Broadcom and Oracle are crushing the S&P 500 and the “Magnificent Seven” in 2025.

Broadcom (AVGO -0.06%) and Oracle (ORCL 1.72%) have been two of the best-performing mega-cap growth stocks in 2025. As of this writing, Broadcom is up 19% since reporting earnings on Sept. 4, and Oracle soared 36% on Sept. 10 in response to its own blowout earnings and guidance.

Broadcom is getting closer to reaching a $2 trillion in market cap, and Oracle is knocking on the door of $1 trillion. Yet, you won’t find either of these stocks in the “Magnificent Seven,” which only includes Nvidia (NVDA -0.20%), Microsoft (MSFT 0.73%), Apple (AAPL 2.98%), Amazon (AMZN 1.04%), Alphabet (GOOG 0.69%) (GOOGL 0.65%), Meta Platforms (META -1.32%), and Tesla (TSLA 1.48%).

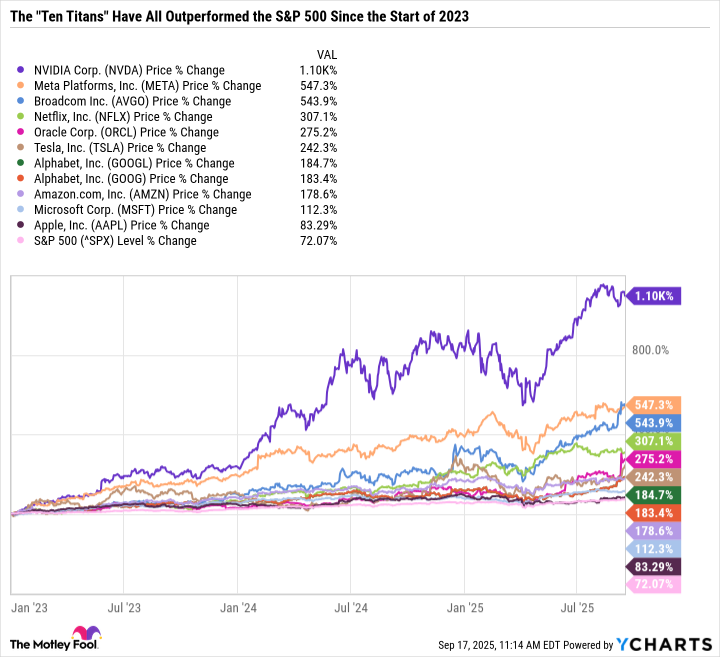

The “Ten Titans” corrects that error by adding Broadcom, Oracle, and Netflix (NFLX 1.38%) to the group. Combined, these 10 growth stocks now make up 39.1% of the S&P 500 (^GSPC 0.28%).

Here’s how the Ten Titans have disrupted the stock market in just a few years and why their dominance in the S&P 500 can still impact your investment portfolio, even if you don’t own any of the Ten Titans outright.

Image source: Getty Images.

A lot has changed in less than three years

The S&P 500 is up a staggering 70% since the start of 2023, and a big reason for that is artificial intelligence (AI). Specifically, a few major companies are profiting from AI through semiconductors and associated networking hardware, software infrastructure, cloud computing, automation, and efficiency improvements.

The Ten Titans encapsulate this theme. The group is now double the market cap of China’s entire stock market and is largely responsible for moving the S&P 500 in recent years.

At the end of 2022, the Ten Titans made up 23.3% of the S&P 500. But since then, many of the Titans have increased in value several-fold, with Nvidia and Broadcom leading the pack.

Data by YCharts.

The Ten Titans’ combination of size and rapid gains has redefined the structure of the S&P 500. Here’s a look at each company’s weight in the S&P 500 as of this writing.

|

Company |

S&P 500 Weight (Sept. 16, 2025) |

|---|---|

|

Nvidia |

6.98% |

|

Microsoft |

6.35% |

|

Apple |

5.99% |

|

Alphabet |

5.08% |

|

Amazon |

4.13% |

|

Meta Platforms |

3.26% |

|

Broadcom |

2.78% |

|

Tesla |

2.25% |

|

Oracle |

1.43% |

|

Netflix |

0.87% |

|

Total |

39.12% |

Data source: Slickcharts.

Oracle’s surge on Sept. 10 briefly pole-vaulted it to become the tenth-largest company by market cap. At that time, the nine largest names in the S&P 500 were all tech companies — a far cry from the days when the most valuable U.S. companies were from the oil and gas, consumer staples, financials, and industrial sectors.

The Ten Titans’ influence is growing

Even if you don’t own any of the Ten Titans stocks, their rise may still have ripple effects for your financial portfolio.

The biggest impact would be if you own index funds or exchange-traded funds (ETFs) with exposure to these holdings. Market-cap weighted passive funds that follow a growth theme or the general market will likely have sizable positions in the Ten Titans. And S&P 500 funds that mirror the index, like the Vanguard S&P 500 ETF, SPDR S&P 500 ETF, the iShares Core S&P 500 ETF will all have around 39% of their holdings in the Titans.

The sheer size of the Ten Titans means that the S&P 500 is no longer a balanced index, at least for now. Rather, it’s more of a growth index, similar to how the Nasdaq Composite is typically viewed.

The S&P 500 may contain hundreds of holdings, but its performance is now based on just a couple dozen companies. Investors looking for mid-cap or even large-cap stocks should venture outside the index because the S&P 500 offers little exposure to non-mega-cap names.

Navigating a Ten Titans-dominated market

The rise of the Ten Titans has benefited their shareholders, S&P 500 index fund investors, and folks with exposure to these stocks through ETFs. However, because they are so big, they will likely make the S&P 500 more volatile going forward.

Investors can offset the Ten Titans concentration by investing in value and dividend stocks that no longer make up a large percentage of the S&P 500. On the other hand, if you’re looking for a low-cost and straightforward way to get exposure to top growth stocks, the S&P 500 may be one of the simplest ways to do so.

Daniel Foelber has positions in Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Netflix, Nvidia, Oracle, Tesla, and Vanguard S&P 500 ETF. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.