Article content

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR RELEASE PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY, OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES.

Get the latest updates on stock markets, economic trends, business insights, personal finance tips, and more

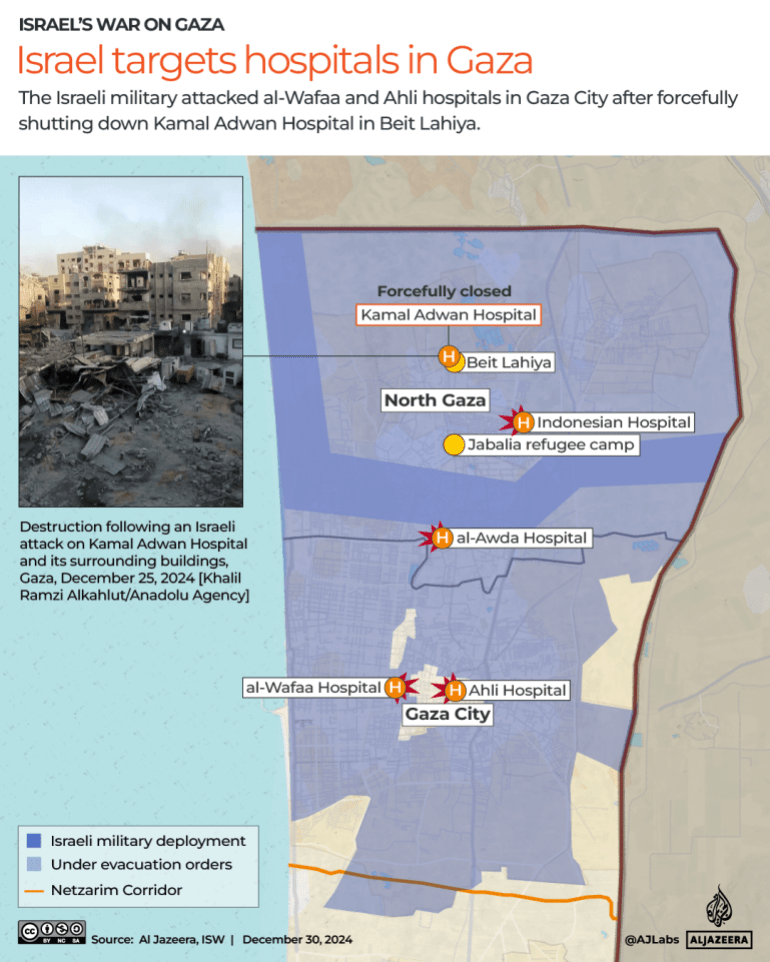

Israel carries out hospital attacks in northern Gaza and Gaza City.

Aid groups are warning Israel is in the late stages of ethnic cleansing in northern Gaza.

Only 12 trucks have managed to distribute aid, to desperate Palestinians there in nearly three months.

Kamal Adwan Hospital in the north has been stormed and bombed by Israeli forces.

On Sunday, air strikes targeted al-Wafa and al-Ahli hospitals in the northern Gaza City.

So, is Israel’s strategy in the north: starve or surrender? And is Gaza city next?

Presenter: Adrian Finighan

Guests:

Amjad Shawa – Director of the Palestinian NGOs Network

Dr Mads Gilbert – Emergency medicine doctor and senior consultant at the University Hospital of North Norway

James Moran – Former EU Ambassador to Egypt and Jordan

Administration of US President Joe Biden has committed more than $65bn in support since Russia’s full-scale invasion.

United States President Joe Biden has announced that his administration will send nearly $2.5bn in military assistance to Ukraine, as the president rushes aid to the war-torn country before President-elect Donald Trump takes office in January.

The new round of assistance, announced on Monday, includes $1.25bn derived from presidential drawdown authority, which allows Biden to withdraw materials from US military supplies without the need for congressional approval.

Another $1.22bn comes from the Ukraine Security Assistance Initiative (USAI), a programme run through the Department of Defense and funded by congressional appropriations.

In addition to the military aid, Secretary of the Treasury Janet Yellen also unveiled $3.4bn in economic assistance on Monday to help Ukraine’s government and prop up its infrastructure.

“I’ve directed my administration to continue surging as much assistance to Ukraine as quickly as possible,” Biden said in a statement. “At my direction, the United States will continue to work relentlessly to strengthen Ukraine’s position in this war over the remainder of my time in office.”

Since February 2022, Ukraine has sought to repel a full-scale invasion from Russia. But in the years since the war erupted, Republicans have grown increasingly fractured over providing future aid to the country.

That aid is likely to face its greatest test yet in the new year. In January, the Republican Party is set to take control of both houses of Congress and the White House.

While Biden, a Democrat, has been a firm supporter of continued US assistance to Ukraine, President-elect Trump has signalled scepticism about further aid and expressed his desire to bring the war to a speedy close. He campaigned on an “America First” policy platform.

Ukrainian President Volodymyr Zelenskyy thanked Biden on Monday for the latest US assistance package, which comes at a vital time for his country.

Ukraine faces manpower shortages and straining national morale after nearly three years of fighting. Russian forces also continue to make advances in eastern Ukraine: On Sunday, for instance, Russia claimed it had seized the village of Novotroitske.

Since the launch of Russia’s full-scale invasion in 2022, the US Defense Department says that the Biden administration has committed more than $65bn in support.

As part of that sum, Biden has delivered 23 aid packages from USAI funds. Monday’s announcement also marks the 73rd “tranche of equipment” Biden has drawn from Defense Department inventories since August 2021.

“Every act of solidarity from our partners saves lives, strengthens our independence, and reinforces our resilience. It also demonstrates that democracies are stronger than autocratic aggressors,” Zelenskyy said in a post on the social media site X.

Monday’s weapons package will include drones, guided missiles, ammunition for High Mobility Artillery Rocket Systems (HIMARS), antitank weapons systems, air-to-ground munitions and spare parts, according to the Defense Department.

Support for such assistance remains high. A November poll by the Pew Research Center found that 25 percent of Americans believe the US is sending the right amount of assistance to Ukraine, and 18 percent say it is not sending enough.

By contrast, 27 percent of survey respondents indicated that too much assistance is being sent to Ukraine.

That number increased among people affiliated with the Republican Party, when taken in isolation. An estimated 42 percent of Republicans told the Pew Center the US was sending too much aid. Just 19 percent indicated that Russia’s invasion of Ukraine was a threat to the US.

Sabrine is the first female governor of the Syrian central bank in its more than 70-year history.

Syria’s new rulers have appointed Maysaa Sabrine, formerly a deputy governor of the Syrian central bank, to lead the institution – the first woman to do so in its more than 70-year history, a senior Syrian official said.

With more than 15 years of experience in the field, Sabrine is a longtime central bank official mostly focused on oversight of the country’s banking sector.

A master’s in accounting from Damascus University and a certified public accountant, Sabrine has been a member of the board of directors at the Damascus Securities Exchange since December 2018, representing the central bank. She has also served as deputy governor and chief of the Office Control Division at the bank, according to the bank’s official website.

Sabrine replaces Mohammed Issam Hazime, who was appointed governor in 2021 by then-President Bashar al-Assad and remained on after al-Assad was overthrown by a lightning rebel offensive, led by Hayat Tahrir al-Sham (HTS), on December 8.

Since the rebel takeover, the bank has taken steps to liberalise an economy that was heavily controlled by the state, including cancelling the need for pre-approvals for imports and exports and tight controls on the use of foreign currency.

But Syria and the bank itself remain under heavy sanctions imposed by the United States and other Western powers.

The bank has also taken stock of the country’s assets after al-Assad’s fall and a brief spate of looting that saw Syrian currency stolen but the main vaults left unbreached.

The vault holds nearly 26 tonnes of gold, the same amount it had at the start of its civil war in 2011, sources said, but foreign currency reserves had dwindled from approximately $18bn before the war to about $200m, they said.

