Mega Moolah slot review: Gameplay, features and payouts explained

THE SLOTS section of any online casino is always the busiest area of the platform, and that highlights the popularity of these games. There is always a vast choice, and although there are new releases regularly, some established titles continue to attract interest.

Released in 2006, Mega Moolah remains hugely popular, and that’s largely due to its jackpot potential. This Mega Moolah slot review will look at possible payouts along with all the other aspects of this game in closer detail.

Mega Moolah slot quick overview

Here’s a quick summary of what Mega Moolah offers:

| 👨💻 Software Provider | NetEnt |

| 🎰 Slot Type | Games Global |

| 💫 Reels | 5×3 |

| 💰 Paylines | 25 |

| 💸 RTP | 88.12% |

| 🔥 Volatility | Medium |

| 🤑 Max Win Potential | Progressive jackpot |

| 🎞️ Theme | Cartoon Animals |

| 🎉 Bonus Features | Free spins, four progressive jackpots |

| 📉 Min Bet | £0.26 |

| 📈 Max Bet | £6.25 |

| 📅 Release Date | November 2006 |

Mega Moolah slot features overview

Since its release in 2006, Mega Moolah has captured more media attention than most slot games. It has provided some of the biggest wins, and while it should be remembered that the big prizes are extremely rare, this is clearly a big part of its appeal.

Despite its low RTP, Mega Moolah has a medium variance, so wins can be more frequent than in other jackpot games. It can suit all players, but it’s largely one of the best online slots for experienced players whose main goal is to target jackpots.

👍 Pros

- Four progressive jackpots

- Free spins round

- Medium variance

👎 Cons:

- Low RTP

- High minimum stake

Mega Moolah slot graphics, sound & gameplay mechanics

This game was released in 2006, so we shouldn’t expect to see state-of-the-art graphics. The game reflects the type of design that was in place back then, but it’s a colourful game, and the cartoon animals offer charming imagery.

The soundtrack aims to conjure the feel of an African safari, and it certainly hits the mark. It has been updated to work on mobile, so there should be no loss of functionality if you switch from a static device to playing on the go.

How to play Mega Moolah slot

Follow these steps if you want to play Mega Moolah at the best online slots sites in the UK:

- Find a casino that hosts the game: All of the best online slots sites host this title, so it shouldn’t take long to find an outlet.

- Set your preferred stake: The game may default to a high stake, so use the tool to change it if you prefer.

- Press spin to play: The spin button will be clearly marked.

- Look for high-paying combinations: Check our Mega Moolah slot review and follow the paytable for high-paying combos.

- Bonus rounds: These will activate automatically when triggered.

- Monitor your bankroll: Play responsibly and don’t use all your bankroll in one session. Ideally, play with up to a maximum of 10% of your balance.

Mega Moolah slot symbols

Mega Moolah features a range of themed symbols split into high- and low-paying categories. The high-paying symbols include safari animals such as elephant, buffalo, giraffe, zebra, and antelope, each offering bigger rewards when landing in combinations. The low-paying symbols are the classic playing cards from A to 10, which appear more frequently but offer smaller payouts.

The lion is the wild symbol – it substitutes for all regular symbols and doubles the payout when part of a winning combination. The monkey serves as the scatter, and landing three or more triggers 15 free spins, where all wins are boosted by a 3x multiplier. These special symbols bring extra value to the base game and create opportunities for bigger wins during regular spins.

Mega Moolah slot RTP, payout & volatility

The RTP of 88.12% is low and means that, on average, £88.12 will be paid out for every £100 wagered, over time. Results between players will vary, but those independently verified stats are worth keeping in mind.

For players who get involved with Mega Moolah, it’s all about aiming for the jackpot. It’s rare to land the truly big payouts, but it’s that possibility that keeps players engaged. The slot has a medium volatility, and in general, payouts will be less frequent but they may be higher when they come in.

