Global Finance presents its 32nd annual list of the best banks worldwide.

If one word described the global economy in 2024, it would be “resilient.” Growth was up slightly, with global GDP growth hovering around 3.1%, while the pace of global inflation slowed to approximately 5.8% from 6.8% the previous year, according to the International Monetary Fund.

Although many thought a financial crisis was imminent, none materialized as businesses continued to focus on strengthening and diversifying their supply chains, implementing digitalization strategies, and responding to rising geopolitical tensions.

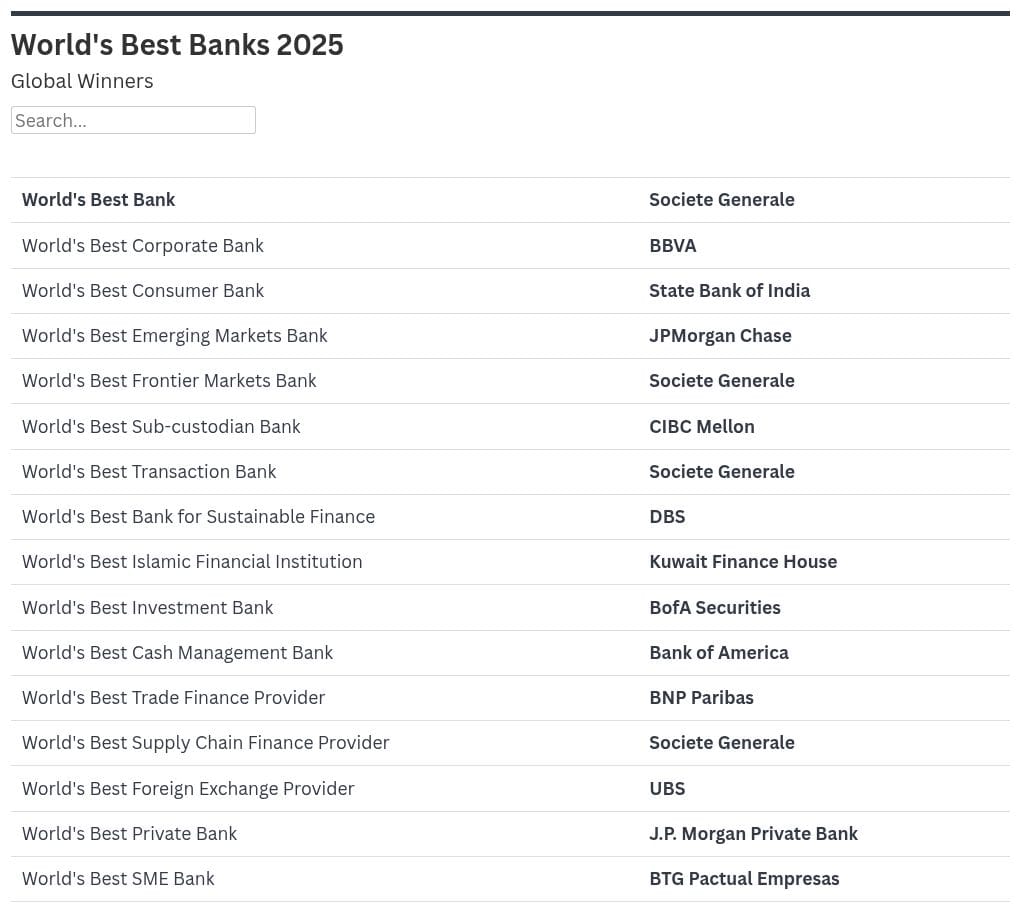

In this environment, French banking giant Societe Generale took numerous crowns, winning as Global Finance’s World’s Best Bank, World’s Best Frontier Market Bank, World’s Best Transaction Bank, and World’s Best Supply Chain Provider—Bank awards.

Throughout 2024, the financial group generated €4.2 billion in group net income (up 69% from the previous year) on €26.8 billion in revenue (up 6.7%) through its 26 million clients worldwide while streamlining its core businesses and divesting others.

The Return Of The M&A

The bright spot for 2024 was the return of M&A.

“On the surface, it may appear difficult to remain sanguine after anticipating a full market resurgence for several years,” wrote Jake Henry and Mieke Van Oostende, senior partners at McKinsey, in the firm’s 2025 annual M&A report. “But many of the dynamics that stymied dealmaking for the past three years, including some that limited 2024 global deal value and volume to roughly the average of the past 20 years, are receding.”