Sabrine is the second woman who has been appointed by the new Syrian administration, headed by de facto leader Ahmad al-Sharaa.

Earlier this month, Aisha al-Dibs was appointed as the head of the Women’s Affairs Office under the Syrian interim government.

Home Transaction Banking

GW Platt Foreign Exchange Bank Awards 2025: Global, Regional And Country Winners

Amid consistently high geopolitical tensions, a shifting interest rate environment in developed and developing economies, and the increasing threat of tariffs impacting global trade, one thing is sure: Top-level foreign exchange (FX) management has seldom been as pivotal to businesses as it is today.

Against this backdrop, FX services have been gaining ground on companies’ balance sheets over the past few years, currently driving an average 50% of corporate value allocation, according to recent research by the market structure and technology research team at Coalition Greenwich.

FX trading volumes have been on a consistent uptrend since the pandemic, hitting a daily record of over $7.5 trillion this year, according to J.P. Morgan. Now, Market Data Forecast projects a 7.14% yearly compounded growth rate into 2032 for the global FX market.

The evolving scenario has prompted banks to rethink the status of their FX divisions, positioning them not just as an ancillary part of the corporate banking operation but as a core component of the overall strategy. On the clients’ side, the trend has significantly increased the demand for tailor-made FX offerings that cater to a client’s unique geographical reach and risk-exposure needs.

“Banks are creating personalized solutions like customized currency hedges or swaps. These tailored strategies help businesses manage currency risks in ways that suit their specific needs,” explains Swapnil Shinde, CEO and co-founder of Zeni, a corporate bookkeeping platform powered by artificial intelligence (AI).

“We also attribute this changing scenario to our corporate clients having a better understanding of the markets, thus managing foreign exchange and interest rate exposures over the short, medium, and long term with greater sophistication,” says Francisco Fernández Silva, managing director and head of the FX sales desk at Chile’s Banco de Credito e Inversiones (BCI).

With sophisticated demand from treasurers and CFOs growing and increased competition from peers, banks have been racing to deploy technological solutions that promise to bring better results and lower operational costs.

“The corporate FX market is undergoing a transformation driven by technological advancements that enhance efficiency, improve risk management, and democratize access for businesses of all sizes,” says Luis Martins, head of Global Macro at BBVA. “As companies increasingly adopt these innovations, they stand to gain a competitive edge in managing their foreign exchange activities effectively.”

However, the market’s most significant shift has occurred at the FX sales desk. Tools such as algorithms and machine learning models have been helping to automate the FX hedging process and other often-complex and highly volatile activities, bringing more-stable results.

BCI’s Fernández Silva also highlights the importance of AI in this revolution. “Breaking technologies, including artificial intelligence, are redefining offerings in the foreign exchange market by incorporating new participants, reducing information asymmetries, and increasing competitiveness,” he says.

Daisy-May Andrew, in interest rates and FX corporate rates sales at BNP Paribas, wrote in a company blog post that, in the current environment, companies must bulk up their currency hedging game with better, faster, automated solutions. “With the right automation tools in place, clients can add systematic hedging checks, which should, in theory, be able to search for the same red flags that one would do manually, albeit without the added concern of human error.”

According to recent research by FX-as-a-service provider MillTechFX, 86% of North American corporations planned to increase their FX hedging activity before the US presidential election, despite 73% noting increased hedging costs. This was due to concern about increased market volatility, among other factors.

Despite the significant numbers, Stephen Bruel, senior analyst at Coalition Greenwich, notes there’s still much ground to gain in FX trading. “Corporates should be encouraging their desks to adopt more advanced tools; the more electronic the trading, the better the data available to analyze execution quality and optimize results,” he added in a prepared statement.

High currency volatility is not alone in preying on corporates’ minds; Russian sanctions, the unwinding of the yen carry trade after 30 years of negative interest rates in Japan, the rise of the Chinese renminbi as an alternative reserve to the dollar, and the growth in alternative investments such as cryptocurrencies also play a role. These concerns have forced the market to increase its focus on currencies other than those of the Group of Five (G5) on the liquidity and product sides.

“Banks have adjusted their product range, offering solutions that include the opening of cash accounts and increased agility in global transactions services,” explains BCI’s Fernández Silva. “In some cases, having the opportunity to trade in different currencies gives clients the chance to realize cost advantages.”

In an October report, J.P. Morgan notes that the advancement of current trade-liberalization efforts across emerging markets, an increase in intranational trading driven by rising domestic customer demand, and these economies’ growing service focus are driving a decline in the proportion of FX reserves held in US dollars.

The trend is more pronounced in commodity markets, where the disruption in energy trade and the People’s Bank of China’s gold-buying spree—which resumed in November after a six-month pause—have prompted a significant change to currency reserves.

Such is the importance of the topic that US President-elect Donald Trump in November threatened to impose a 100% tariff on the nine BRICS countries should they “create a new BRICS currency, nor back any other currency to replace the mighty US dollar.”

Despite the warning signs, J.P. Morgan analysts do not see “de-dollarization” as an imminent threat, but as an important factor for corporations and banks to consider in particular business areas.

“FX reserves offer an incomplete picture of foreign asset accumulation. The rise in EM [emerging market] dollar-denominated bank deposits, sovereign wealth funds, and private foreign assets more than offsets the decline in overall dollar share of EM FX reserves,” says Saad Siddiqui, EM fixed-income strategist at J.P. Morgan, as quoted in the October report.

Zeni’s Shinde agrees that opportunities abound for the non-G5 currency market but notes that corporates and banks should be aware of the risks associated. “Businesses are looking at currencies beyond the traditional G5 to spread their risks. Still, they need to consider factors like stability and ease of trading before using them.”

Along with the myriad technological tools hitting the FX market over the past few years, leading banks have also been investing heavily in improving their research and advisory teams.

Against an FX market driven by central bank decisions and carry trade due to the global pivot to lower interest rates, these teams proved particularly important to corporate customers looking to stay one step ahead of the market.

In keeping with this trend, banks have been digging deep into their pockets to hire new talent. Recently, Citi, Deutsche Bank, Barclays, ING, Nomura, and Saxo Bank, and others, have made strategic additions to their FX departments.

BCI’s Fernández Silva explains the importance of balancing technology with first-class human talent: “In a landscape where central bank decisions and carry trade play a central role in global foreign exchange markets, financial institutions can offer unique value to their corporate clients through analysis of rate movements, economic variables, and exchange rate impacts, thus helping them capture value from carry trade and interest rate movements.”

BBVA’s Martins also highlights the key role of relationship management with clients and dealers. “Being able to offer best-in-class services in today’s foreign exchange markets requires a combination of strong relationships with clients and other dealers, along with top-level technology and data management,” he concludes.

—Thomas Monteiro

Global Finance selects its award winners based on objective factors such as transaction volume, market share, breadth of offerings, and global coverage, as detailed in public company documents and media reports.

