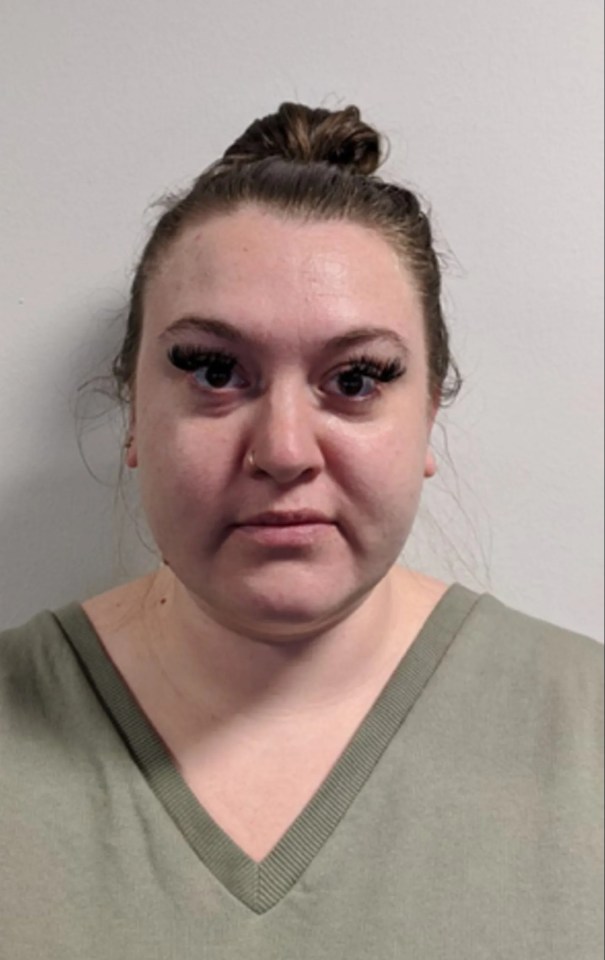

OPENING up her bank account, Grace Parkin can hardly believe how healthy her balance is – and it’s all thanks to Mounjaro.

The mum-of-one says the weight-loss jab has not only helped her slim down to a size 12 from 26, dropping 9st – but it’s stopped her £1k-a-month “boredom spending” sprees.

The estate manager, from Sheffield, had been looking into weight loss surgery but decided to try Mounjaro in May 2024 as a less invasive way to shed the pounds.

Grace, 34, was 17st 9lbs before starting the weekly injections and has now lost 9st 4lbs, making her a slender 10st 7lbs and a size 12.

But she credits the drug, which she is still taking, with not only helping her control her diet but also her out-of-control spending habits.

Previously, the mum-of-one was blowing up to £1,000 a month on luxuries including clothes, eating out and alcohol.

She told The Sun: “I was an impulsive spender before.

“I was spending between £600 and £1,000 a month on recreational things. I’d just be buying shoes – trainers, Uggs, boots.

“Then it would be buying loads of jumpers and holiday clothes, even when I’d not booked a holiday.”

Grace said at her worst, she could spend up to £300 while sat on the sofa.

She explains: “I wasn’t getting into debt, but if I was bored in an evening – I’d buy from Boohoo, PrettyLittleThing, Shein – any brands that did plus-sized clothes.”

Meanwhile, Grace impulsively went on shopping trips several times a week purely for the thrill.

She said: “Two or three times a week, I’d be in my local shopping centre and would come out with bags of stuff. I’d go to Primark and pick up five or six tracksuits for my son.

“I was void-filling – looking for that adrenaline. If I could spend money and it could give that rush – I’d do it.”

Despite being in a well-paid job and always paying her bills, Grace said by the end of the month her wages would be gone.

But since being on Mounjaro, Grace had cut her spending down and now saves £600 each month.

She said: “Now if I need something, I buy it, but I no longer buy things due to boredom. I’m saving in excess of £600 a month.”

“”I am sure my Uber Eats driver probs think I’ve died.

“My Evri driver asked, ‘Is everything alright?'”

My spending diet plan – and how I stay on track

SAVVY saver Karen Powell keeps her spending on a strict diet plan to save her hundreds of pounds every year.

Karen, from Surrey Hills, has budgets for different outgoings and checks her bank statements each week to make sure she’s on track with her money.

The 63-year-old, who runs the time management and organisation skills company The Organising Lady, said: “It’s so important to slim down your spending for your mental health, relationships, and family.

“There’s nothing worse than worrying about money.

“Spending can be addictive if you’re not careful – it’s a dopamine hit going shopping.”

