L.A. County’s $4-billion question: How to vet sex abuse claims?

L.A. County is bringing on a retired judge to tackle a $4-billion question: How can officials ensure that real victims are compensated from the biggest sex abuse payout in U.S. history — and not people who made up their claims?

The county has tapped Daniel Buckley, a former presiding judge of the county’s Superior Court, to vet cases brought by Downtown LA Law Group after The Times found nine people represented by the firm who said they were paid to sue the county by recruiters. Four of the plaintiffs said they were told to fabricate the claims.

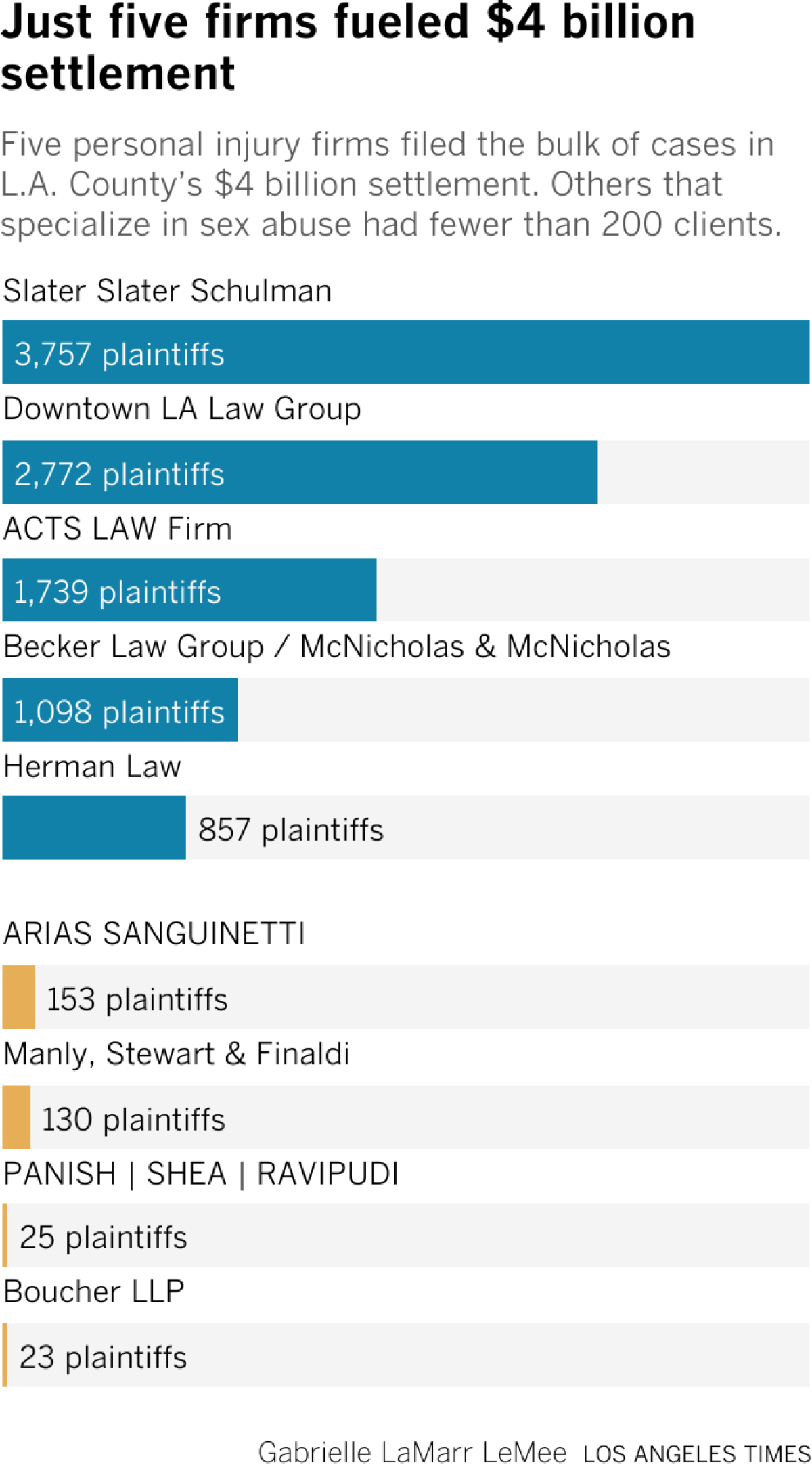

Downtown LA Law Group, or DTLA, has denied paying any of its roughly 2,700 clients, but agreed to cover the cost of Buckley to examine their cases in the $4-billion sex abuse settlement.

In a letter sent to clients Monday, Andrew Morrow, the lead attorney in the firm’s sex abuse cases, noted there are “additional safeguards” and “vetting protocols” underway following recent reports of paid clients, but did not specifically mention the new judge.

“While we categorically deny this ever occurred, we take these matters seriously and welcome the implementation of additional review procedures to ensure false claims do not move forward in the process,” wrote Morrow, the chairman of the firm’s mass torts department.

On Oct. 17, Dawyn Harrison, the top attorney for the county, requested an investigation from the State Bar based on The Times’ reporting, saying she believed some of the settlement would flow to “the pockets of the plaintiffs’ bar” rather than victims.

“The actions described in the article, if true, are despicable and run afoul of ethical duties of attorneys and criminal law in California,” Harrison wrote in a letter to Erika Doherty, the bar’s interim executive director. “I request the State Bar investigate all of the potential fraudulent and illegal activities described in this letter.”

DTLA declined to comment last week. The firm has previously said it works “hard to present only meritorious claims and have systems in place to help weed out false or exaggerated allegations.”

The bulk of the claims will be reviewed by retired Superior Court Judge Louis Meisinger, who will decide awards between $100,000 and $3 million.

The amount will depend on the severity of the abuse, the impact on the victim’s life and the amount of evidence provided, according to the allocation protocol. The money will be paid out over five years unless the victim opts to get a one-time check for $150,000.

If the judges find cases they believe are fraudulent, the county can either resolve them through a $50,000 payment or get them removed from the settlement. The county saves money in that case, but runs the risk of the plaintiff continuing to litigate and landing a larger payout from a jury trial.

It’s unusual — but not unheard of — for a neutral arbiter to be appointed to investigate cases from a specific firm in a massive settlement.

Retired U.S. Bankruptcy Judge Barbara Houser, who is overseeing the $2.4-billion trust for victims of the Boy Scouts of Americas sex abuse cases, said last month that she had asked for an “independent third party” to vet the claims brought by Slater Slater Schulman after finding a pattern of “irregularities” and “procedural and factual problems” among its plaintiffs.

Slater Slater Schulman, headquartered in New York City, represents roughly 14,000 victims in the Boy Scouts case. It also represents roughly 3,700 people in the L.A. County settlement — the most of any firm, by far.

On Oct. 14, Lawrence Friedman, a former Department of Justice attorney who headed up the federal watchdog office for the bankruptcy system, spearheaded a blistering motion asking Houser to reduce Slater’s attorneys fees, which he estimated were at least $20 million. Friedman is seeking to push them out of the case, alleging the firm had “run amok” and “dangled the prospect of lottery sized payouts” in front of clients without vetting them.

“The SLATER law firm has little if any quality controls in place to validate the information in the 14,600 claims other than validating that they were real people who had filed the claim,” the motion stated. “…What SLATER has effectively created is simply a ‘Claims Machine’ designed to spit out huge wads of cash for itself!”

Clifford Robert, an outside attorney who is representing Slater Slater Schulman in its issues with the Boy Scouts cases, said the firm’s priority “has been and always will be securing justice on behalf of sexual abuse victims.”