Our criteria include subjective factors such as reputation, thought leadership, customer service, and technological innovation. We use input from industry analysts, surveys, corporate executives, and others. Although entries are not required in order to win, submissions that provide additional insight may inform decision-making.

| Best Foreign Exchange Banks 2025 | |

|---|---|

| GLOBAL WINNERS | |

| Best Global Foreign Exchange Bank | UBS |

| Best FX Bank for Corporates | Investec |

| Best FX Bank for Emerging Markets Currencies | Itaú Unibanco |

| Best Liquidity Bank | BBVA |

| Best FX Market Maker | J.P. Morgan |

| Best ESG-linked Derivatives | Nordea |

| Best FX Commodity Trading Bank (offering currency and commodity trading) | BTG Pactual |

| COUNTRY AND TERRITORY WINNERS | |

| Algeria | Société Générale |

| Angola | Standard Bank Angola |

| Argentina | Citi |

| Armenia | Ameriabank |

| Australia | ANZ Australia |

| Austria | UniCredit Bank Austria |

| Bahrain | National Bank of Bahrain |

| Barbados | Republic Bank |

| Belgium | BNP Paribas Fortis |

| Brazil | Itaú Unibanco |

| Bulgaria | DSK Bank |

| Canada | Scotiabank |

| Chile | Itaú Chile |

| China | Bank of China |

| Colombia | BBVA |

| Costa Rica | BAC Credomatic |

| Côte d’Ivoire | BICICI |

| Cyprus | Bank of Cyprus |

| Czech Republic | Komercni banka |

| Denmark | Danske Bank |

| Dominican Republic | Banco Popular Dominicano |

| DR Congo | Rawbank |

| Ecuador | Produbanco |

| Egypt | CIB |

| El Salvador | Banco Cuscatlán |

| Finland | Nordea Markets |

| France | BNP Paribas |

| Georgia | TBC Bank |

| Germany | Deutsche Bank |

| Ghana | Ecobank |

| Greece | National Bank of Greece |

| Guatemala | Banco Industrial |

| Honduras | Banco Ficohsa |

| Hong Kong | Standard Chartered Bank (Hong Kong) |

| Hungary | OTP Bank |

| India | IndusInd Bank |

| Indonesia | Bank Mandiri |

| Ireland | Investec Europe |

| Italy | Intesa Sanpaolo |

| Jamaica | National Commercial Bank Jamaica |

| Japan | MUFG Bank |

| Jordan | Arab Bank |

| Kazakhstan | ForteBank |

| Kenya | KCB |

| Kuwait | National Bank of Kuwait |

| Latvia | Swedbank Latvia |

| Lithuania | SEB Bank |

| Luxembourg | BGL BNP Paribas |

| Malaysia | Maybank |

| Mauritius | AfrAsia |

| Mexico | Citi México |

| Morocco | Attijariwafa |

| Mozambique | Millennium BIM |

| Namibia | Bank Windhoek |

| Netherlands | ING |

| New Zealand | TSB |

| Nigeria | Zenith Bank |

| North Macedonia | Komercijalna banka Skopje |

| Norway | DNB Markets |

| Oman | Bank Muscat |

| Panama | Mercantil Banco Panamá |

| Paraguay | Banco Itaú Paraguay |

| Peru | Banco de Crédito del Perú |

| Philippines | BDO Unibank |

| Poland | Bank Pekao |

| Portugal | Banco Santander |

| Qatar | Qatar National Bank |

| Saudi Arabia | Al Rajhi Bank |

| Serbia | OTP Bank Serbia |

| Singapore | DBS |

| South Africa | FirstRand (First National Bank/Rand Merchant Bank) |

| South Korea | Hana Bank |

| Spain | BBVA |

| Sweden | Nordea |

| Switzerland | UBS |

| Taiwan | CTBC Bank |

| Thailand | Kasikorn Bank |

| Tunisia | Banque Internationale Arabe de Tunisie |

| Turkey | BBVA |

| Uganda | Stanbic |

| United Arab Emirates | Emirates NBD |

| United Kingdom | HSBC |

| United States | J.P. Morgan |

| Uruguay | Banco Itaú Uruguay |

| Venezuela | Mercantil Banco Universal |

| Vietnam | VietinBank |

| Zambia | Stanbic |

Upon completing its megamerger with failing Credit Suisse in May 2024, Swiss banking giant UBS leveraged its already best-in-class corporate banking and foreign exchange (FX) capabilities and product offerings for a record-breaking year on several counts. Not only did the bank’s global operation more than double analysts’ expectations in the third quarter of 2024, booking a massive $1.4 billion in net income, but it did so with significant gains from its corporate banking division, which saw revenue jump by more than 8% year over year (YoY).

Those numbers received a massive boost from UBS’s thriving FX operation, which averaged over $125 billion in daily electronic FX trades during the year, with more than 2,500 active global clients.

The bank also posted substantial growth across several geographies and currency pairs. Among the highlights: solid profitability growth in Middle Eastern and Northern African currencies and a massive 40% market-share increase in Scandinavian currencies.

In Asia, the bank’s continued effort to improve its already top-tier suite of electronic FX capabilities paid off handsomely in China and Singapore, where it doubled down on its data center improvement efforts this year.

On the technology front, UBS kept expanding the limits of the global FX market, in July hosting the world’s first intraday FX swap in a regulated venue. The bank also recently launched its blockchain-based multicurrency payment solution, UBS Digital Cash. This addition to its’ digital offerings, processed through its flagship FX Engine Room, enhances the bank’s overall offering. —Thomas Monteiro

Central banks were the star of the show in FX markets in 2024, bringing high volatility amid a global pivot in monetary stance that shifted interest rate differentials between the G5 countries and developing-market currencies. Corporate clients worldwide found a haven in Investec’s team of top FX experts, who led the way in research, analysis, and execution, ensuring that customers stay one step ahead of the competition in spotting the most important market trends.

In addition, the bank’s Investec ix digital platform proved a key differentiator by providing real-time rate visibility, allowing clients to secure competitive rates at a glance amid the shifting macroeconomic environment. Additional features like easy trade execution and payment on the same page were also important to leverage during the year.

Whether clients are individual corporates, small or midsize companies, or large institutions, Investec’s dedicated FX dealers, robust trading desk capabilities, and best-in-breed app guarantee the combination of a tailored approach with global capabilities when it matters most. As a result, the bank has continued to gain significant market share in the global FX world, more than tripling its presence over the past five years. —TM

One of the largest FX providers in Latin America, Itaú Unibanco kept pushing the boundaries of what it means to provide excellence in trading of emerging market currencies in 2024. From July 2023 through June 2024, the Brazilian banking giant served over 326,000 clients in more than 1.9 million FX transactions in Latin America alone, with a notional amount totaling $225 billion.

Amid growing exports in the region, bolstered by a strong US dollar, an increase in nearshoring initiatives, and geopolitical uncertainty in the breadbasket Black Sea region, the bank leveraged its leadership to provide superior service, handling over $92.7 billion in trade deals during the same period.

To capitalize on the growing demand, the bank has expanded its dedicated FX team, increasing employee numbers by more than 10% from 2021 to 2024. The bank is also boosting investment in technology, increasing tech spending to nearly $20 million in 2024, an 8% rise over the prior two years.

The massive sum supports system modernization and enhances digital service delivery, allowing about 73% of transactions to be executed electronically. The bank’s trading platforms provide real-time pricing linked to market-makers’ books, ensuring competitive and efficient deals for clients. —TM

BBVA’s market positioning across several geographies, including emerging and developed markets, has proved the key to success for corporate clients seeking to take advantage of the fast-paced interest rate environment of 2024.

The bank’s centralized core pricing engine is key to leveraging its FX capabilities to the next level, providing consistent and competitive FX rates globally. As the backbone for processing and executing FX transactions, the engine ensures that pricing is optimized and dependable. The bank also shines brightly through its unrivaled suite of fast-execution digital channels, with offerings such as BBVA Net Cash, which aligns FX goals with corporate clients’ business requirements; and BBVA eMarkets, which integrates FX with broader investment banking needs.

These tools ensure solid and instant liquidity in markets from Latin America to Turkey. They offer streamlined access to one of the most diverse ranges of FX products in the market, including spot, swaps, forwards, and more-complex structured products like options and exotics.

Due to top-level execution, the Spanish behemoth reached all-time highs in monthly electronic FX business volumes last year, boasting one-fifth of the market share in derivative volumes in 2024: a significant milestone. —TM

The winner of the global Best FX Market Maker award is J.P. Morgan, reflecting its strong market position, deep resources, and technological prowess. These attributes allow the bank to provide exceptional scale and market access while efficiently handling high volumes of FX transactions.