According to data from WTW’s Quarterly Deal Performance Monitor, 15 megadeals worth more than $10 billion each closed last year, a 36% increase from 2023, and there were 162 deals valued between $1 billion and $10 billion, for a 21% increase. The number of deals totaling between $100 million and $1 billion grew approximately 15% over the same period.

Although not the “full throttle comeback that many dealmakers hoped for in 2024, performance improved (in some regions, significantly),” the McKinsey report noted. “Global dealmaking was curbed by a variety of pressures and delivered moderate returns, with deal value up 12% to $3.4 trillion.”

The year’s M&A deals were not evenly distributed geographically, however, according to WTW. North America saw the most deals closed, with 361, up 14% from the previous year. Europe notched 155 deals, up 32% from 2023. In the Asia-Pacific region, companies concluded 163 deals, representing a 5% increase.

Overall, Global Finance’s Best Banks led the way in helping to grow the M&A pipeline.

Along with the World’s Best Bank award, global honors this year include recognition as Best Corporate Bank, Best Consumer Bank, Best Banks Worldwide in Emerging and Frontier Markets, and Best Sub-Custodian Bank. All are being announced here for the first time.

Previously announced honors include Best Global Transaction Bank, Best Bank for Sustainable Finance, Best Islamic Financial Institution, Best Investment Bank, Best Cash Management Bank, Best Trade and Finance Providers, Supply Chain Provider—Bank, Best Foreign Exchange Provider, Best Private Bank, and Best SME Bank.

Methodology

The editors of Global Finance, with input from industry analysts, corporate executives, and technology experts, selected the global winners of the World’s Best Banks 2025 using information provided by entrants as well as independent research based on objective and subjective factors.

Entries are not required, but experience has shown that the information supplied in an entry can increase the chances of success. In many cases, entrants present details that may not be readily available to the editors.

Judges considered performance from January 1 to December 31, 2024. Global Finance applies a proprietary algorithm to narrow the list of contenders and assign a numerical score, with 100 signifying perfection. The algorithm weights a range of criteria for relative importance, including knowledge of the sector, market conditions and customer needs, financial strength and safety, strategic relationships and governance, capital investment and innovation, scope of global coverage, size and experience of staff, risk management, range of products and services, and use of technology. The panel tends to favor private-sector banks over government-owned institutions.

The winners in each category are those banks and providers that best serve the specialized needs of corporations engaged in global business.

World’s Best Bank 2025

Societe Generale

In a year of economic uncertainty, persistent inflation and supply chain reorganization, Societe Generale stood head and shoulders above its global competition, earning the titles of World’s Best Bank and World’s Best Frontier Market Bank.

Its three core businesses—French Retail Banking; Global Banking and Investment Solutions; and Mobility, International Retail Banking, and Financial Solutions—generated €4.2 billion in group net income (up 69% from the previous year) on €26.8 billion in revenue (up 6.7%).

Throughout the year, Societe Generale combined strategic investments in cutting-edge technology, sustainability, and innovation with a drive to streamline core businesses while divesting non core areas.

The French banking giant has leveraged AI in approximately 420 use cases across its operations to enhance customer support via its Sobot chatbot and Elliot callbot, personalize advice for private banking clients using its Synoé platform, and numerous middle- and back-office operational, security, and risk management functions.

The bank surpassed its goal of contributing €300 billion to sustainable finance by 2025, a year ahead of schedule. It has since raised its target to €500 billion, comprising €400 billion in financing and advisory services and €100 billion in sustainable bonds, by 2030. Sustainable finance deals, including acting as the mandated lead arranger for a $1.2 billion green loan that enabled ReNew Power to develop a combined wind, solar, and battery storage infrastructure in its home market of India, have helped Societe Generale maintain a leading global role in this field.

Among the new offerings the bank debuted in 2024 were a joint venture with AllianceBernstein, dubbed Bernstein, which combines the two companies’ equity research, sales, and trading operations.

Societe Generale meanwhile strengthened its capital base by simplifying its business model, improving efficiency and increasing existing synergies through a series of strategic divestitures. It exited its private banking operations in the UK and Switzerland with the sales of SG Kleinwort Hambros and Societe Generale Private Banking Suisse and continued divestment of its African subsidiaries in Benin, the Democratic Republic of Congo, Madagascar, and Morocco.