Friedman, who has been outspoken about misconduct by mass tort attorneys in bankruptcy cases, said he now represents dozens of former Slater plaintiffs. The ex-clients alleged the firm waited more than a year before informing them their cases were undergoing additional vetting and their payments would be delayed. The firm told them this September about the outside investigation, which began in June 2024, according to an email attached to the Oct. 14 motion.

“We now agree that there are procedural and factual problems in some of our claim submissions to the Trust,” the three partners of Slater Slater Schulman wrote in a joint email to clients on Sept. 9. “Because of the problematic claims, we have agreed that all of our claim submissions to the Trust be vetted by an independent third party.”

Both judges who will vet the L.A. County sex abuse payouts work for Signature Resolution, a firm that specializes in resolving legal disputes outside the courtroom with a heavyweight roster of former judges and lawyers. Litigation management company BrownGreer will be the settlement administration arm, responsible for making sure the checks go out, liens are settled and the judges have the records they need from the 11,000 plaintiffs.

An additional 414 sex abuse claims that led to a separate $828-million settlement announced Oct. 17 will be reviewed by a different judge with the money distributed over the course of three years. That settlement, which involves claims from three firms that opted to litigate separately from the rest, is expected to receive final approval from the Board of Supervisors on Tuesday.

The county will give the first tranche of money to the fund administered by BrownGreer in January, though it’s unclear when that money will trickle down to victims. The additional fraud review could slow the process as the judges will need to decide what all 11,000 of the claims are worth before any of the money goes out.

“They should have had their duck in the rows at the beginning,” said Tammy Rogers, 56, who sued over sex abuse at a county-run shelter for children in 2022.

Rogers said she has seen her bank account depleted recently following a shoulder surgery and her daughter’s funeral. She said she’s grown skeptical the settlement money will come her way anytime soon after reading the recent coverage of plaintiffs who say they were paid to sue.

“They should have known people were going to come out of the woodwork and do stuff like this,” she said. “They should have taken this time in the beginning, not in the end.”

Tammy Rogers, one of the plaintiffs who sued L.A. County over alleged abuse at MacLaren Hall, says she’s worried the extra vetting may delay payments to victims.

(Carlin Stiehl/Los Angeles Times)

The number of claims has fluctuated in recent months as some of the firms have dismissed cases from plaintiffs who died, lost interest in their lawsuit, or stopped responding. Since the Times initial investigation ran on Oct. 2, DTLA has asked for the dismissal of at least 14 plaintiffs, according to a Times analysis of court records.

On Oct. 17, the firm asked a judge to dismiss three people in a 63-plaintiff lawsuit filed April 29 who told The Times they’d been paid to sue the county for sex abuse.

Quantavia Smith, whose case DTLA asked to be dismissed without prejudice, previously told The Times a recruiter paid her to join the litigation, but said she had a legitimate sex abuse claim against the county. She said the recruiter drove her to the office of a downtown law firm and then gave her $200.