One such solution is the bank’s Execute platform, which offers corporate and institutional clients full-service macro trading from a single platform. The benefits include diverse liquidity access, trade transparency, and competitive pricing for streamlined FX execution, as well as the ability to execute trades across over 300 currency pairs with efficient order routing across multiple electronic communication networks. The platform also provides enhanced functionality through various channels, including the web, application programming interfaces, and desktop or mobile devices, along with real-time analytics to access market insights from J.P. Morgan traders and analysts. Execute also includes a customizable alert feature to capture market movements. The Execute Mobile component provides transaction efficiency through one-touch trade execution, the ability to view historical trades, and a market monitor for FX rates.

The bank has also expanded its capabilities for FX options with an integrated platform that allows clients to transact a range of vanilla, exotic, structured, or multileg instruments. Additional features include the ability to view the market with multicurrency volatility grids and live insights from the bank’s options traders. —David Sanders

Nordea’s undisputed positioning in the global FX environmental, social, and governance (ESG) market goes far beyond the bank’s extensive suite of investment products. ESG principles are a core part of the bank’s operation, providing unique market knowledge and opportunities for small and large companies.

The Nordic bank’s customers enjoy a full holistic sustainable-finance advisory that helps them allocate resources efficiently and protect against risks in the sector, particularly as the global ESG market stages a rebound thanks to 2024’s currency volatility.

Moreover, the bank’s extensive FX Algo Suite, which covers the full spectrum of FX transaction needs, from passive to aggressive market positionings, has proven a game-changer for those assessing market risks. It is further supported by the bank’s proprietary model of ESG accountability, which provides customers with another layer of confidence when making ESG-related investments on and off the FX spectrum.

This outstanding ESG offering is complemented by top-tier FX market research and financial advisory that allows clients to tailor market opportunities and financial planning to their needs and goals. —TM

By offering first-class, tailor-made solutions for importing and exporting FX-related products, BTG Pactual, Latin America’s largest investment bank, rode the positive wave in Latin American commodities to a record-beating third quarter.

Although the Brazilian giant’s investment banking operation faced some macro headwinds, primarily due to underperformance in its home stock market, its corporate lending and business operation more than compensated, notching a phenomenal 29% YoY revenue growth as of the third quarter.

Against a backdrop of increasing export-related profitability and high currency volatility due to a devaluating Brazilian real, BTG helped clients in all areas of the commodity market by providing a combination of fast execution, excellent financial advisory, and top-grade hedging products.

The bank also continued expanding its FX funds offering last year, allowing clients based in Latin America to adopt more-sophisticated foreign currency holdings and hedging solutions. This allowed clients to benefit from a thriving global market.

BTG’s superior offering and financial planning helped commodity clients, in particular, weather growing supply costs due to the devaluating local currencies in Latin America. —TM

| Best Foreign Exchange Banks 2025 | |

|---|---|

| REGIONAL WINNERS | |

| Africa | Standard Bank |

| Asia-Pacific | Hana Bank |

| Central & Eastern Europe | OTP Bank |

| Latin America | Itaú Unibanco |

| Middle East | Qatar National Bank |

| North America | J.P. Morgan |

| Western Europe | BBVA |

Adjudged the best bank for foreign exchange (FX) in Africa, Standard Bank continues to service the cross-border payment and funding needs of its corporate, investment, and individual clients despite the currency volatility and devaluation challenges that many African countries face. Standard Bank has an FX transactions market share of 30% in the African countries in which it operates. At the same time, it is one of the top finance institutions for FX needs in countries such as South Africa, Angola, and Zimbabwe.

Accounting for a larger market share “allows us to make, maintain, and manage a live, active, and tradable market price,” says a bank spokesperson. Standard Bank has more than 100 employees dedicated to its FX business, covering sales, trading, and operations. There are three dedicated FX trading desks: spots, forwards, and futures.

With 1.6 million trades per year and $1.7 trillion in overall turnover, Standard Bank signed an agreement in November with the World Bank’s International Finance Corporation on cross-currency swaps and derivatives for Africa. FX and local currency liquidity can be challenging in Africa, where some market reforms and attractive returns increasingly bring in more global investors, raising FX needs and transactions.

“There is growing interest in sub-Saharan countries, with investors recognizing the continent’s potential,” said Kayode Solola, head of global markets for Africa at Standard Bank Group, in comments accompanying the announcement.

The bank’s FX professionals “have the skills to support a diversified international and domestic client base trading in all G10 as well as 40 African currencies,” says the bank.

Winning the Best FX Bank awards in Africa and Angola represents international recognition of Standard Bank’s capabilities in meeting clients’ foreign currency demands. —Tawanda Karombo

South Korean–based Hana Bank has established itself as a regional leader in the Asian financial markets, particularly in providing FX services. The bank has grown from a local financial institution into one of the most significant players in the global banking industry, and is currently boasting total assets of $400 billion.

“Hana Bank’s success in the foreign exchange market is built on our unwavering commitment to innovation and customer-centric solutions,” says CEO Lee Seung-lyul, the first CEO of Hana Bank with a background in foreign exchange. “We continually invest in cutting-edge technology and strive to offer the industry’s most efficient and secure FX services.”

This demonstrated expertise enables the bank to offer tailored solutions that meet the specific needs of its clients, whether they are looking to hedge against currency risk, make international payments, or engage in speculative trading.

This award recognizes Hana Bank’s outstanding performance and innovation in the FX market and underscores its position as a trusted and influential player in FX services. —Simon Littlewood

This year’s winner for Central and Eastern Europe (CEE) is OTP Bank. Privatized in the 1990s and formerly the National Savings Bank of Hungary, OTP Bank is now a familiar name across the 11 countries in CEE and the Central Asia region where it has a presence. It sold its operations in Romania to Banca Transilvania because local regulations prevented it from further expansion. OTP is renowned for its innovative yet flexible service.

OTP Bank runs a centralized FX operation out of its Budapest headquarters. Ten traders and 25 salespeople conduct transactions for the main and regional subsidiary banks, offering pricing for 100 currency pairs.

The bank has started an internal digitalization project to simplify and accelerate the workflow for FX transactions. It operates a groupwide internet-based platform where clients of six subsidiaries can conclude FX transactions and convert funds into more than 40 currencies. The system already operates in Russia, Bulgaria, Serbia, Montenegro, Slovenia, and Croatia. Management is keen to introduce it to other subsidiaries and add new currency pairs to improve service and market coverage.

In November 2024, OTP contracted Integral Development, a leading currency-technology provider based in Palo Alto, California, to improve and automate foreign exchange pricing and distribution to the bank’s clients in FX spots, forwards, and swaps. According to Integral, its systems offer “liquidity aggregation, pricing engine, trading, and risk management solutions to deliver the highest pricing accuracy and reliability to its clients. … The flexible architecture ensures that OTP Bank can easily scale and adapt its FX infrastructure to meet evolving client needs” across the CEE region. —Justin Keay

Despite already occupying a leading position in Latin America’s FX market, the Brazilian behemoth Itaú Unibanco kept expanding its offerings and robust geographical presence to notch another year of sustained growth in volume and profitability.

From July 2023 to June 2024, Itaú executed over 1.9 million FX transactions, with a total notional amount of $225 billion. The bank served over 326,000 clients during the period, demonstrating its extensive reach and expertise in managing substantial transaction volumes and liquidity.

Amid the region’s increasingly competitive market, the powerhouse accelerated its technological investment. This jumped from approximately $15.9 million in 2022 to nearly $17.2 million in 2024, mainly focused on improving the bank’s cloud platforms and microservices architecture.

The bank also added generative artificial intelligence to its offerings, thus enhancing efficiency and scalability in client operations. This endeavor has already generated significant results, with Itaú increasing its automation rate from 25% to 44% in 2024.

Despite its growing investment in technology, the bank continued to support its team of FX professionals. The team boasts around 350 best-in-class employees across several functions including sales specialists, support specialists, sales traders, and market-makers. —Thomas Monteiro

Qatar National Bank (QNB) is the largest bank in the Middle East by assets. It operates in 28 countries, including 14 in the region. Its leading FX business, capitalizing on its strong credit rating, which reflects its financial strength and partial state ownership. A solid custody business aids FX operations.

