This semiconductor giant has outperformed the Nasdaq Composite index handsomely in the past decade.

The tech-laden Nasdaq Composite index clocked impressive gains in the past decade, rising 374% during this period and outpacing the S&P 500 index’s jump of 240%. The disruptive nature of technology companies is a key reason why the Nasdaq has delivered above-average returns. Tech companies can grow at faster rates thanks to the innovation taking place in this sector. New products, services, and features can witness rapid adoption by customers, organizations, and governments, leading to robust revenue and earnings growth for tech stocks.

Taiwan Semiconductor Manufacturing (TSM 1.26%), popularly known as TSMC, enables innovation and disruption with its advanced chip manufacturing processes. Not surprisingly, TSMC stock has shot up a remarkable 12.5x in the past decade, significantly outpacing the Nasdaq Composite index’s jump.

Let’s look at the reasons why it has real potential to keep outperforming the Nasdaq Composite in the next 10 years.

Image source: Getty Images.

TSMC’s growth is likely to accelerate in the coming decade

TSMC is the world’s largest semiconductor foundry. According to Counterpoint Research, it controlled 35% of the global Foundry 2.0 market in the first quarter of 2025, growing its share by almost six percentage points from the year-ago period.

The Foundry 1.0 market is defined by pure chip manufacturing, while Foundry 2.0 includes ancillary services such as advanced packaging, assembly and testing, and photomasking. TSMC, which was a pure-play chip manufacturer earlier, has been expanding its expertise to offer Foundry 2.0 solutions to its customer base.

This explains why the company keeps gaining a bigger share of this market. TSMC established a massive lead over its rivals in the Foundry 2.0 space, with second-placed Intel controlling just over 6% of this market in the first quarter. Another thing worth noting is that the Foundry 2.0 market saw a 13% year-over-year increase in revenue in Q1 2025 to $72 billion, driven by the growth of artificial intelligence (AI) and high-performance computing chips.

TSMC’s advanced chip manufacturing processes are tapped by several fabless chip designers such as AMD, Nvidia, Broadcom, Sony, Apple, Qualcomm, and others, who don’t have manufacturing facilities of their own. These companies have been tapping TSMC’s 3nm (nanometer) and 5nm process nodes to fabricate AI chips that go into multiple applications ranging from data centers to consumer electronics devices to vehicles.

Specifically, 60% of TSMC’s revenue came from the high-performance computing (HPC) segment in the previous quarter, while smartphones accounted for 27%. The Internet of Things (IoT) and the automotive segment aren’t moving the needle in a significant way for the company right now. However, all these end markets are expected to clock healthy growth over the next decade, paving the way for secular growth at TSMC.

Deloitte, for instance, points out that the growth of AI is expected to lead to a 30x increase in data center power demand by 2035. This rapid surge will be driven by the construction of more data centers needed to tackle AI workloads. According to one estimate, AI-focused data center spending is expected to jump by almost 4x by 2030, which should allow TSMC to sell more of its advanced chips.

Meanwhile, the adoption of AI in other areas, such as robotics and the automotive industry, can create more lucrative growth opportunities for TSMC. In all, the AI chip market expects to clock an annual growth rate of close to 35% through 2035. TSMC’s solid share of the foundry market puts it in a solid position to make the most of this massive growth opportunity.

Product development moves should help it maintain its solid position

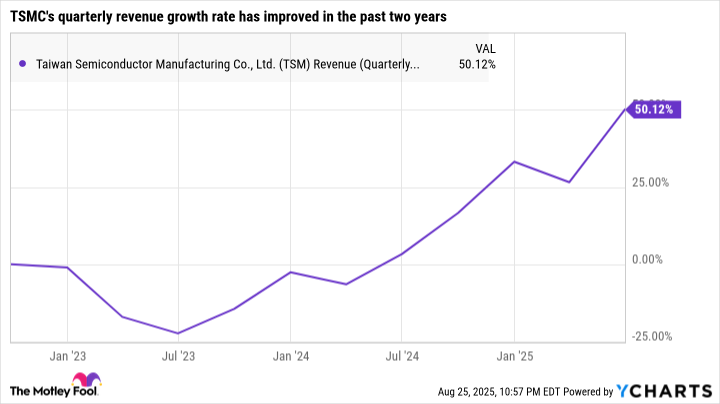

TSMC’s growth picked up impressively in the past couple of years on account of the AI boom.

Data by YCharts.

The company expects 30% revenue growth this year. It can sustain such impressive growth levels in the future as well, since it is focused on further advancing its manufacturing processes, which should enable it to maintain its healthy lead in this market. For example, TSMC is already constructing 2nm and A16 (1.6nm) chip fabrication facilities.

These new processes are expected to deliver significant performance and efficiency gains over the company’s current 3nm chip node. The 2nm process, for instance, is expected to deliver a 10% to 15% increase in performance while reducing power consumption by 20% to 30%. The A16 process is also expected to replicate such gains when compared to the 2nm process.

The improved performance of TSMC’s new chips should come in handy while tackling AI workloads in the cloud and in edge devices such as smartphones and personal computers. So, TSMC seems set to retain its lead in the foundry market in the future. As such, it is a no-brainer buy right now at 25 times earnings since its healthy financial performance can help this AI stock outpace the Nasdaq Composite’s gains over the next 10 years.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Intel, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and recommends the following options: short August 2025 $24 calls on Intel. The Motley Fool has a disclosure policy.