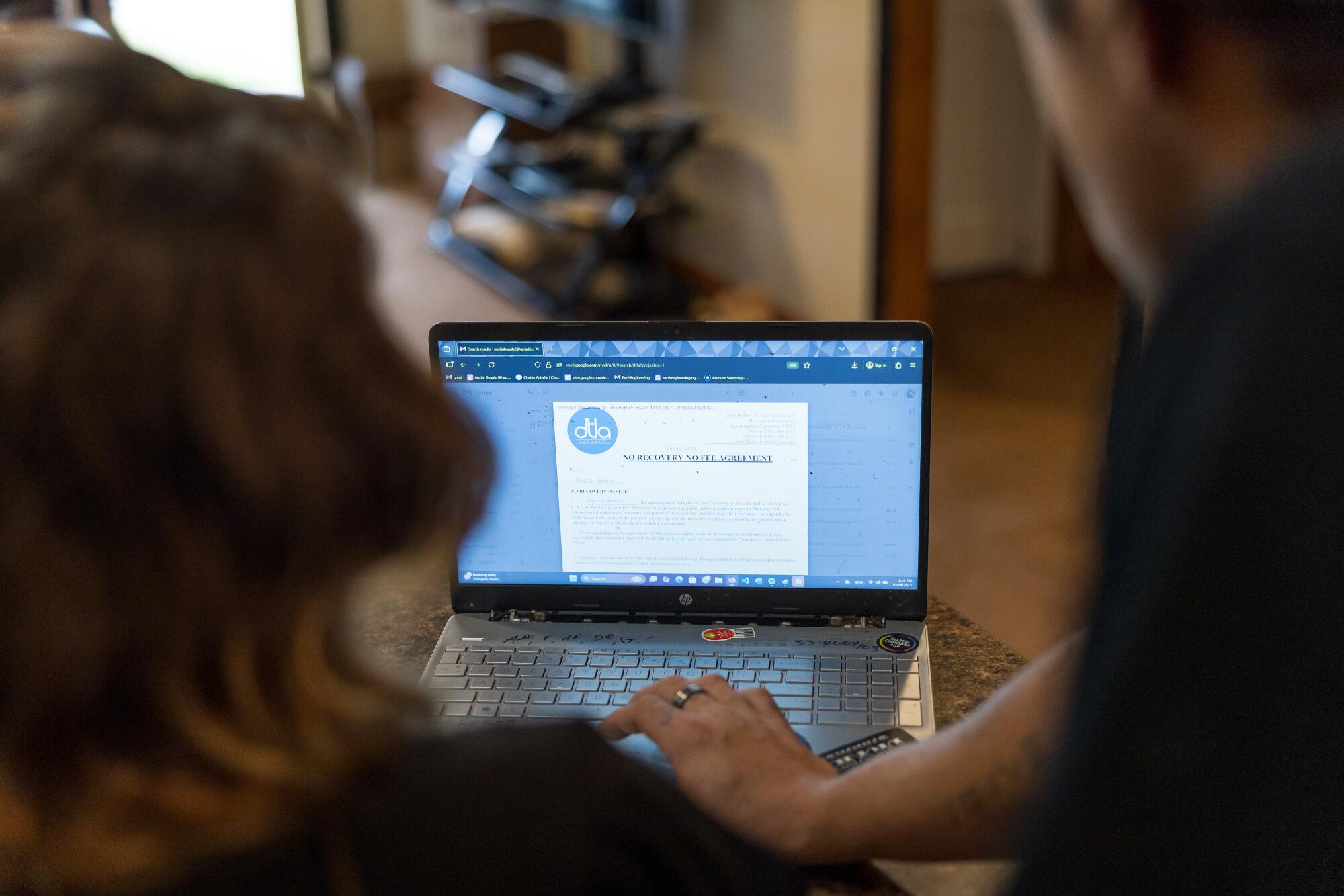

The firm also asked to dismiss the cases of Nevada Barker and Austin Beagle with prejudice, meaning the cases can’t be refilled. The Times reported this month that the Texan couple were told to make up allegations of abuse at a county-run juvenile hall and provided a script by someone inside the firm’s downtown office. Both said they left the firm with $100.

The Times could not reach the alleged recruiter for comment.

Austin Beagle and Nevada Barker say they were unwittingly ushered into a fraudulent lawsuit against L.A. County filed by Downtown LA Law Group.

(Joe Garcia/For The Times)

On the morning the story published Oct. 16, Beagle and Barker each received an automated email from Vinesign, a legal e-signature site, telling them Downtown LA Law was requesting their signature on a document.

“I wish to affirm my claim that I was sexually abused in a Los Angeles County juvenile facility, and I was never paid to bring this claim forward,” stated the DTLA declaration, which they were asked to sign under the penalty of perjury.

Both said they did not want to sign as it was not true — and the opposite of what had just been published that morning in The Times. Beagle said the firm called twice that morning to discuss.

“We told them just dismiss it,” said Beagle. “We ain’t talking about it.”

Times assistant data and graphics editor Sean Greene contributed to this report.