To keep her finances on track, Karen limits her spending.

“I try and stick to £100 a week on food.

“We’re careful with holidays, and will only have two ‘splurge meals’ out while we’re away.

“Me and my sister set a £20 limit on birthday and Christmas presents.

“And me and my husband don’t buy gifts for each other.”

She makes sure to never throw away any food by bulk cooking and freezing – which she reckons saves her £600 a year at least.

She also puts time in her diary each week to monitor her finances.

“Once a week, I’ll look at my bank account to make sure I haven’t splurged and so I can keep track of what I’ve spent.”

She also has “treat” days where she’ll buy affordable things for herself to avoid overspending on big shopping trips.

“I’m human and I love clothes – I just make sure I choose well now, and stick to the rule of one in, one out and sell my unwanted clothes on sites like Vinted.”

Some users of the weight-loss jab have reported a secondary side effect that has helped them to curb impulsive spending.

It’s thought the drug – and other GLP-1 medicines – can not only help to intercept brain signals associated with food cravings but for shopping splurges as well.

We previously revealed how the drug helped another user who was struggling with a cocaine and gambling addiction.

Binge drink and gorge on takeaways

Grace has struggled with her weight for years.

She previously got a gastric balloon in 2009 – when she was just aged 18 – but she only lost three stone and found it didn’t help with her eating habits.

She was never a “big eater” but would find herself gorging during the weekend.

Grace would stick to a strict healthy diet during the week, but it would all go out the window at the weekend when she would binge drink and gorge on takeaways and bacon butties.

She said: “I’d think, ‘It’s the weekend – I can treat myself to a takeaway’.”

She would often go out drinking on a Friday or a Saturday and eat a pizza on her way home.

To mop up her hangover the next day, she would tuck into a bacon sandwich and a takeaway.

She says: “By Monday, I’d hate myself and be back on the diet.”

But when she realised her diet wasn’t working she started to look into surgery options, before trying Mounjaro as a last ditch attempt to shift the pounds.

How Grace cut her spending sprees

WE reveal how Grace dramatically cut down her spending sprees.

Spending before:

£200 to £300 on clothes (often in one go)

£300 on holiday spending

£200 to £400 on takeaways

£200 to £400 on meals out

Spending now:

£100 max on clothes

£100 max on takeaways

£100 max eating out

£200 on food shop

Grace said: “It’s been incredible. It turns the food noise off.”

She added it has stopped her cravings to gorge on fast food and while she might still occasionally have a takeaway, she’ll opt for a smaller meal.

She explained: “It removes the guilt from food.”

The only bad side effects she has experienced are feeling cold and nauseous and stomach discomfort.

She said: “I had sulphur burps for one day, but I’d take that every day.”

Grace has also seen the mindset shift help with other aspects of her life – including her spending habits.

How you can slim down your spending

ANDREW Hagger, founder of MoneyComms, shares his top tips to slash your spend and avoid piling on the pounds.

Slim down your direct debits

Check your last few bank statements to see if there are any regular payments or subscriptions you can do without.

Cancel any non-essential direct debits to give your bank balance a breather.

Slash your lunchtime spend

Take a few minutes to make sandwiches for the next day to save a packet compared to shop bought lunches.

Dine out on switching bonuses

Switching your bank account could help you to bag a cash lump sum.

You could earn £100 or more by swapping banks, which can give your balance a big boost.

Shed costly credit card balances

You may be able to save hundreds of pounds by switching to a 0% credit card if your credit score is good.

You can transfer your balance to a 0% credit card for up to 34 months without needing to pay interest.

Drop your overdraft

You could save money by ditching your overdraft and paying with a credit card instead.

Doing so could slash your interest rate from 40% to 24.9%.

But if you pay off your card in full each month then it won’t cost you a penny.

Previously, she would splash out on clothes, holidays, eating out and alcohol without so much as a second thought.

But now she only buys what she needs – and credits the control the drug has given her.

“I didn’t try to curb my spending – it just naturally happened,” she said.

“I had money left after the first month on Mounjaro and thought I’d missed a bill.”

Grace doesn’t usually do a weekly food shop but estimates that if she did it would have been £160 before and now would be around £50.

“Before I’d go looking for tea and pick up 20 other things. Without realising I’d spend £50,” she said.

“Now I don’t go in and look at crisps and puddings.”

Grace says she has seen some harsh comments about those choosing to take the jabs.

But she said: “Why would you want to be miserable?

“When I say I have battled obesity and used medication people say ‘you’ve cheated’.

“I’ve tried it the hard way. This has been life-changing. It’s saved my life.”

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories