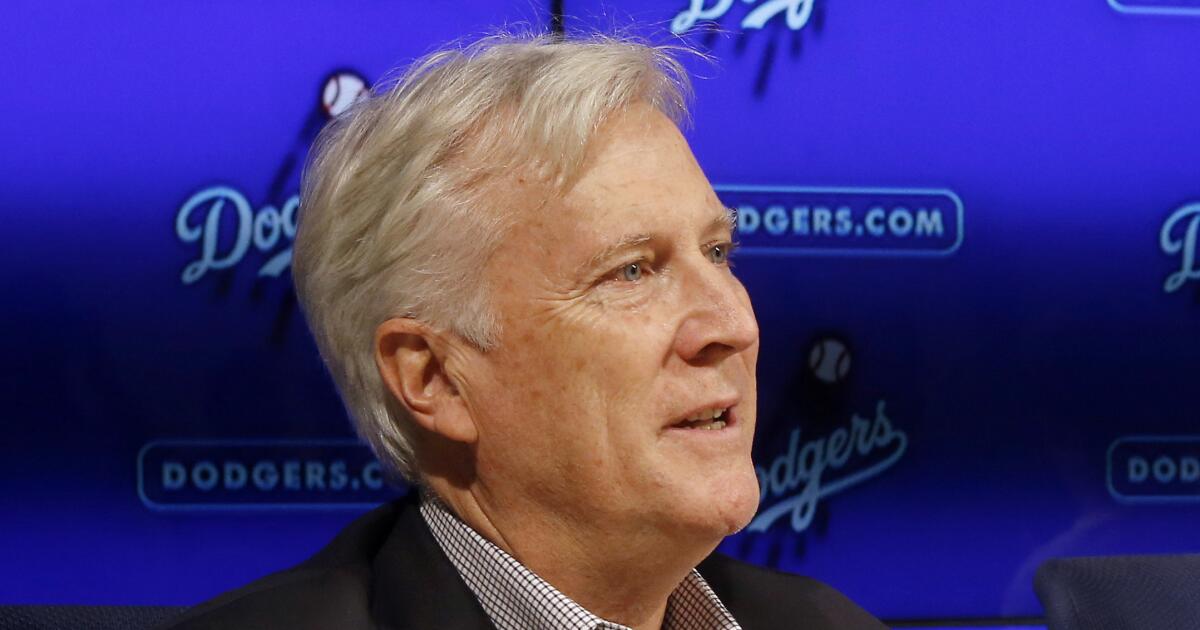

Fox Corp. CEO and favored son Lachlan Murdoch prevails in family succession drama

The closely watched Murdoch succession drama has ended with a $3.3-billion settlement that gives Lachlan Murdoch control of the family’s influential media assets, including Fox News, the New York Post and the Wall Street Journal.

Fox Corp. on Monday announced the “mutual resolution” of the legal wrangling that had clouded the future direction of the television company and the Murdoch-controlled publishing firm News Corp. The dollar figure was confirmed by a person familiar with the matter who was not authorized to comment publicly.

The succession dispute flared into public view last year after three of Murdoch’s children attempted to block proposed changes that patriarch Rupert Murdoch wanted to make to his trust to cement his oldest son Lachlan’s grip on power. In December, a Nevada probate commissioner rejected Rupert Murdoch’s request to amend his trust amid the opposition by his three adult children.

The 94-year-old mogul wanted to ensure the conservative leanings of his media empire would carry on and felt that Lachlan Murdoch, who serves as chairman and chief executive of Fox, was the most ideologically compatible with his own point of view.

Until now, Rupert’s four oldest children — Prudence MacLeod, Elisabeth Murdoch, Lachlan Murdoch and James Murdoch — were set to jointly inherit control of the businesses. But, as part of the settlement, Prudence, Elisabeth and James agreed to relinquish their shares in the family trust and give up any roles going forward.

Two new trusts will be established. One will benefit Lachlan Murdoch and Rupert Murdoch’s two youngest daughters, Chloe and Grace Murdoch, who were born during his union with ex-wife Wendi Deng.

The second trust will benefit Prudence, Elisabeth, James and their descendants. Fox Corp. separately announced a public offering of 16.9 million shares of Fox Corp. stock, currently held by the Murdoch Family Trust.

Those proceeds, along with the sale of 14.2 million shares of publishing company News Corp.’s Class B common stock, will fund the new trust.

Fox said Monday that voting control of the Fox and News Corp. shares held by this trust “will rest solely with Lachlan Murdoch through his appointed managing director” through 2050.

“Fox’s board of directors welcomes these developments and believes that the leadership, vision and management by the Company’s CEO and Executive Chair, Lachlan Murdoch, will continue to be important to guiding the Company’s strategy and success,” the board said in a statement.

Fox said it is not selling any of its stock.

The family will sell nonvoting Class B shares and hold on to its voting shares — and control. Rupert Murdoch will remain the company’s chairman emeritus.

During a six-month period following the stock sales, James, Prudence and Elisabeth will be expected to “sell their de minimis personal holdings in FOX and News Corp.” to severe all ties with the companies.