Tesla’s stock price relies on the fate of one key growth opportunity.

Despite a difficult start to the year, Tesla (TSLA 2.27%) stock is now up by double digits in 2025. With a market cap of $1.3 trillion, however, many investors are wondering how much additional growth potential shares offer. Some analysts think that Tesla can become a $2 trillion business by the end of 2026. But there are some key risks to be aware of before loading up on Tesla stock.

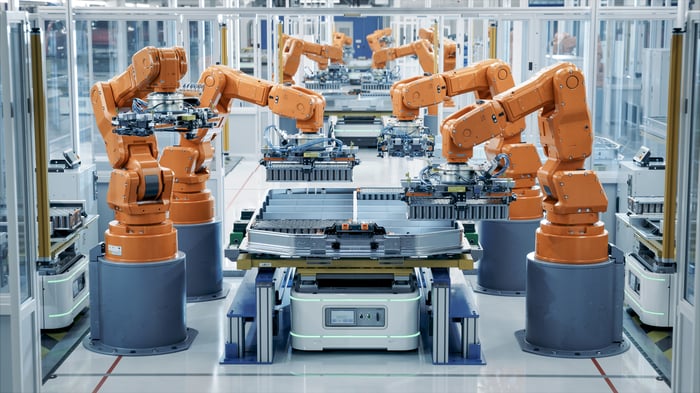

Image source: Getty Images.

Tesla trades at a steep premium to Rivian and Lucid Group

The biggest risk facing Tesla right now is the stock’s premium valuation. Shares trade at a price-to-sales ratio of around 16. Other electric car stocks like Lucid Group and Rivian have stocks that trade between 3 and 7 times sales. According to this metric, Tesla trades at a 100% to 400% premium over the competition. That’s the case even though competitors like Rivian and Lucid have market caps under $20 billion, theoretically providing much longer growth runways versus Tesla’s $1.3 trillion valuation.

Of course, paying a high premium isn’t a problem if the company in question is growing fast enough to justify such a valuation. A company that trades at 16 times trailing sales, for instance, would trade at just 8 times sales one year from now if revenues grew by 100%. That is far from the case for Tesla, however.

This year, analysts expect Tesla’s sales to fall by around 5%. For comparison, Lucid and Rivian are expected to see sales grow by 61% and 6%, respectively. Next year, analysts do expect positive growth to return for Tesla, with 20% sales growth expected. But Lucid and Rivian are still expected to see higher sales growth than Tesla, with 93% and 33% expected sales growth, respectively.

So at least on a price-to-sales basis, Tesla shares trade at a hefty premium to both Lucid and Rivian even though its expected sales growth both this year and next year are below that of both companies. What’s up with that?

To be sure, competitors like Rivian and Lucid don’t have the scale or brand name recognition that Tesla does. But as mentioned, both also have arguably much more room to grow long term. The main differentiator is current or near-term growth, but long term growth potential in a new and exciting — but possibly overhyped — business segment: robotaxis.

Source: Getty Images

Robotaxis could become a $1 trillion business for Tesla

Analysts are very bullish on Tesla’s robotaxi dreams. The company launched a pilot version of its autonomous taxi service this summer in Austin, Texas. Additional cities like San Francisco may soon be on the way. Tesla CEO Elon Musk optimistically believes there could be 1 million or more Tesla robotaxi’s roaming the streets of America by the end of 2026.

How big could this business be for Tesla? Dan Ives, an analyst at Wedbush Securities, believes it could soon add $1 trillion to Tesla’s market cap. Cathie Wood, a high-profile, outspoken Tesla investor, believes the overall market could eventually be worth $10 trillion. Tesla is uniquely positioned to take on this market, with its large production facilities, multi-year investments in autonomous driving, and its sheer access to capital.

Even if Tesla’s robotaxi service stumbles in its first year — which many skeptics predict — the growth opportunity is clearly immense. And as mentioned, Tesla is uniquely capable of taking a leading role in this new industry. But as Reuters recently pointed out, “getting from dozens to millions of self-driving cars won’t be easy.” This should be viewed as a multi-decade opportunity for Tesla, not a near-term reality. Tesla’s bumpy rollout in Austin should be a testament to that fact.

Tesla’s stock price is reasonable for long-term investors who believe in the company’s robotaxi aspirations. But the premium is far too high for a simple EV manufacturer with smaller business segments in energy storage and generation. Tesla remains an exciting company to watch, but investors must be bullish on robotaxis over the long haul to justify a position.

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.