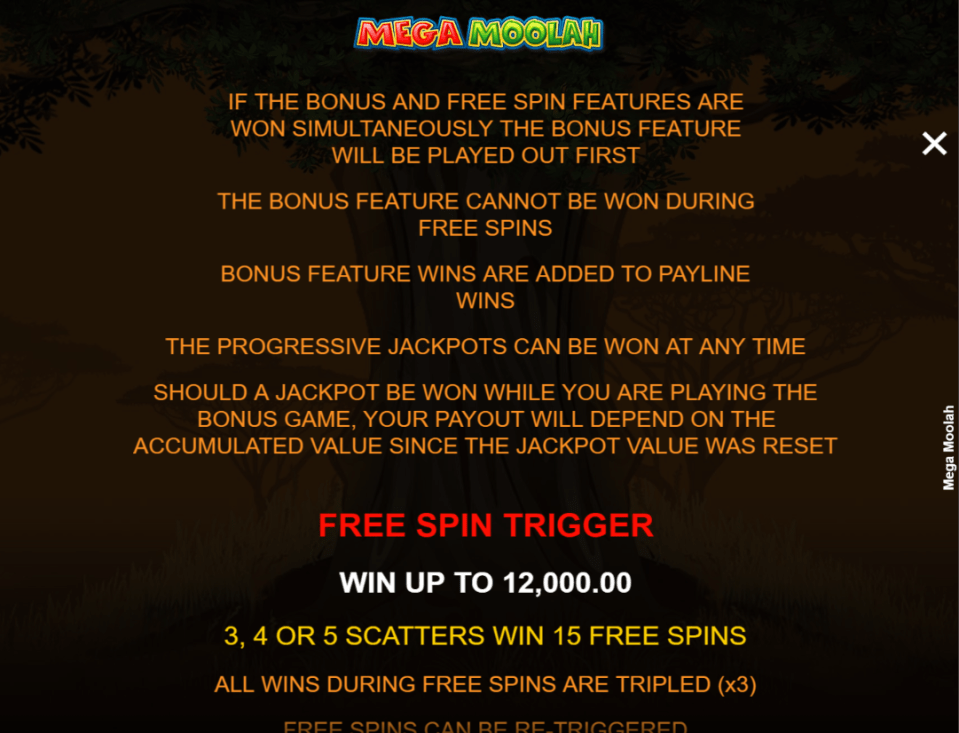

Mega Moolah bonus features & free spins

We’ve already seen that the lion is the wild symbol and the monkey is the scatter in Mega Moolah. The lion is a conventional wild icon that replicates all others as it looks to find a matching combination. If it does find a winning match, it will double any payout.

To activate the free spins section, at least three of the monkey scatters must fall into view. When this happens, players are rewarded with 15 additional spins.

The progressive jackpots can be triggered at random at any point. There are no special symbols to look out for, and the four jackpots in question are labelled Mini, Minor, Major and Mega. Any of these can be activated randomly during the base game.

Where to play Mega Moolah slot in the UK

As one of the most popular games online, the best UK online casinos all host Mega Moolah. Use the search bar at your favourite casino to check, but it’s almost certain that it will be on the listing.

Two recommended options for players in the UK are Dream Vegas and bet365. Both are well-known brands, but more importantly, they are licensed by the UK Gambling Commission, they promote responsible gambling, and both offer a good choice of secure funding providers.

If you are looking for one of the best online slots sites, you need to find a platform that covers all of those points.

Another trusted option is Casumo. This has customer support around the clock, as well as secure payment options and a mobile-friendly casino interface.

Key takeaway

Undoubtedly, it’s those progressive jackpots that have made Mega Moolah so popular with slots players over the years. The game is among the titles with the biggest payouts in history, and it continues to attract attention for that reason alone.

That said, those wins are rare, and it’s always important to play responsibly. With its straightforward gameplay, familiar safari theme and the chance to land life-changing prizes, Mega Moolah is a solid pick for UK players who enjoy classic slots with big potential. Try it out at a trusted, UK-licensed online casino.

🔎 More slot reviews

About the author

James Anderson

James Anderson is a Betting & Gaming Writer at The Sun. He is an expert in sports betting and online casinos, and joined the company in November 2020 to work closely with leading bookmakers and online gaming companies to curate content in all areas of sports betting. He previously worked as a Digital Sports Reporter and Head of Live Blogs/Events at the Daily Express and Daily Star, covering football, cricket, snooker, F1 and horse racing.

Remember to gamble responsibly

A responsible gambler is someone who:

- Establishes time and monetary limits before playing

- Only gambles with money they can afford to lose

- Never chase their losses

- Doesn’t gamble if they’re upset, angry or depressed

- Gamcare – gamcare.org.uk

- GambleAware – GambleAware.org

Read our guide on responsible gambling practices.

For help with a gambling problem, call the National Gambling Helpline on 0808 8020 133 or go to gamstop.co.uk to be excluded from all UK-regulated gambling websites.