The bank has significantly increased its market share of inflows to Qatar and international markets. QNB has broad access to the region, global financial hubs, and a broad network across Asia. The bank has rolled out a new cash management platform and ramped up business and operational capabilities. QNB has strengthened its offering as an integrated payment provider for cross-border transactions.

QNB has launched programs for exporters as well as cross-selling initiatives based on its trade finance and cash management capabilities. International payments have increased due to a new remittance system and enhancements to the bank’s correspondent account management and treasury transaction services. QNB successfully onboarded the first clients into its application programming interface (API) platform. Clients can now increase their internal financial accuracy and eliminate manual processes by accessing daily FX rates through API functions.

The FX desk has continued to perform well. The bank has improved its client service due to investment in stronger FX capabilities, allowing it to capture market opportunities. —Darren Stubing

With its comprehensive suite of FX services, J.P. Morgan (JPM) has earned our award as Best FX Bank in North America. Through its Execute and Transact platforms, the bank offers institutional clients innovative solutions with an integrated approach to FX execution, including commodities and rates trading capabilities.

JPM’s Execute provides exceptional liquidity access, efficient execution, and trade transparency through robust market-analytics features, real-time data for trade optimization, and live support from traders and analysts to streamline workflows. The platform is accessible through multiple channels, including the web, APIs, and desktop or mobile devices. Execute Mobile provides market data and one-touch trading ability.

With FX Algos on Execute, clients can customize algorithmic trading strategies for greater efficiency, enhanced trade transparency and performance, and integrated pre-trade and post-trade analytics tools. Through JPM’s Transact digital platform, clients benefit from robust FX hedging and settlement solutions to manage cross-border exposure covering over 100 currencies. These offerings are integrated with treasury and cash management functions, contributing to a more efficient workflow.

Innovative new developments include advancements in blockchain technology through the Kinexys platform, which facilitates cross-border transfers. Integration with JPM’s FX services is expected in early 2025, enabling clients to execute and settle FX transactions with greater flexibility and efficiency and reduced settlement risk. —David Sanders

In a year when volatility was the norm across Western European markets, with several central banks pivoting their monetary stances, BBVA’s best-in-breed FX management and comprehensive suite of technological offerings gave the bank’s users a significant edge.

By leveraging its knowledge and presence across different geographies, the Spanish banking giant managed to post positive numbers in most of the region’s currencies, including the euro, British pound, Norwegian krone, Swedish krona, Danish krone, and Swiss franc. The secret behind BBVA’s outstanding performance is a combination of local-market expertise and a powerful, user-friendly app that allows users to instantly access and execute products such as FX spots, forwards, swaps, options, and structured notes, at the click of a button, with the best insights in the market.

Our Best FX Bank in Spain, BBVA also doubled down on its efforts to support growth in Western Europe by focusing on products that cater to the specific needs of the region’s small and midsize enterprises (SMEs). Through its flagship Net Cash app, the bank enables SMEs to hedge their FX exposure, order international transfers, and configure FX market alerts, all through a user-friendly interface tailored to their habits and needs. —TM

The content in this section is supplied by GlobeNewswire for the purposes of distributing press releases on behalf of its clients. Postmedia has not reviewed the content.

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR RELEASE PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY, OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES.

Article content

Article content

TORONTO, Dec. 30, 2024 (GLOBE NEWSWIRE) — PTX Metals Inc. (CSE: PTX) (OTCQB: PANXF, Frankfurt: 9PX) (“PTX” or the “Company“), is pleased to announce the closing of the previously announced non-brokered private placement of units (the “Units“) and flow-through common shares in the capital of the Company (“FT Shares“), which has been over-subscribed, raising total combined gross proceeds of $3,419,834 (the “Private Placement“) including the first and final tranches (see press release dated December 11, 2024 for details regarding first tranche).

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

In addition, a closing of a $150,000 Quebec Flow Through Private Placement at 15 cents per share of PTX is expected to occur on December 31, 2024 (the Quebec Flow-Through Private Placement”).

Pursuant to the closing of the Final Tranche of the Private Placement, the Company issued 1,205,814 FT Shares at a price of $0.14 per FT Share for aggregate gross proceeds of $168,814. Each FT Share will qualify as a “flow-through share” as defined in subsection 66(15) of the Income Tax Act

(Canada).

Also pursuant to the closing of the Final Tranche of the Private Placement, the Company issued 1,834,000 Units at a price of $0.125 per Unit for aggregate gross proceeds of $229,250. Each Unit consists of one common share in the capital of the Company (a “Common Share“), and one-half of one Common Share purchase warrant (each whole warrant, a “Warrant“). Each Warrant is exercisable at a price of $0.18 for a period of 24 months from the date of issuance.

In connection with the closing of the Final Tranche, the Company paid finders an aggregate of $22,700.71 in cash fees and issued 163,646 finder’s warrants (“Finder’s Warrants“). Each Finder’s Warrant entitles the holder to purchase one common share of the Company at a price of $0.14 for a period of 24 months from the date of issuance.

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

Over 60 investors participated in the Private Placement and the proceeds will be used to advance the Company’s projects in Ontario and for general working capital. The Company will announce detailed exploration programs for its W2 Cu-Ni-PGE project and South Timmins Gold projects during the month of January 2025.

All securities issued in connection with this Private Placement will be subject to a four month plus one day hold period from the date of issuance in accordance with applicable securities laws.

Heenan Mallard Gold Project Winter 2025 Drilling Program:

The Company is pleased to announce the commencement of a diamond drilling program at the Heenan Gold Project located in Swayze Greenstone Belt of the Abitibi near the Cote Gold Project. The up to a 750-metre drill program is following up on the gold discovery made earlier in 2024 (see press release dated February 21, 2024, for further details). Several consistent wide zones of gold mineralization from surface to 177m was intersected in the first program which was following up on mechanized stripping program completed in Q4 2023 that discovered gold occurrences in two channel sample composites including 4.05 g/t Au over 2.00 m, and 2.39 g/t Au over 8.00 m in Trench 2.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

The program commenced in mid-December 2024 and then subsequently halted over the holidays and will resume in January 2025.

Quebec Flow-Through Private Placement:

Furthermore, the Company has arranged an additional private placement of $150,000 with an arms length investor. This private placement is expected to close tomorrow, December 31, 2024, with the issuance of 1,000,000 shares of PTX at a price of 15 per share cent per PTX share. All the proceeds will be utilized as eligible Quebec flow-through expenditures by the Company’s subsidiary, Green Canada Corporation (“GCC”) on its Matoush Project located in Quebec. In this regard, all the proceeds will be advanced to GCC increasing PTX’s ownership interest in GCC from 52% to 54% by issuing 1,500,000 shares of GCC at 10 cents per share.

The transaction constitutes a “related party transaction” under Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”) as the Company and GCC are related parties by virtue of the Company’s significant shareholdings. However, the transaction is exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 pursuant to subsections 5.5(a) and 5.7(1)(a) and (b), respectively, as the fair market value of the transaction, insofar as it involves related parties, is less than 25% of the market capitalization of either party, as determined in accordance with MI 61-101. The board of directors of each of the Company and GCC have reviewed and approved the transaction and determined that it is in the best interests of each entity.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

Amendments to Outstanding Convertible Loan:

The existing outstanding convertible loan of $250,000 with an arm’s length investor (Cormel Capital Sarl) was amended in December resulting in: 1) a reduction of the conversion price into common shares of the Company from 20 cents to 14 cents, and 2) an extension of the maturity date of the convertible loan to May 2026. All other terms previously disclosed in the Company’s financial statements remain the same.

