commission (SEC).

Image source: Getty Images.

According to unidentified “people familiar with the matter,” the financial news agency wrote that the probe is in response to a whistleblower complaint filed earlier this year, plus a series of short seller reports on AppLovin disseminated recently.

Specifically, the article stated, the SEC’s effort is focused on AppLovin’s data collection practices. Bloomberg’s sources said that the company hasn’t (yet) been accused of wrongdoing, although it did not seem to be aware of what stage the regulator’s probe might be in.

Mum’s the word for now

The SEC declined to comment on the matter, citing an inability to respond to press queries due to the federal government shutdown. AppLovin also effectively refused, stating that “we regularly engage with regulators and if we get inquiries we address them in the ordinary course.”

Although at this point any investigation must be considered speculative, this is unquestionably a development worth watching for AppLovin investors and observers. Given that, it wouldn’t be wise to invest in the company on that share-price swoon.

Eric Volkman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.