Mandel increased his Amazon stake by a sizable amount.

Billionaire Steve Mandel and his hedge fund Lone Pine Capital have been a great one to follow for individual investors. Although some hedge funds have a poor record of underperforming the broader market, Mandel has substantially outperformed the market over the past three years. So, when he makes a move in his portfolio, investors should pay attention.

One thing Mandel did during Q2 was sell off some of his Microsoft shares. Although it wasn’t a massive move, the hedge fund reduced its position by about 5%. Then, Mandel used some of those funds to invest in another promising AI stock that has increased in value by nearly 800% over the past decade.

That stock? Amazon (AMZN -1.16%).

Image source: Getty Images.

AWS is the best reason to invest in Amazon right now

Amazon may not be the first company that comes to mind when you think about AI. Instead, it probably seems more like an e-commerce investment. While that sentiment is true for the consumer-facing portion, the reality is that a large chunk of Amazon’s profits comes from AI-related revenue streams.

The biggest is from Amazon Web Services (AWS), its cloud computing arm. Cloud computing firms are having a strong year, thanks to the massive demand generated by AI workloads. Because more companies can’t justify spending millions (or even billions) of dollars on a data center dedicated to training AI models, it’s far more reasonable to rent computing power from a firm that already has the capacity. That’s the idea behind cloud computing, and it has translated into strong growth for the business unit.

In Q2, AWS’s sales rose 17% to $30.9 billion. That’s strong growth, but it is a bit slower than its peers, Microsoft Azure and Google Cloud, which each grew revenue by more than 30% in Q2. However, AWS is much larger than both of these units, so it shouldn’t surprise investors that AWS is growing at a slower rate. AWS accounted for about 18% of Amazon’s total revenue in Q2, but it made up 53% of its operating profit. That’s because AWS has far superior margins compared to its commerce business units, making AWS a critical part of the Amazon investment thesis.

AWS is experiencing a significant boost from AI, making it a strong stock pick in this space.

But Microsoft is also a solid AI pick, so why is Mandel moving from Microsoft to Amazon?

Amazon’s stock looks more promising over the long term

From a valuation perspective, both companies trade at fairly expensive levels for their growth. However, they’re both priced about the same from a forward price-to-earnings (P/E) standpoint.

AMZN PE Ratio (Forward) data by YCharts

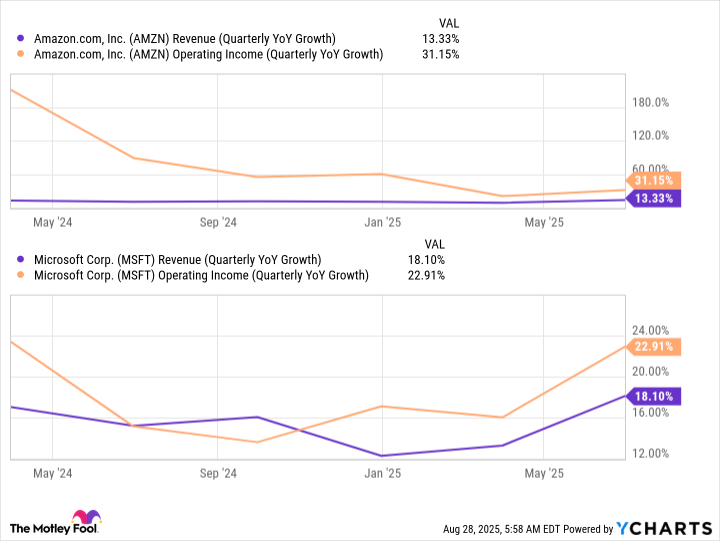

One thing Amazon has going for it that Microsoft doesn’t is the steady upward pressure on Amazon’s margins. Thanks to AWS and its advertising service business units being the fastest growing in Amazon, its margins are steadily improving. Although Amazon’s revenue growth rate appears to be somewhat slow, its operating income growth rate is actually quite rapid.

AMZN Revenue (Quarterly YoY Growth) data by YCharts

This trend still has years to unfold, which is a solid reason to transition from Microsoft to Amazon. I believe this will be a winning trade over the long term, as Amazon’s profits are expected to grow at a significantly faster rate than Microsoft’s, resulting in the stock outperforming its peer over the long term due to their similar valuations.

However, both stocks are still solid AI picks, and you can’t go wrong with either one.

Keithen Drury has positions in Amazon. The Motley Fool has positions in and recommends Amazon and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.