Qualified Person

The technical information presented in this news release related to the Heenan Gold Project has been reviewed and approved Joerg Kleinboeck, P. Geo, a qualified person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

About PTX Metals Inc.:

PTX is a mineral exploration company focused on high-quality critical minerals projects, including two flagship projects situated in northern Ontario, renowned as a world-class mining jurisdiction for its abundance of mineral resources and investment opportunities. Our corporate objective is to advance the exploration programs towards proving the potential of each asset, which includes the W2 Cu-Ni-PGE and gold Project and South Timmins Gold Joint Venture Project.

Advertisement 6

This advertisement has not loaded yet, but your article continues below.

Article content

PTX’s portfolio of assets offers investors exposure to some of the world’s most valuable metals including gold, as well as essential critical minerals for the clean energy transition: copper, nickel, PGE, uranium and rare metals. PTX’s portfolio of assets was strategically acquired for their geologically favorable attributes, and proximity to established mining companies. PTX’s mineral exploration programs are designed by a team of expert geologists with extensive career knowledge gained from their tenure working for global mining companies in northern Ontario and around the world.

PTX is based in Toronto, Canada, with a primary listing on the CSE under the symbol PTX. The Company is also listed in Frankfurt under the symbol 9PF and on the OTCQB in the United States as PANXF.

For additional information on PTX, please visit the Company’s website at https://ptxmetals.com/.

For further information, please contact:

Greg Ferron,

President and Chief Executive Officer

Phone: +1 (416) 270-5042

Email: [email protected]

Forward-Looking Information

Advertisement 7

This advertisement has not loaded yet, but your article continues below.

Article content

This news release contains forward-looking information which is not comprised of historical facts. Forward-looking information is characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, and opportunities to differ materially from those expressed or implied by such forward-looking information, including statements regarding the ability of the Company to satisfy regulatory, stock exchange and commercial closing conditions of the Private Placement, and the potential development of mineral resources and mineral reserves which may or may not occur. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, and general economic and political conditions. Forward-looking information in this news release is based on the opinions and assumptions of management considered reasonable as of the date hereof, including that all necessary approvals, including governmental and regulatory approvals will be received as and when expected. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether because of new information, future events or otherwise, other than as required by applicable laws. For more information on the risks, uncertainties and assumptions that could cause our actual results to differ from current expectations, please refer to the Company’s public filings available under the Company’s profile at www.sedarplus.ca.

Advertisement 8

This advertisement has not loaded yet, but your article continues below.

Article content

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America. The securities described herein have not been and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”) or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Article content

Share this article in your social network

For artists, it is difficult to reflect on the past year without thinking about Israel’s genocide in Gaza that has killed more than 45,000 Palestinians per the official count or more than 220,000 per realistic estimates.

While art is something to be enjoyed, as it enriches every aspect of our lives, identities, and culture, it is also central to struggle. Art is powerful, it allows us to share emotions and stories with people around the world even if we don’t share a common language. Israel knows this, and that’s why it targets all those with a talent and passion to transmit messages about Gaza’s horrific reality.

Indeed, Israel seems to make it a tactic in its broader strategy of ethnic cleansing to wipe out Palestinians who inspire not just their own people, but everyone waging a fight against injustice.

Painters, illustrators, poets, photographers, writers, designers … so many talented Palestinians have already been killed. It is incumbent on us to ensure that they are not forgotten. They are not numbers, and their work should be remembered, always.

We must tell people about Heba Zagout, the 39-year-old painter, poet and novelist, killed along with two of her children in an Israeli air strike. Her rich paintings of Palestinian women and the holy sites of Jerusalem were her way of speaking to the “outside world”.

We must say the name of renowned painter and arts educator, Fathi Ghaben, whose beautiful works that captured Palestinian resistance should be seen by all.

We have to teach the words of Refaat Alareer, one of Gaza’s most brilliant writers and teachers who lectured at the Islamic University of Gaza.

We have to talk about the beauty in the art of Mahasen al-Khatib, who was killed by an Israeli air strike on Jabalia refugee camp. In her last illustration, she honoured 19-year-old Shaban al-Dalou, who burned to death in the Israeli attack on the Al-Aqsa Hospital compound.

We must also remind the world of writer Yousef Dawwas, novelist Noor al-din Hajjaj, poet Muhamed Ahmed, designer Walaa al-Faranji, and photographer Majd Arandas.

However, ensuring their stories and works are not erased also means we need to take action, wherever we are. Honouring these martyrs and celebrating their art requires that we go beyond words.

Some in the art world already know this. They have joined the resistance within art spaces and ensured that Israel’s crimes are denounced on their platforms. There have been many acts of solidarity and bravery throughout the past year.

When the Barbican Centre in London cancelled Indian writer Pankaj Mishra’s lecture on the genocide in Palestine in February, art collectors Lorenzo Legarda Leviste and Fahad Mayet withdrew artwork by Loretta Pettway from the centre’s gallery.

“It is incumbent on all of us to stand up to institutional violence, and demand transparency and accountability in its wake … We will never accept censorship, repression and racism within its walls,” they wrote.

In March, Egyptian visual artist Mohamed Abla returned his Goethe Medal, awarded for outstanding artistic achievement by Germany’s Goethe Institut, in protest of the German government’s complicity in the Israeli genocide.

Before the opening of the Venice Biennale in April, more than 24,000 artists from around the world – including previous Biennale participants and prestigious award recipients – signed an open letter calling on the organisers to exclude Israel from the event. One Israeli artist eventually decided not to open her exhibition.

In September, Pulitzer Prize-winning author Jhumpa Lahiri refused to accept an award from the Noguchi Museum in New York after it fired three employees for wearing Palestinian keffiyeh scarves.

Earlier this month, artist Jasleen Kaur, who received the prestigious Turner prize, used her acceptance speech to condemn the genocide, calling for a free Palestine, an arms embargo and extending solidarity with the Palestinians. She stood in solidarity with all those who protested outside the Tate Britain in London, where the event took place, calling on it to divest from funds and projects linked to the Israeli government.

“I want to echo the calls of the protesters outside. A protest made up of artists, culture workers, Tate staff, students, who I stand firmly with,” Kaur stated. “This is not a radical demand, this should not risk an artist’s career or safety.”

Despite these acts of solidarity, the vicious censorship, omission, repression and witch-hunts of art related to Palestine have not abated over the past 12 months.

In January, the Indiana University art museum cancelled an exhibition by Palestinian artist Samia Halaby.

In May, the town of Vail in Colorado cancelled the artist residency of Danielle SeeWalker, a Native American artist who had compared the plight of Palestinians to the plight of Native Americans.

In July, the Royal Academy of Arts removed two pieces of artwork from their Young Artists’ Summer Show because they were related to Israel’s war on Gaza. This came after the pro-Israel Board of Deputies of British Jews had sent it a letter regarding the artwork.

In November, the altonale festival in Hamburg cancelled an exhibition of artworks produced by children in Gaza after social media posts attacking it.

These are just a few examples of the massive censorship that Palestinian art and artists and creators who have voiced their solidarity with Palestine have faced over the past year. The silencing and whitewashing within cultural spaces have also taken place at an institutional level.

In the UK, the Arts Council England (ACE) warned art institutions that “political statements” could potentially negatively affect funding agreements. This was revealed upon the trade union Equity’s Freedom of Information request, which also showed that ACE and the Department of Media, Culture and Sport (DMCS) even met about the “reputational risk relating to Israel-Gaza conflict”.

Some have highlighted the contradiction of ACE’s actions given it openly expressed solidarity with Ukraine in 2022 after the Russian invasion. But it is not just ACE that has demonstrated blatant double standards in addressing the slaughter in Gaza.

The brilliant Palestinian artist Basma Alsharif articulated the institutional hypocrisy perfectly in her letter to the “Vapid Neoliberal Art World”.

She wrote: “I hope this genocide finds you well. What exactly are you doing these days? Why did it take you months to write a statement, if you did at all? Why didn’t you just shut down? Why aren’t you able to boycott Israel the way you have Russia, the way you did Apartheid South Africa? Have you seen the number of statements out there? The open letters? The call for strikes? How many hashtags did you all decide it would take to atone for your sins?”