Despite these changes, Societe Generale remains the leading player in frontier markets through its Global Transaction Banking network, which spans more than 50 countries and offers a range of integrated services including managing cross-border payments, liquidity, and trade finance. Leveraging its expertise in sustainability, the bank has partnered with the International Finance Corporation to accelerate financing of energy transition projects in developing markets through its Solar Pack initiative.

World’s Best Corporate Bank 2025

BBVA

BBVA claims the title of World’s Best Corporate Bank for the third consecutive year, having expanding its market share and deal leadership during 2024. It led 86 deals across telecommunications, energy, infrastructure, consumer goods, and services for a total volume of €5.16 billion. Among these was the €6.6 billion underwriting of MasOrange, formed by the merger of the telecom companies Orange and MasMovil.

BBVA also reinforced its commitment to sustainable finance, leading the €383 million project financing of Repsol Renovables’ Gallo portfolio, a 777-megawatt solar and battery storage facility spanning Texas and New Mexico as well as the refinancing of the Monegros wind project in Aragón. Additionally, the bank directed €51.1 billion into sustainable financing throughout the year.

All told, BBVA’s Corporate & Investment Banking division earned some €5.8 billion in revenue in 2024, up 27% from the previous year, while increasing its net attributable profits by 30%.

Helping to fuel its growth has been the bank’s strategic investment in its infrastructure and technology partnerships. BBVA’s internal AI Factory has applied AI and machine learning to enhance customer experiences and streamline internal processes.

World’s Best Consumer Bank 2025

State Bank of India

Continued investment in digitalization, a growing global footprint, and innovative offerings earned the State Bank of India (SBI) its first World’s Best Consumer Bank award. Building on a history that dates back to 1806, SBI continues to enhance a menu of digital offerings that serve 132 million internet banking and 287 million mobile banking clients.

SBI reimagined its You Only Need One (YONO) banking and lifestyle mobile app in 2024 with its midyear announcement of YONO 2.0. The latest version enables users to initiate transactions at an SBI branch and complete them on the app, and vice versa, and features a more modular architecture for faster processing and transaction speeds. Other innovations include the debut of a tap-and-pay function in its BHIM SBI personal banking app, which leverages India’s Unified Payment Interface, as well as an end-to-end digital loan application for the bank’s Surya Ghar Loan scheme for the installation of rooftop solar collectors.

Despite its stress on digitalization, SBI also invested in 600 new branches across India to improve accessibility for underserved rural and semi-urban areas: more than fourfold the number of branches it opened the previous fiscal year.

World’s Best Emerging Markets Bank 2025

JPMorgan Chase

One of the largest financial institutions globally, JPMorgan Chase (JPMC), wins the World’s Best Bank for Emerging Markets award for its broad set of offerings, continued focus on serving emerging markets, and overall expertise.

Although many of its competitors are pulling out of emerging markets, JPMC is expanding into them. It plans to enter new African markets or deepen its existing presence there “every couple of years or so,” Chairman and CEO Jamie Dimon told Reuters last October. The bank set up a representative office in Kenya that month and new offices in Côte d’Ivoire later in the year.

JPMC had a strong 2024, raising more than $400 billion in emerging market debt, including on a rising number of debt-for-nature transactions that enable countries to repurchase existing debt on better terms and use the savings to benefit the environment. El Salvador utilized the structure to secure an approximately $1 billion loan from the bank, then used it to repurchase $1.03 billion in a tender offer. The savings were allocated to improve and protect the country’s Lempa River watershed.

Besides raising debt, JPMC’s advisory services were strengthened by the launch of a Center for Geopolitics, which provides expert analysis of geopolitical trends aimed at helping clients navigate the complexities of the global economy, manage risks, and identify new opportunities.

Emerging market clients also benefit from the bank’s global infrastructure and sizable investment in its technology platforms, JPMC says. Access to these cutting-edge systems gives clients a more efficient, secure, and convenient way to manage their finances and business operations.

World’s Best Frontier Markets Bank 2025

Societe Generale

Frontier markets are playing an increasingly important role in the global economy, as they offer significant growth, albeit with smaller capitalization and higher volatility. Banks serving frontier markets must provide a comprehensive blend of corporate and commercial banking services that go beyond lending and deposits to more complex offerings, such as trade finance, securities servicing and sustainable finance. French banking giant Societe Generale is a leader across the board, with its broad range of offerings, and has beaten out its competitors to win this year’s World’s Best Frontier Market Bank award.

