The AI-powered voice software business is seeing triple-digit year-over-year sales growth.

The hype over artificial intelligence (AI) stocks helped shares of SoundHound AI (SOUN 7.26%) hit a 52-week high of $24.98 last December. But in 2025, its stock is down about 35% through Sept. 3. The drop could be a signal that now is a good time to invest in this AI tech provider. Or does it suggest reasons exist to steer clear of the stock?

To determine whether SoundHound is a worthwhile investment in the AI sector, a deeper look into its business is required. Here’s an analysis into this company specializing in voice-activated conversational AI.

Image source: Getty Images.

SoundHound’s strengths

SoundHound possesses attributes that make it a compelling investment. In the second quarter, its revenue hit $42.7 million, an impressive 217% increase over last year.

The company’s sales success prompted management to raise the revenue outlook for this year. SoundHound now expects 2025 sales of $160 million to $178 million, a substantial step up from the previous year’s $84.7 million.

The company made strategic acquisitions in 2024 that expanded its business beyond the automotive sector, which had previously accounted for 90% of sales. Today, SoundHound’s income is more diversified, as its services reach into industries such as restaurants, healthcare, and financial services.

This diversification helps its business to weather economic downturns in any one sector. Now, no one vertical contributes more than 25% of revenue.

SoundHound also boasts a robust balance sheet. In Q2, total assets were $579.5 million, including $230.3 million in cash and equivalents. Total liabilities were $219.7 million.

SoundHound’s shortcomings

But the business has downsides, too, notably its lack of profitability. SoundHound’s Q2 operating loss widened considerably to $78.1 million from a $22 million loss in the prior year. This increase was primarily a result of greater expenses related to its acquisitions.

The company is working to improve its financials. Management’s goal is to be profitable on an adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) basis by the end of 2025. Adjusted EBITDA stood at a loss of $14.3 million in Q2.

In addition, SoundHound intends to strengthen its Q2 gross margin of 39%, which is down from 63% in the prior year, again due to the acquisitions. A boost in gross margin will support its goal of achieving profitability.

The company noted, “We expect to gradually improve gross margins in the midterm,” as it finds cost synergies while integrating its acquired businesses into existing operations.

Other considerations with a SoundHound investment

A key factor that dragged down SoundHound stock this year was that Nvidia sold its entire stake in the company. Nvidia revealed the sale in a February filing, which led investors to follow suit, causing shares to plunge nearly 30%. Nvidia’s move made sense at the time. SoundHound’s share price valuation was quite high when the AI semiconductor chip leader decided to sell.

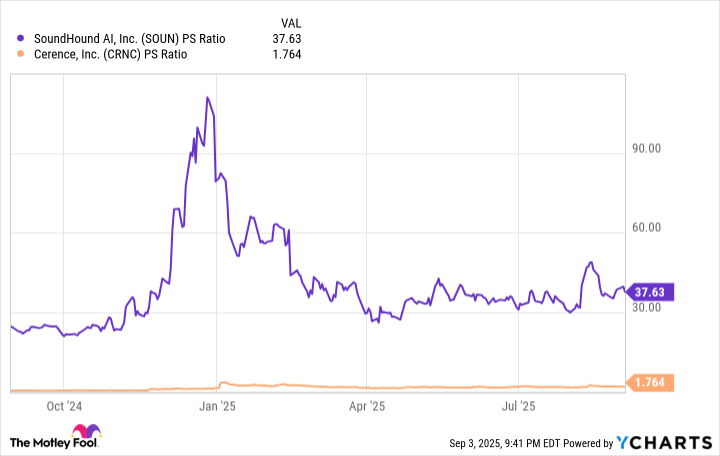

You can see this in the stock’s price-to-sales (P/S) ratio, which measures how much investors are willing to pay for every dollar of revenue produced over the trailing 12 months, particularly in comparison with competitor Cerence, which also offers voice-activated AI products for the automotive industry.

Data by YCharts.

The chart shows SoundHound’s sales multiple peaked around the end of last year, indicating its stock was expensive. Its P/S ratio is lower now, but still elevated compared to Cerence’s.

Arguably, SoundHound deserves a higher valuation, since Cerence’s revenue in its fiscal Q3, which ended June 30, declined to $62.2 million from $70.5 million in the previous year. Meanwhile, SoundHound’s Q2 sales grew over 200% year over year. That said, SoundHound stock’s current valuation is so far above Cerence’s that it still looks high.

SoundHound has rising revenue and a diversified business in its favor, but its elevated stock valuation suggests it’s best to put it on your watch list and wait for the share price to drop.

You may also want to consider waiting for SoundHound’s Q3 earnings report to see if it’s made headway on reducing operating expenses and improving its gross margin and adjusted EBITDA before deciding to invest.

Robert Izquierdo has positions in Nvidia and SoundHound AI. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Cerence. The Motley Fool has a disclosure policy.