There are no excuses for complacency regarding the genocide in Gaza. The Palestinian people face extermination and our responsibility to them is to ensure our governments, institutions and industry are not left in peace until they cut ties with Israel, stop silencing those speaking out against its crimes, and commit to the liberation of Palestine.

I urge all those in the art world – a pocket of whom were so vibrantly represented in the protest outside the Tate when Kaur was awarded – to remember the words of American author James Baldwin:

“The precise role of the artist, then, is to illuminate that darkness, blaze roads through that vast forest, so that we will not, in all our doing, lose sight of its purpose, which is, after all, to make the world a more human dwelling place.”

States and their institutions may use the scramble for funding and platforms to repress our expression of solidarity, but ultimately they won’t win. Those who concede for their personal and professional gains may try to convince themselves that this movement will die down and the issue will be forgotten, but until Palestine is free – and this will take place – we are keeping the receipts, we are noting the absence, we are hearing the silence over Israel’s genocide in Gaza. It is not too late to stand on the right side of history.

A happy new year will only be possible once the Palestinians and all those facing oppression are free.

The views expressed in this article are the author’s own and do not necessarily reflect Al Jazeera’s editorial stance.

It’s clear banks and borrowers fared better than feared

TORONTO — The big questions in Canadian finance heading into 2024 were whether the economy could avoid a recession and what would happen with interest rates.

Article content

Article content

The uncertainty at the start of the year had banks tucking billions of dollars aside in case the picture worsened for heavily-indebted Canadian consumers as many renewed their mortgages at much higher rates.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

As the year comes to a close, it’s clear banks and borrowers fared better than feared, leaving some of the biggest stories in the financial industry to be blockbuster deals, surprises and scandals at individual lenders.

Here’s a look at some of the key numbers that tell the story of 2024 for the Canadian financial sector:

$58,771,000,000: The adjusted profits of the Big Six banks in the 2024 fiscal year. That’s up a billion dollars from a year earlier, though still a little below the highs of 2021-2022. Heading into 2024, there were heightened fears about mortgage defaults and borrower stress with interest rates running high. The strains did lead to subdued loan growth, but with Canada settling into a soft economic landing, banks still managed robust profits. Expectations are for better growth in 2025, mostly in the second half of the year, as interest rate cuts have time to work through the economy.

3.25 per cent: The Bank of Canada interest rate at the end of the year, down from five per cent at the start of June. Banks followed the central bank’s lead and have lowered their prime rates to 5.45 per cent. More cuts are on the way for 2025 with RBC expecting the central bank rate to lower its key rate to two per cent by July because of the weak economy. Meanwhile, the U.S. interest rate came down only half a percentage point as its economy remains much stronger. The United States Federal Reserve suggested earlier this month it may cut just twice next year.

Posthaste

Breaking business news, incisive views, must-reads and market signals. Weekdays by 9 a.m.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Posthaste will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

0.20 per cent: The mortgage delinquency rate in Canada at the end of the third quarter, according to Equifax Canada. That’s up from a historically low 0.14 per cent two years ago, but still below the more than 0.30 per cent that it averaged in the years before the pandemic. Banks expect delinquencies to creep higher next year as job losses grow, but say overall, they’re comfortable with their mortgage portfolios.

$4.45 billion: What TD Bank Group paid the U.S. government for its oversight failures on anti-money laundering controls. The bank took full responsibility for the failures, which led to criminals laundering more than $965 million in illicit drug profits through its branches in the U.S. Regulators also capped its retail asset growth. TD chief executive Bharat Masrani announced he would retire in the new year, to be replaced by Raymond Chun.

780,000: The number of customers who were moved over to RBC after Canada’s largest bank closed its $13.5 billion acquisition of HSBC Canada in March. RBC also took on about 4,500 employees and $108.5 billion in assets. The acquisition took out a dynamic player in the mortgage space, but banks maintain that rate competition remains fierce.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

$246,000,000,000: RBC’s market capitalization as of the last Friday of the year, after an almost 30 per cent climb in 2024. The gains came thanks in part to the HSBC deal closure, as well as easing worries from investors around the banking sector. Royal Bank is by far Canada’s largest company by market cap, ahead of Shopify at around $199 billion and well ahead of TD Bank Group at $133 billion, after TD lost a little more than 10 per cent of its value over the year.

$49 million: The amount RBC’s former chief financial officer Nadine Ahn sued the bank for over claims of wrongful dismissal. RBC had fired Ahn in April over allegations she had an “undisclosed close personal relationship” with another employee, who received preferential treatment. Back and forth legal filings revealed numerous personal details about her relations with her colleague, including pet names, a poem and a “Love Book” photo album, but Ahn maintains it was a workplace friendship and not the close personal relationship as RBC alleges. Ahn signed on as deputy chief financial officer of Canaccord Genuity in October.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

557,400: The number of shares that a Scotiabank subsidiary held in Israeli defence contractor Elbit Systems Ltd., worth about US$144 million, near the end of the year. That’s down from the 2,236,500 shares, worth about US$443 million, that it held near the end of 2023. Scotiabank had faced numerous protests related to the holdings because of Elbit’s role in supplying Israel weapons for the war in the Gaza Strip, but it said the decision by its 1832 Asset Management to sell wasn’t influenced by the protests.

US$104 billion: The amount of fossil fuel funding Canada’s five biggest banks provided in 2023, as outlined in a March report from a coalition of climate groups. For most banks, it was their lowest level of oil and gas funding since the signing of the Paris climate agreement in 2015, but the drop also came as huge oil and gas profits lowered the industry’s need to borrow. RBC, which topped the list in the report at US$28.2 billion, also committed to tripling its renewable energy funding to $15 billion by 2030.

Recommended from Editorial

60 per cent: The current maximum legal interest rate lenders can charge, based on an effective annual interest rate basis that factors in compounding. It works out to 48 per cent on an annual percentage rate. The federal government moved forward this year with regulations that will see the rate capped at 35 per cent on an annual percentage rate. The change, which also puts new restrictions around payday loans, comes into effect Jan. 1.

Article content

Share this article in your social network

The sound of tanks rumbling through the streets outside of Kamal Adwan Hospital woke everyone up, they were already on edge after enduring months of direct Israeli attacks.

Then came the loudspeakers ordering everyone to evacuate – the sick, the wounded, medical staff, and displaced people seeking shelter – early on Friday morning.

It was clear that the medical complex in northern Gaza’s Beit Lahiya was about to face an Israeli raid, like so many had before it as Israel seemed to systematically destroy all healthcare in Gaza.

It didn’t matter that, according to the World Health Organization, the hospital was the last major health facility operational in northern Gaza, an area that has been suffocatingly besieged and decimated by Israel in its ongoing war.

Nor that it was a refuge for hundreds of Palestinians whose homes had been destroyed by Israel and had nowhere else to go.

At about 6am, patient Izzat al-Aswad heard Israeli forces summoning Dr Hussam Abu Safia, the hospital director, over their loudspeakers.

Dr Abu Safia came back and told people in the hospital they had been ordered to evacuate. Abu Safia himself, who was a rare voice exposing what Israel was doing to the hospital, was taken by Israel, which has refused to release him despite calls to do so from the UN, humanitarian NGOs and international health organisations.

A little later, al-Aswad said Israeli soldiers demanded that all the men strip down to their underwear to be allowed to leave.

Shivering, frightened, many of them injured, the men were ordered to walk to a checkpoint the Israelis had set up about two hours away, al-Aswad recounted by phone.

At the checkpoint, they gave their full names and had their photographs taken.

Then a number was scrawled on their chest and neck by a soldier, indicating they had been searched.

Some of the men were taken for interrogation.

“They beat me and the men around me,” al-Aswad said. “They hit the injured people like me directly on our injuries.”

