Dollar General beat expectations and raised its guidance for the rest of the year when it reported earnings.

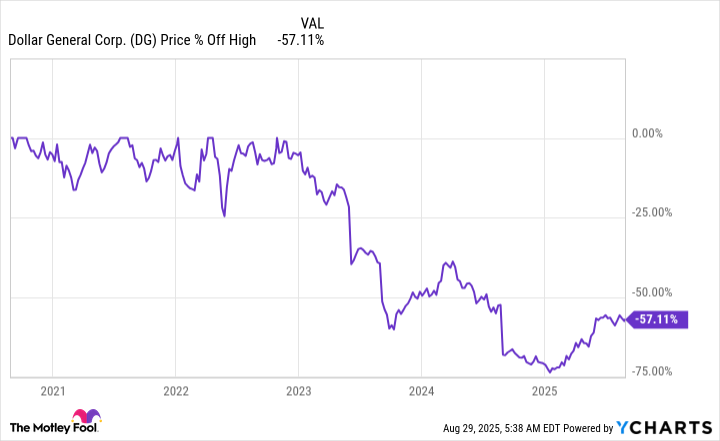

Shares of Dollar General (DG -2.64%) are up around 45% so far in 2025. But they are also down more than 55% from their 2022 peak. The retailer’s strong second-quarter-2025 earnings update shows that the turnaround is still going strong. Here’s why I’m excited about Dollar General stock after reading its most recent earnings update.

What does Dollar General do?

Dollar General, as its name implies, is a dollar store. The term is a bit misleading, however. It sells a variety of products, from everyday necessities to clothing and seasonal items, at low prices. For example, it may sell a name brand consumer staples product, like toilet paper, just like another store, but the size of the product might be smaller. Buying a single roll is simply cheaper than buying 20 in a multipack from a club store, even if the per-roll cost from the club store is ultimately a better deal.

Image source: Getty Images.

Dollar General leans into its role of serving less affluent customers with its choice of store locations. The retailer purposely operates relatively small stores in mostly rural areas that are underserved by larger competitors. This makes it more convenient for a customer to stop by a Dollar General store than to drive to a big-box store, even though it might be cheaper to buy from the big box store.

Although Dollar General’s stores are kind of small, the company is actually quite large. It operates over 20,700 Dollar General, DG Market, DGX and pOpshelf stores across the United States (it also operates Mi Súper Dollar General stores in Mexico). It expects to complete over 4,800 real estate projects in fiscal year 2025. That list includes capital investments like renovating older stores but also the addition of as many as 575 new stores in the United States and 15 in Mexico.

Dollar General is turning things around

Although the stock has risen dramatically in 2025, that has erased only a small portion of the decline since late 2022. And that’s the opportunity for long-term investors. But the really big news from the second-quarter earnings update was the company’s financial and operational performance. A look at some income statement highlights tells a very exciting story.

Specifically, sales increased 5.1% year over year, hitting $10.7 billion. However, the real star was same-store sales, which measures the performance of existing locations. That metric rose 2.8%, driven by rising traffic (1.5 percentage points of that total) and an increase in the amount spent by customers on each visit (1.2 percentage points). To put that in plain English, more customers are showing up, and they are spending more.

Earnings for the quarter came in at $1.86, up 9% over the same quarter in 2024. And, notably, earnings came in well above Wall Street analyst expectations, beating consensus by roughly 18%. A big help to the bottom line was the company’s ability to increase its gross margin by 137 basis points year over year, led by less shrinkage, higher inventory markups, and less inventory damage.

This is all very good news and shows that the company’s turnaround effort is working. But the best part of the story is that management updated its full-year 2025 guidance, suggesting that the turnaround is set to continue. Previously, sales were projected to rise between 3.7% and 4.7%. Now they are expected to jump 4.3% to 4.8%. Same-store sales were updated similarly, with a slight increase on the top end and a material change at the low end of the guidance range. Basically, the worst-case scenario that management envisioned appears to be off the table.

There could be more upside from here

My excitement is tempered by the fact that Dollar General’s stock price has risen a great deal in a very short time. Wall Street appears to be aware of the positive reversal in the business dynamics. But that doesn’t change the fact that the stock remains well off its highs, hinting that there could be more room for recovery ahead. Perhaps it won’t happen as quickly as the initial turnaround, but if you think in decades and not days, Dollar General and its still-historically-high 2.1% dividend yield could be a good stock for a deep dive today.