Target’s stock is currently trading around multi-year lows.

This year has been a tough one for many retailers, with global tariffs and trade wars raising costs and creating plenty of uncertainty. Consumers, meanwhile, have been cutting back on discretionary spending as they look to tighten up their budgets.

One retailer that has felt the effects of this in a significant way is Target (TGT -3.60%), whose sales have been stagnant. And over the past 12 months, its valuation nosedived by 37%. Its performance has been so bad that the stock is trading around the levels it fell to during the brief market crash in 2020.

The trouble is, it may not necessarily be due for a rally just yet, even despite its beaten-down valuation. And the company recently announced a new CEO, which investors and analysts aren’t convinced will rectify the situation. Could Target’s stock be headed for even more of a decline in the future, or is it a worthwhile contrarian pick to add to your portfolio today?

Image source: Getty Images.

Investors worry an internal hire may be a mistake for Target

On Aug. 20, Target announced that Michael Fiddelke will take over as CEO of the company on Feb. 1, 2026. Current CEO Brian Cornell is stepping down but will be on the company’s board of directors. Cornell says that Fiddelke, who is currently Target’s chief operating officer and who has been with the company for 20 years, is the best-suited person to lead the company’s turnaround efforts.

The words of confidence, however, didn’t seem to have much of an effect on investors, with shares of Target declining after the news. Investors may have been hoping for a more aggressive effort to turn the business around, similar to Starbucks‘ move to grab high-profile executive Brian Niccol a year ago, who came over from Chipotle Mexican Grill. While that hasn’t paid off for Starbucks just yet, the Niccol hire has been seen as a bold move for the struggling coffee chain to help make significant changes necessary to improve its operations.

The danger with an internal hire, particularly of an existing executive, is that it might mean more of the status quo for the business, and a continuation of a process and strategy that hasn’t been working. Target’s results have been lackluster of late, and significant changes may be needed to get investors bullish on the retail stock.

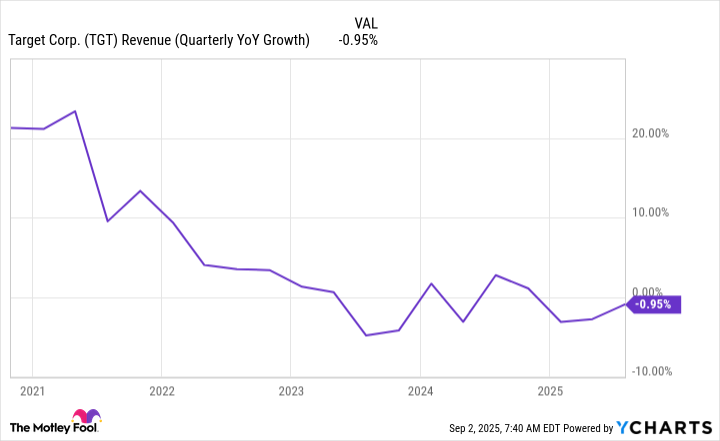

Target has been struggling to grow its sales in recent years

The problem for Target may be more to do with macroeconomic conditions rather than poor management decisions. As consumers are scaling back on discretionary spending, many retailers have been struggling to generate any growth. Target’s lackluster sales growth has been going on for a couple of years now, coinciding with rising interest rates, which have increased costs for consumers and businesses alike.

TGT Revenue (Quarterly YoY Growth) data by YCharts

In Target’s most recent quarter, which ended Aug. 2, the company’s net sales totaled $25.2 billion and were down 0.9% year over year. And with costs still rising, its operating income fell by more than 19%, to $1.3 billion. For the full fiscal year, which ends in January, Target continues to expect a low-single digit drop on the top line.

For Fiddelke, it won’t be an easy task to fix Target’s problems given that they may be stemming from economic factors. Even if he were to make drastic changes, they could be costly, at a time when it may be more important for the business to trim expenses rather than to experiment with store designs or product mix. Weathering the storm may be the key at this point for Target.

Target’s business isn’t broken, but investors will need patience with the stock

Target is facing some tough times right now, but I don’t believe the business is in awful shape and that it needs significant changes. It wasn’t all that long ago, during the pandemic, when sales were soaring as consumers had an excess of discretionary income at their disposal. Now, however, as that situation has changed, the reverse is happening and sales aren’t looking so strong anymore.

For long-term investors who can afford to be patient with the stock, Target may be worth investing in today, even though it may still go lower in the short term. It trades at a price-to-earnings multiple of 11, which is incredibly cheap when you consider the S&P 500 average is 25. It may take some time for the stock to turn things around, but Target also offers a compelling 4.7% dividend yield that can compensate you for your patience.

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill, Starbucks, and Target. The Motley Fool recommends the following options: short September 2025 $60 calls on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.