Shorouq al-Rantisi, 30, a nurse in Kamal Adwan’s laboratory department, was among the women taken from the hospital.

The women were told to walk to the same checkpoint, which was in a school, and then waited for hours in the cold.

“We could hear the men being beaten and tortured. It was unbearable.”

Then the searches started.

“The soldiers were dragging the women by the head towards the search area,” al-Rantisi said. “[They] shouted at us, demanding we remove our headscarves. Those who refused were beaten badly.”

“The first girl called for searching was told to strip. When she refused, a soldier beat her and forced her to lift her clothes.

“A soldier dragged me by the head and then another soldier ordered me to lift the top of my clothes, then the bottom, and checked my ID,” she said.

Al-Rantisi said the women were eventually taken, left at a roundabout, and told they could not go back to Beit Lahiya.

“How could we leave and abandon the patients? None of us ever thought of leaving until we were forced to,” she said on the phone.

Israel assaulted the hospital for many weeks before the raid.

“The hospital and its courtyard were bombed relentlessly, day and night, as if it was normal,” al-Aswad said.

“Quadcopters fired at anyone moving in the courtyard … they targeted generators and water tanks, while medical staff were struggling to care for patients.”

The night before the raid was “terrifying”, al-Aswad added, with Israeli attacks all around, including on the “al-Safeer” building.

“Witnesses say about 50 people were in there, including nurses from the hospital. No one could rescue them or retrieve their bodies, they’re still there,” he recounted.

Al-Aswad and the men who were not taken for interrogation were released after a full day of abuse and humiliation.

“The soldiers ordered us to go west of Gaza City and never come back,” he said. “We walked through destruction and rubble, freezing, until people came to meet us near Gaza City, offering help and blankets.”

Israel’s raid merely compounded “the global silence and abandonment” Palestinians in Gaza have been faced with throughout more than a year of relentless Israeli attacks that killed more than 45,000 people, al-Rantisi said.

“Over 60 days of relentless shelling – quadcopters, artillery, and targeted strikes on generators,” she said.

“Dr Hussam’s pleas went unanswered until the hospital was stormed and emptied. How does the world allow this to happen?”

“I feel we were all betrayed,” Fadi al-Atawneh, 32, said bitterly on the phone.

“I was wounded, so I stayed in the hospital, hoping that the World Health Organization would evacuate or protect us, but it never happened,” al-Atawneh said.

“I am deeply saddened by what happened to us and the fate of Dr Abu Safia. We’re left alone in the face of this aggression.”

Cold weather in Gaza has claimed the life of a baby, the sixth to die in a week, according to medical sources, as Israel continues its relentless attacks on hospitals across the strip.

One-month-old Ali al-Batran died on Monday at Al-Aqsa Martyrs Hospital in central Gaza, the Palestinian news agency Wafa reported, quoting medical sources who attributed his death to plummeting temperatures.

The day before, his twin brother, Jumaa al-Batran, perished from the cold in the displaced family’s flimsy tent in Deir el-Balah, also in the centre of the enclave, his father said, describing how Jumaa had been discovered with his head as “cold as ice”.

The babies were born one month prematurely.

Israeli forces have displaced almost all of the 2.3 million residents of Gaza, forcing tens of thousands of them into makeshift tents in open-air camps along the rainy, windswept coast.

Three of the six Palestinian babies who have died of hypothermia in the past week lived in the coastal “safe zone” of al-Mawasi, close to the southern town of Khan Younis.

Gaza’s Government Media Office said on Monday that “bitter cold and frost” hitting “dilapidated tents” in the strip’s camps had killed seven people, including an adult healthcare worker.

Gaza’s Ministry of Health reported on Monday that 27 people had been killed over the previous 24 hours.

Reporting from Deir el-Balah, Al Jazeera’s Hind Khoudari said: “You can’t imagine the situation right now. We are all freezing and shaking due to the very cold weather. … Especially those who are in al-Mawasi very close to the beach are suffering from the cold.”

“We’re talking about Palestinians who have been displaced for more than 14 months. They still have the same tent. There [are] no tent tarps. It’s also very expensive to afford any nylon or any equipment or tools to cover your tent and even winter clothes [and] blankets.”

In parallel, Israel has attacked two hospitals – al-Wafaa and al-Ahli – in Gaza City. The bombing of al-Wafaa on Sunday killed seven people and critically wounded others, according to the Palestinian Civil Defence.

A witness at the scene of the al-Wafaa bombing described seeing bodies “ripped to pieces”. The Israeli military said its attack targeted a Hamas “command and control centre”, but it provided no evidence to support this assertion.

Israeli forces also detained hundreds of Palestinians, including dozens of medical staff from Kamal Adwan Hospital in Beit Lahiya in northern Gaza on Friday. Among them was its director, Dr Hussam Abu Safia.

The military has not disclosed Abu Safia’s whereabouts. However, CNN reported on Monday that he was being kept at the Sde Teiman army base, which is also a detention facility in the Negev desert in southern Israel. It quoted two recently released Palestinian prisoners who had heard his name being read out.

On Monday, Tedros Adhanom Ghebreyesus, the head of the World Health Organization, called for Abu Safia’s immediate release.

Tedros, who last week escaped an Israeli strike on Yemen’s main airport that he said hit metres away from him, said in a post on X that hospitals in Gaza had become “battlegrounds” and the health system was “under severe threat”.

“We repeat: stop attacks on hospitals. People in Gaza need access to health care. Humanitarians need access to provide health aid. Ceasefire!” he said.

Meanwhile, Israeli media released a video of the moments before Abu Safia was detained by Israeli forces. The footage captured his efforts to move hundreds of patients and medical staff to safety after the Israeli military issued a 15-minute warning to leave the hospital.

Reporting from Deir el-Balah, Al Jazeera’s Tareq Abu Azzoum said the military had released the footage in a bid to depict their operations as “incredibly targeted, precise and humane”.

“But later on, we have heard from eyewitnesses … quite the opposite in terms of the humiliation [and] bad treatment that they received at the hands of the Israeli soldiers [and] the brutal beatings that they have witnessed during the military operations,” he added.

Since Israel’s war began in October 2023, Gaza’s residents have endured severe shortages of electricity, drinking water, food and medical services as the vast majority of them have been forced out of their homes and displaced – many repeatedly.

The Israeli genocide in Gaza has killed at least 45,541 Palestinians and wounded 108,338. More than 1,100 people were killed in Israel during Hamas-led attacks on October 7, 2023, and dozens were taken captive.

Beirut, Lebanon – The Palestinian Authority (PA) is cracking down on armed groups in the Jenin refugee camp in what experts say is an attempt to restore its limited authority in the occupied West Bank and persuade incoming United States President Donald Trump that it can be a useful security partner.

However, the crackdown has earned it condemnation from many Palestinians, especially after the Saturday night killing of 21-year-old journalist Shatha Sabbagh, who had been reporting from Jenin and whose family said she was killed by PA gunfire.

Since the start of the PA raids, they have been criticised as serving the interests of Israel over supporting the Palestinian struggle for freedom and self-determination.

“Over the past few years, the PA has lost control over the West Bank, and I imagine it is trying to claw back control to prove its worth to its handlers – Israel and the United States,” said Omar Rahman, an expert on Israel-Palestine with the Middle East Council on Global Affairs, a think tank in Doha, Qatar.

“I think it is trying to prove it can play a part that is still relevant, especially at a time when there are voices in the Israeli government trying to force the collapse of the PA,” Rahman told Al Jazeera.

Over the past three years, Israeli raids – both by the army and settlers – have killed and displaced numerous civilians in the West Bank and destroyed homes and livelihoods.

Since the Hamas-led attacks on southern Israel on October 7, 2023, Israeli forces and settlers have stepped up their attacks in the West Bank, killing 729 Palestinians, according to the United Nations Office for the Coordination of Humanitarian Affairs.