The bank, with over 160 years of experience, boasts a global network spanning more than 50 countries and offers highly integrated solutions for trade finance, cross-border payments, and liquidity management.

Through increased investment in artificial intelligence and other technologies, the bank has automated numerous processes and digitized others. In securities servicing, the company has leveraged generative AI, smart workflows, and robust data management to provide an enhanced client experience for its corporate and institutional clients, resulting in a doubling of client recommendation rates and increased participation in satisfaction surveys.

Meanwhile, Societe Generale has made great leaps in sustainable finance. The bank has committed 300 billion euros to sustainable finance by 2024 and introduced a new target of 500 billion euros by 2030, with a focus on decarbonization in sectors with the highest carbon-intensive emissions. To further strengthen its position, the bank also launched its Sustainable Global Transaction Banking Framework, which enables businesses to assess and monitor the environmental and social impacts of their working capital, trade, and liquidity management activities.

Societe Generale also signed a collaboration framework agreement with the World Bank’s International Finance Corporation to accelerate sustainable finance through investments in clean energy, water, and other infrastructure projects, as well as in agribusiness and women entrepreneurs.

World’s Best Transaction Bank 2025

Societe Generale

Societe Generale excels at navigating the complexities of realtime payments, offering rigorous testing and dedicated IT support including client training. While clients expect similar functionalities for domestic and cross-border payments, Jean-François Mazure, head of Cash Clearing Services, notes that they struggle to differentiate. Converging both payment types, which hinges on interlinking financial market infrastructures, is critical, he argues.

Numerous market initiatives, including immediate cross-border payments (IXB) between the US and Europe, face significant hurdles, Mazure warns: “It is truly complex from a compliance and legal framework standpoint. So, for the moment, none of these initiatives has succeeded in scaling up.”

To interconnect real-time payment systems, he says, the most likely way forward is to adopt the “one leg out” (OLO) principle already in operation for transactions involving one bank inside the European Economic Area and one bank outside. But all parties will need to continue to align for interconnectivity to be achieved, he adds. OLO’s success hinges on compliance with ISO 20022 standards as well as resolving commercial and liability challenges across various schemes.

World’s Best Sub-custodian Bank 2025

CIBC Mellon

CIBC Mellon continues to refine its comprehensive asset-servicing business model, emphasizing innovation, process efficiency, and client service. Jointly owned by Bank of New York Mellon and Canadian Imperial Bank of Commerce, CIBC Mellon leverages CIBC’s local knowledge in the Canadian market combined with BNY’s technology and global custody infrastructure to serve institutional clients in Canada and globally. The combination has yielded consistent growth; assets under administration recently surpassed C$3 trillion ($2.2 trillion).

Ongoing priorities focus on broadening customer relationships and services through continual investment in IT and partnerships with the fintech sector, aimed at providing greater levels of core service automation along with enhanced transaction transparency and execution efficiency. This includes better straight-through processing for a seamless and secure transmission of client data, investment in pre- and post-trade communication services for trade matching and routing, and tracking of the settlement lifecycle.

Project Fuel, an enterprise-wide data and innovation initiative, is focused on transforming the client experience by equipping customers with tools to manage and analyze data more effectively, improving transparency and accelerating decision-making.

CIBC Mellon continues to enhance its online reporting platform, NEXEN, which integrates data and predictive analytics to provide clients with faster, real-time cash position and activity reporting through an improved user interface. Digital assets are expanding in the market; the bank is collaborating with stakeholders in Canada and globally and with BNY’s digital-asset unit to develop offerings in this area. This involves bolstering its data analytics capabilities and digital infrastructure through enhanced customization, automation, and service flexibility with a view to assisting clients to launch new offerings including alternative-asset ETFs and cryptocurrency funds.

World’s Best Bank for Sustainable Finance 2025

DBS

DBS aims to green Asia’s economy by acting as an environmental-transition catalyst for anchor companies, mid-caps, and SMEs. The bank provides transition-related financing for these organizations at the corporate, project, and asset levels. Among its offerings are green, sustainability-linked, and social loans and bonds, along with carbon-market financing and other products.

Standout transactions in 2024 included a loan to LG Energy to construct a plant in Poland that manufactures batteries used in electric vehicles. A HK$3 billion (about $385.7 million) loan to the Hong Kong Housing Society will help create affordable residential projects. A S$300 million (about $224.2 million) bond will help Singaporean developer CapitaLand develop projects in alignment with green finance frameworks.

In addition, the bank develops analytical tools to track and analyze climate data and engages with industries—notably in the power, automotive, steel, shipping, and real estate sectors—and policymakers to chart paths to a healthier environment.

World’s Best Islamic Financial Institution 2025

Kuwait Finance House

Kuwait Finance House (KFH) is recognized as the World’s Best Islamic Financial Institution for strengthening its franchise in multiple markets, for financing innovation, and for its overall operating performance. KFH provides services to customers in the Middle East, Europe, and Asia through extensive distribution channels, with an increasing emphasis on digitalization. The bank has subsidiaries in Kuwait, Turkey, Egypt, Bahrain, Iraq, Malaysia, the UK, and Germany.

KFH has made significant strides toward digital transformation in risk management, adopting the latest advancements in AI, machine learning, and advanced analytics to enhance risk measurement and monitoring. Tam Digital Bank, KFH’s digital bank in Kuwait, recorded strong customer numbers and transaction growth in 2024.

The bank’s financial profile is noticeably sound; a successful capital management program yielded a capital adequacy ratio (CAR) of 19.9%, considerably exceeding regulatory requirements and promising to support growth in the coming years. Return on average assets is good at 1.8% and loan asset-quality metrics are robust. KFH’s Islamic banking products and services cover commercial, retail, and corporate banking as well as real estate, trade finance, project finance, asset management, and investments.

World’s Best Investment Bank 2025

BofA Securities

Against the backdrop of thriving global stock markets and rising debt-finance activity, Bank of America (BofA) Securities’ global operations achieved an impressive 43% year-over-year jump in investment banking fees as of the fourth quarter of 2024.

The numbers were buoyed mainly by the bank’s three big areas of operations: North America, Latin America, and Europe, where the bank controlled a commanding 8.3%, 9%, and 4.4% of total investment banking fees, respectively. That boosted revenue for the full year to nearly $5.5 billion, according to Dealogic, representing around 6.2% of the global investment banking market.

BofA also scored big on M&A despite somewhat subdued activity in the field, serving as lead buy-side advisor on the $1.9 billion acquisition of Hawaiian Airlines by Alaska Air. The bank also acted as sole buy-side financial advisor on Keurig Dr Pepper’s $990 million acquisition of energy beverage company GHOST.

World’s Best Bank for Cash Management 2025

Bank of America

Reflecting the demand for consistent global visibility and control, Bank of America saw the app version of its CashPro platform surpass $1 trillion in payment approvals in 2024. CashPro allows clients to manage treasury operations across multiple channels: online, app, APIs, and file-based interfaces.

“One thing that distinguishes CashPro is its global consistency,” says Tom Durkin, head of CashPro at BofA’s Global Payments Solutions, “so that when a company’s finance team has team members in different countries, they’ll all have access to the same tools, views, and processes. The advantages are obvious: better visibility and control and no additional financial outlays.”

Much of CashPro’s success is due to BofA’s close engagement with clients, Durkin notes, particularly those who participate in client board meetings.

“This dialogue is so important,” he says. “We do deep dives into our clients’ priorities and challenges, we present options for new functionality and discuss whether those innovations are going to solve their real-world issues.”

The bank’s strategic vision for CashPro “will always be to provide a best-in-class platform that is personalized, predictive, and proactive,” he adds. “One recent demonstration is how we’ve embedded CashPro into our clients’ own systems through the CashPro Network, a collaboration with third-party providers allowing quick, easy connection to the bank with little to no investment.”

World’s Best Trade Finance Provider 2025

BNP Paribas

Offering global trade finance in 44 countries and more than 100 trade centers across more than 60 countries gives BNP Paribas a strong geographical foundation for its offering of seamless trade finance solutions across borders, supporting client growth throughout the entire trade cycle.

A broad range of traditional trade finance and working capital management solutions and substantial investment in technology, including web-based e-banking platforms like Connexis Guarantee, Connexis Trade, and Connexis Supply Chain, helps the French multinational support clients with complex international trade operations. Leveraging digital solutions, such as blockchain and AI, streamlines processes, improves efficiency, and enhances customer experience.

In 2022, BNP Paribas launched a program using AI to streamline the processing of trade finance documents and improve traceability for its clients. Since then, the bank has rolled the program out to 15 countries and processed 40,000 transactions.

“We have implemented AI technology to help classify, extract data, and automate controls. This is live today and being further expanded in terms of functionalities,” says Jean-François Denis, global head of Trade Solutions. “Bank guarantees also present the potential for AI usage, such as verifying guarantee clauses against acceptable clauses, policies, and guidelines. Anti-money laundering is yet another area where we have deployed AI.”

