AMD is second fiddle to Nvidia in the largest computing buildout we’ve seen.

Advanced Micro Devices (AMD -0.23%) hasn’t had the best few years. It has been outshined by its rival Nvidia (NVDA 0.34%) in the biggest computing buildout of all time, and there doesn’t appear to be a path where AMD can be a direct competitor with Nvidia. Instead, it’s only viewed as an alternative so customers can push back against Nvidia if it gets too aggressive with pricing.

Furthermore, AI hyperscalers are starting to design their own chips in collaboration with Broadcom, creating another fierce competitor for AMD. Alongside all of that, AMD isn’t completely focused on high-powered graphics processing units (GPUs). It also has an embedded processor division as well as other computing chips used in gaming consoles and PCs.

All of this creates a company that is more diversified than its peers. However, diversification isn’t always a good thing, especially when one division is experiencing a generational growth opportunity.

So, what will AMD’s stock price be by 2030? Let’s take a look.

Image source: Getty Images.

AMD is a more diversified business than Nvidia

AMD splits its business into three primary divisions: data center, client and gaming, and embedded.

Data center isn’t AMD’s largest division by revenue; Client and gaming is by a slim margin. In Q2, data center revenue was $3.24 billion versus client and gaming’s $3.62 billion. However, AMD’s data center divisions were heavily affected by the ban on selling computing hardware to China, which also affected Nvidia.

When comparing Nvidia and AMD’s data center growth, it’s quite heavily favored in one direction. AMD’s data center revenue increased by 14% year over year in Q2, while Nvidia’s rose by 56%. This clearly indicates that AMD is getting smoked by Nvidia, and doesn’t really have a chance to catch up.

Most AI hyperscalers have already built a ton of infrastructure using Nvidia’s technology, and when these GPUs eventually burn out, it would cost a significant amount more to switch over to AMD’s architecture versus staying with Nvidia’s. As a result, AMD is stuck in second place.

To make matters worse for AMD, its embedded and client and gaming divisions do not have significant long-term potential. These are divisions that over the long term won’t grow much more than 10% annually, making them essentially market performers.

This doesn’t bode well for AMD, especially with its already expensive valuation.

AMD’s expensive stock price is holding its long-term potential back

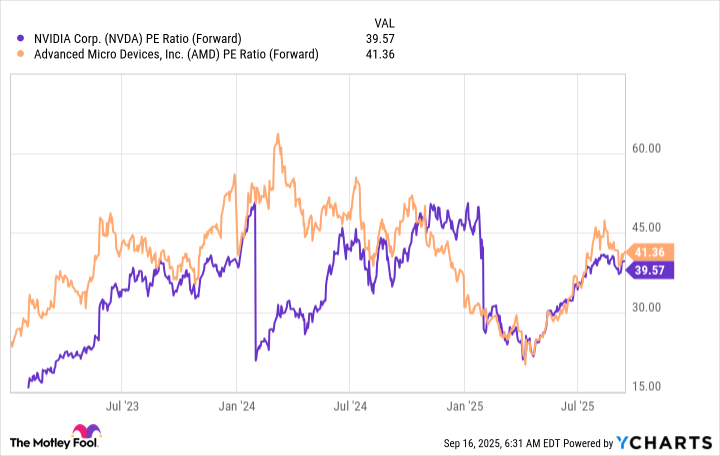

Despite AMD clearly being a second-place company, it’s actually more expensive than its peer.

NVDA PE Ratio (Forward) data by YCharts

AMD’s 41 times forward earnings price tag isn’t cheap, and I’m not sure its growth justifies it. In 2025 and 2026, Wall Street analysts project 28% and 22% revenue growth, respectively. There are plenty of companies that are expected to grow near that level over the next few years that don’t have nearly the premium that AMD does, so this also works against it.

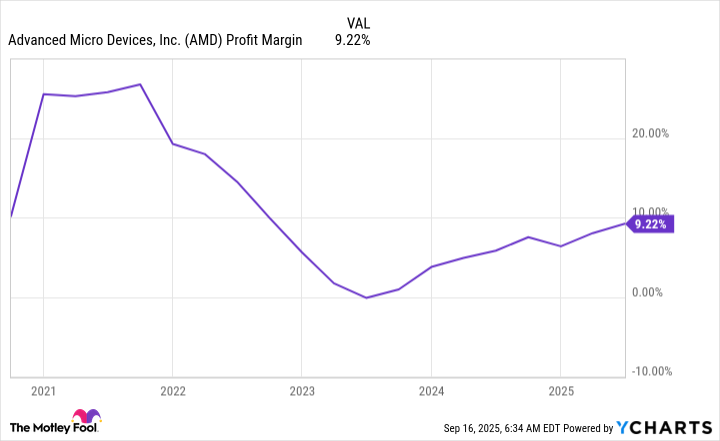

However, that’s not the only way for a company to perform. AMD is also working on improving its margins, something that it has done consistently over the past few years.

AMD Profit Margin data by YCharts

If AMD can improve its margins to 15% by 2030, it could be a winning investment. If AMD trades at a more reasonable valuation of 30 times forward earnings, grows at a 20% pace, and achieves that margin level, it could be worth about $225 per share.

However, that’s only a 40% upside from today’s stock price. I think there are a lot better stocks to invest in than AMD, as it doesn’t have the growth that others in its industry have. Furthermore, if the AI market goes down, it will drag AMD’s stock with it. It may not decline as much as Nvidia’s, but it would still result in hefty losses. There are far better alternatives to invest in than AMD, and I think investors would be better off picking those stocks instead.

Keithen Drury has positions in Broadcom and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.