The trading platform has come a long way.

If you still think of Robinhood (HOOD -2.29%) as a trading platform for the risky retail investor, you’ve been missing what’s happening at the financial services company. Although retail investing is still its bread and butter, it has evolved into a large fintech company with a broad range of services.

Granted, risk-embracing traders might still be its core user base, but Robinhood has become impressively profitable and is leading the way in financial technology. Below, I’ll dig a little deeper and see whether Robinhood stock is a buy today.

Beyond meme status

Robinhood made a splash when it debuted free online trades, attracting millions of users who could easily start trading online. The concept took off but got plenty of negative attention for what people saw as encouraging risky behavior. That culminated in the GameStop episode, when retail investors banded together to create a short squeeze in the shares of the ailing video game and electronics seller.

Instead of putting the brakes on the company’s business, this episode made it a household name — and Robinhood has only grown since then. Today, it has an expanded and profitable business offering many financial services, all with its signature, disruptive style.

Image source: Getty Images.

Trading is still Robinhood’s core business, and many of its new services are different kinds of investing instruments, including cryptocurrency and options. But the company is leaning into more traditional products, like bank accounts and credit cards, too, and is launching in new regions. It’s catching on and becoming a solid player in finance.

Consider the phenomenal second-quarter results. Revenue increased 45% year over year to $989 million, and net income was up 105%. Funded accounts increased 10% over last year to 26.5 million, and Gold membership, which is the company’s premium program, increased 76% to 3.5 million members.

It’s moving beyond its products and tapping into the excitement and energy of its user base, and it just announced the launch of a new social media app for its users to be able to communicate about trading. Previously, users gathered in spaces like Reddit to collaborate, where idle and even misleading speculation sometimes was sometimes taken as investment advice. Robinhood is planning for its social media channel to follow an X-style template, but trades will be verified if users chat about them, which will take some of the sketchiness out of the picture.

This is important for another reason: Funded members, the company’s main user base, increased 10% year over year in the second quarter, which isn’t a huge increase. If Robinhood’s edge has been free trades, that edge is long gone. There are countless other brokerages offering free trading today, including almost every large bank, plus many new startups. Robinhood needs to monetize its user base in new ways but also needs another way to stand out.

High gains, high risk

Robinhood operates in some risky markets. Cryptocurrency, for example, may be all the rage today, and it’s been like that for a few years already. It may be here to stay, but it may not.

The company’s excellent performance also hinges on strong trading activity. The current bull market is driving trading volume, but that could end if the market turns bearish. You have to have a fairly healthy risk tolerance to invest in a company like Robinhood because its core products also are risky.

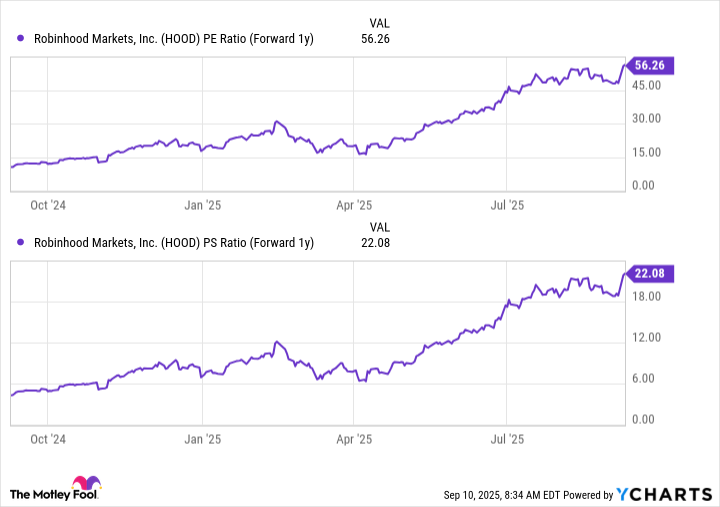

Finally, Robinhood has been a monster stock recently, up 500% during the past year. It trades at a sky-high valuation, which means it’s priced for perfection. That’s also risky because any error could send it plummeting.

HOOD PE Ratio (Forward 1y) data by YCharts.

In another 10 years, Robinhood could be much bigger and reward investors accordingly. If you believe in its innovative model, you might decide it’s worth the risk.

Most investors should probably wait and look for a few more rounds of increasing earnings and durability. I’d also wait for a better entry point before investing in Robinhood stock.

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.