World’s Best Supply Chain Finance Provider – Bank 2025

Societe Generale

The French banking giant introduced a new workflow product in 2024 that includes external data and better analyzes clients’ working capital needs. The new offerings include peer comparison of key receivables and payables financing elements.

On the sustainability front, Societe Generale offers an ESG version of its full range of solutions, including green or social-focused factoring, forfaiting, and sustainability-linked supply chain financing (SCF). The bank also offers a dedicated and simplified solution for retail clients and SMEs based on their ESG rating.

Finally, establishing connectivity to CRX Markets, the marketplace for working capital finance, has improved support for SocGen’s largest clients, helping to grow the bank’s SCF programs.

World’s Best Global Foreign Exchange Bank 2025

UBS

Upon completing its megamerger with Credit Suisse in May 2024, UBS leveraged its already best-in-class corporate banking, foreign exchange (FX), and product offerings for a record-breaking year. Not only did its global operation more than double analysts’ expectations in the third quarter of 2024, booking a massive $1.4 billion in net income, but it did so with a significant contribution from its corporate banking division, which saw revenue jump by more than 8% year over year.

Those numbers received a massive boost from UBS’s thriving FX operation, which averaged over $125 billion in daily electronic FX trades, with more than 2,500 active global clients. The bank posted substantial growth across several geographies and currency pairs. Among the highlights: solid profitability growth in Middle Eastern and Northern African currencies and a massive 40% market-share increase in Scandinavian currencies. In Asia, UBS’s continued efforts to improve its already top-tier suite of electronic FX capabilities paid off handsomely in China and Singapore, where it has doubled down on its data center improvement efforts.

On the technology front, UBS further expanded the limits of the global FX market, hosting the world’s first intraday FX swap in a regulated venue in July. The bank recently launched its blockchain-based multicurrency payment solution, UBS Digital Cash, processed through its flagship FX Engine Room, enhancing its overall FX offering.

World’s Best Private Bank 2025

J.P. Morgan Private Bank

For the fifth consecutive year, J.P. Morgan US Private Bank has excelled at adapting to shifting macroeconomic conditions, delivering best-in-breed results to its clients. Riding the phenomenal rebound in global investing built on improving monetary conditions and subsiding inflationary pressures, the bank saw client assets rise by 24% over the previous year, totaling more than $2.5 trillion under supervision.

Against this backdrop, revenues increased 18.5%, with pretax income showing an even more significant 36% boost year on year.

On the product side, J.P. Morgan made significant strides at integrating advanced AI tools, including JPMorgan Chase’s Connect Coach and the Chase Connect mobile app, into its award-winning product portfolio. These include risk analytics and portfolio management services that serve as a benchmark for many in the industry. Alongside these product advances, the bank added over 300 expert advisors to its team, helping it attract more than 5,400 new clients.

World’s Best SME Bank 2025

BTG Pactual Empresas

BTG Pactual Empresas boasts an SME lending portfolio that reached R$22.1 billion (approximately $3.9 billion) in the first quarter of 2024, its SME credit book growing 52% year on year. SME business now accounts for 12% of BTG Pactual’s total portfolio.

The bank attributes its SME growth in part to its digital capabilities. Its digital platform offers an integrated portfolio of SME products and services, providing access to the bank’s credit, guarantee, insurance, investments, foreign exchange, and derivatives products. Associated services accessible via the platform include creation of invoices payable by QR code; online invoicing; instant electronic bank transfers; open banking; payments to suppliers, tax authorities, and utilities; budgeting and categorized spending services; and digital receipts. The platform offers more than 45 integrations, including Telegram and Google Workspace, along with a extensive range of productivity improvement products.

Speed is a crucial benefit. The platform enables BTG to disburse 95% of its loan funds in less than 10 minutes, the bank says, 16 times faster than its competitors.

Agriculture is a big part of the Brazilian economy, and BTG offers services tailored to the sector including credit lines for agricultural products (fertilizers, pesticides, seeds); equipment financing; and infrastructure financing for the construction of silos, warehouses, and other facilities.

Activities addressing ESG issues are also important to BTG. Of its loans to corporations and SMEs, 72% are subject to social, environmental, and climate-risk analysis, in line with international best practices. R$8.9 billion of its lending portfolio aligns with the bank’s sustainable financing framework.