Artificial intelligence is driving an acceleration in Microsoft’s cloud revenue growth.

Over the next few weeks, many of America’s largest technology companies will report their operating results for the quarter ended Sept. 30. They will provide investors with a valuable update on their progress in the artificial intelligence (AI) race, which is driving an enormous amount of value right now.

Sept. 30 marked the end of Microsoft‘s (MSFT -0.43%) fiscal 2026 first quarter, and it is scheduled to report those results on Oct. 29. The company’s Azure cloud computing platform and its Copilot virtual assistant will be key points of focus for Wall Street because they are at the center of the company’s AI strategy.

Microsoft stock has already climbed 25% year to date. Is it still a buy ahead of the Oct. 29 earnings report?

Keep an eye on Copilot adoption

Microsoft launched its Copilot virtual assistant in early 2023. It was created using a combination of the company’s own AI models and those developed by its longtime partner OpenAI. The chatbot can be used for free in some of Microsoft’s flagship software products like Windows, Edge, and Bing, but it’s also available as a paid add-on for enterprise products like the 365 productivity suite.

Copilot can rapidly generate content in applications like Word and PowerPoint, autonomously transcribe meetings in Teams, and help users craft email replies in Outlook, so it has the potential to significantly increase productivity for enterprises. Microsoft says organizations around the world pay for over 400 million licenses for 365, all of which are candidates for the paid Copilot add-on, so the AI assistant could generate billions of dollars in recurring revenue for the company over the long term.

During the fiscal 2025 fourth quarter (ended June 30), Microsoft said several large customers expanded their Copilot adoption through 365. Barclays, for example, bought 100,000 licenses for its employees after running an initial test with 15,000, which implies a high degree of satisfaction with the assistant’s capabilities. This is the kind of information investors should look out for on Oct. 29, because it could be a predictor of future revenue.

But 365 isn’t Microsoft’s only enterprise opportunity when it comes to Copilot. There is Copilot Dragon, an innovative healthcare solution that autonomously documents millions of doctor-patient interactions, saving clinicians valuable time. Then there is Copilot Studio, a platform that allows businesses to create custom AI agents to automate workflows in any application, even those outside Microsoft’s ecosystem.

The most important segment to watch on Oct. 29

Microsoft’s Azure cloud platform operates hundreds of data centers spread across dozens of different regions around the world. They are fitted with the most advanced chips from suppliers like Nvidia and Advanced Micro Devices, and businesses rent the computing capacity from Azure to power their AI training and AI inference workloads.

Microsoft also launched Azure AI Foundry earlier this year, which ties many of the cloud platform’s AI services together to form a holistic solution for enterprises. It can be used to turn raw data into documents, build AI chat applications, deploy AI software, perform multimodal content processing, and more. It also offers access to the latest large language models (LLMs) from third parties like OpenAI to accelerate AI development.

Azure is regularly the fastest-growing part of Microsoft’s entire business, but it surprised even the most bullish analysts during the fiscal 2025 fourth quarter when its revenue soared by a whopping 39% year over year. It was the fastest growth rate in three years, and it marked a significant acceleration from the 33% growth Azure generated in the third quarter just three months earlier.

Demand for data center capacity and Foundry were the key drivers of the incredible result, so this is where investors should focus most of their attention on Oct. 29.

Should you buy Microsoft stock before Oct. 29?

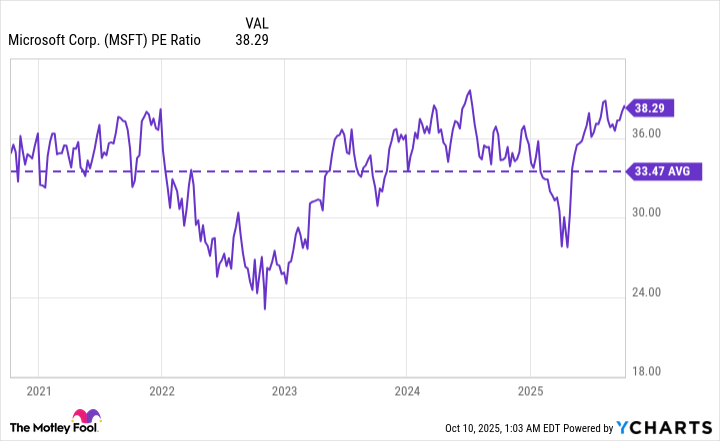

Microsoft stock isn’t cheap right now. It’s trading at a price-to-earnings (P/E) ratio of 38.3, which is a 14% premium to its five-year average of 33.5. It’s also notably more expensive than the 33.3 P/E of the Nasdaq-100 index, which is home to many of Microsoft’s big-tech peers.

MSFT PE Ratio data by YCharts

As a result, investors who are looking for short-term gains over the next few months might be left disappointed. That doesn’t mean the stock is a bad buy ahead of Oct. 29, but investors who pull the trigger must be willing to hold it for the long term — preferably for three to five years — to maximize their chances of earning a positive return.

One single quarter is unlikely to shift Microsoft’s momentum in either direction, but as long as Copilot adoption continues to expand and Azure’s revenue growth maintains its recent momentum, investors will probably be glad this stock is in their portfolio.

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, and Nvidia. The Motley Fool recommends Barclays Plc and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.