The company’s business model and strategy help secure an ongoing stream of income for investors.

Investors in energy stocks, such as Chevron (CVX -1.71%), always need to keep a close eye on energy commodity prices. That’s one significant reason why the stock is intriguing right now, as the share price has outperformed during a period of downward drift in oil prices. That makes it particularly appealing for passive income investors looking to buy Chevron shares for a 4.3% dividend yield.

Chevron offers protection

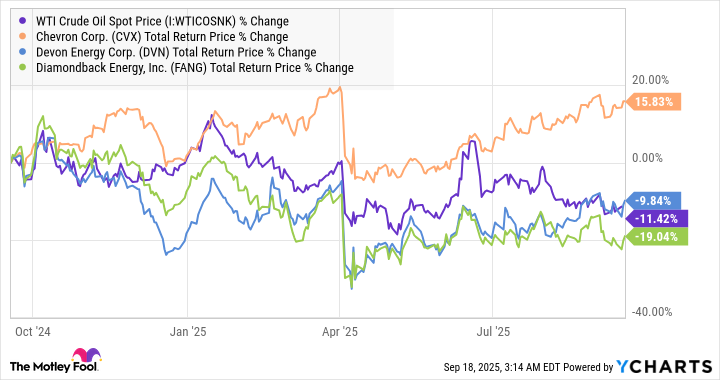

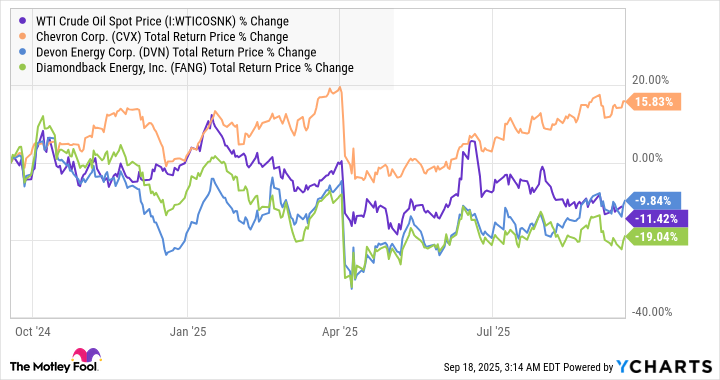

The chart below compares Chevron to two higher-quality energy exploration and production companies, Devon Energy and Diamondback Energy. While the others have performed in line with the declining price of oil, Chevron has outperformed.

WTI Crude Oil Spot Price data by YCharts

This is a valuable demonstration of what many income-seeking investors are looking for from energy stocks. While pure-play exploration and production stocks have demonstrated a correlation with the price of oil, the benefits of Chevron being a vertically integrated oil major are becoming increasingly apparent.

This means it combines upstream operations (exploration and production) with downstream operations (refining, marketing, and chemicals), and in doing so secures the cash-flow generation to support a growing dividend.

In addition, Chevron’s $53 billion acquisition of Hess Corporation has added significant international assets (in Guyana) that tend to have a lower break-even cost (the minimum price of oil a producer can cover costs in producing oil), and adds assets in the Bakken (North Dakota) to Chevron’s existing strength in the Permian (West Texas and New Mexico).

Image source: Getty Images.

What it means to investors

While Chevron will never be completely immune from falling oil prices, its downstream assets and efforts to diversify by acquiring lower break-even-cost international assets protect it from a moderated decline, which is good news for income-seeking investors. At the same time, it has upside potential coming from a possible increase in oil prices.

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron. The Motley Fool has a disclosure policy.