As Trump makes rare visit to Malaysia, PM Anwar’s balancing act faces test | Donald Trump News

Kuala Lumpur, Malaysia – When US President Donald Trump lands in Malaysia for Southeast Asia’s headline summit this weekend, he will be delivering Malaysian Prime Minister Anwar Ibrahim a diplomatic coup.

US presidents rarely visit Malaysia, a multiracial nation of 35 million people sandwiched between Thailand and Singapore, which for decades has maintained a policy of not picking sides in rivalries between great powers.

Recommended Stories

list of 3 itemsend of list

Trump is just the third US leader to travel to the Southeast Asian country, which is hosting a Sunday-to-Tuesday summit for the Association of Southeast Asian Nations (ASEAN), following visits by former US Presidents Barack Obama and Lyndon B Johnson.

After skipping ASEAN summits in 2018, 2019 and 2020, Trump, whose disdain for multilateralism is renowned, will be attending the gathering of Southeast Asian nations for just the second time.

The US president will be joined by a host of high-profile leaders from non-ASEAN countries, including Japanese Prime Minister Sanae Takaichi, Brazilian President Luiz Inacio Lula da Silva, and South African President Cyril Ramaphosa.

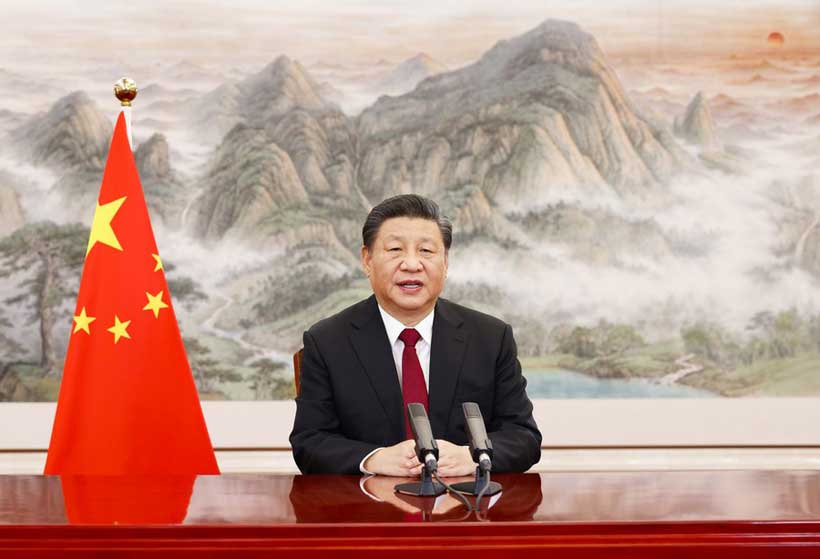

Opting not to attend are Indian Prime Minister Narendra Modi, Russian President Vladimir Putin, and Chinese President Xi Jinping, who Trump is expected to meet in South Korea at next week’s Asia-Pacific Economic Cooperation (APEC) summit.

Trump’s visit, in many ways, is emblematic of the delicate balancing act that Anwar’s government has sought to maintain as Malaysia navigates the headwinds of the heated rivalry between the US and China.

Malaysia is deeply entwined with both the US and Chinese economies.

The US, which has a large footprint in Malaysia’s tech and oil and gas industries, was the Southeast Asian country’s top foreign investor and third-biggest trading partner in 2024.

China, a major purchaser of Malaysian electronics and palm oil, the same year took the top spot in trade and was third for investment.

But Malaysia’s efforts to walk a fine line between Washington and Beijing have become increasingly fraught as the superpowers roll out tit-for-tat tariffs and export controls while butting heads over regional flashpoints such as Taiwan and the South China Sea.

“Optimally, Malaysia wants to productively engage both China and the US on a variety of issues,” said Thomas Daniel, an analyst at the Institute of Strategic & International Studies in Kuala Lumpur.

“It is in our interest,” Daniel told Al Jazeera.

Anwar has cast Trump’s visit as a chance to bolster economic ties, champion regional peace and stability, and elevate ASEAN’s standing on the international stage.

Anwar has also pledged to use the rare opportunity for face time with Trump to constructively raise points of difference between Washington and Kuala Lumpur, particularly the Palestinian cause.

“The through-line is autonomy: avoid entanglement, maximise options, and extract benefits from both poles without becoming anyone’s proxy,” Awang Azman Awang Pawi, a professor at the University of Malaya, told Al Jazeera.

During Trump’s visit, US tariffs on Malaysia, currently set at 19 percent, and China’s mooted export controls on rare earths are expected to be high on the agenda.

For Malaysia, the priority is preserving “rules-based” trade that allows for countries to deepen economic ties despite their political differences, said Mohd Ramlan Mohd Arshad, a senior lecturer at the MARA University of Technology in Shah Alam, near Kuala Lumpur.

A prolonged economic cold war between the US and China is the “worst thing” that could happen to Malaysia, Arshad told Al Jazeera.

Trump, who has made no secret of his ambitions for the Nobel Peace Prize, is also expected to witness the signing of a peace accord between Thailand and Cambodia, which engaged in a brief border conflict in July that left at least 38 people dead.

For Anwar, who has led a multiracial coalition of parties with diverse and competing interests since 2022, the balancing act also involves political considerations at home.

US support for Israel’s war in Gaza has been a bone of contention in Muslim-majority Malaysia, where the plight of Palestinians has inspired frequent public protests.

In the run-up to the summit, critics have demanded that Anwar rescind Trump’s invitation over his role in supporting the war, which a United Nations commission of inquiry last month determined to constitute genocide.

“A person like Trump, no matter how powerful, should not be welcomed in Malaysia,” former Prime Minister Mahathir Mohamad, Anwar’s former mentor-turned-nemesis, said in a video message last month.

Defending the invitation, Anwar has stressed his view of diplomacy as “practical work” for advancing his country’s interests “in an imperfect world”.

“It demands balance, discipline, and the courage to stay the course even when the ground shifts beneath us,” he told a conference in Kuala Lumpur earlier this month.

As a small power, Malaysia has always put pragmatism at the centre of its foreign policy, said Sharifah Munirah Alatas, an international relations lecturer at the National University of Malaysia.

“Anwar and Malaysia cannot afford to do otherwise,” Alatas told Al Jazeera.

“And given the current highly unpredictable Sino-American tension induced by the Trump 2.0 era, ASEAN will remain actively non-aligned, without taking sides.”

Awang Azman, the University of Malaya professor, said that while Trump’s visit will elevate Malaysia and ASEAN’s profile by itself, the true test of the summit’s success will be tangible outcomes on issues such as the Thailand-Cambodia conflict and trade.

“It’s not just a photo op if a ceasefire accord and concrete trade language land on paper,” Awang Azman said.

“If either track stalls, the visit is still symbolically significant – given the rarity of US presidential trips to Malaysia – but the narrative will revert to optics over outcomes.”