The state law that shielded Southern California Edison and other utilities from liability for wildfires sparked by their equipment came with a catch: Top utility executives would be forced to take a pay cut if their company’s safety record declined.

Edison’s safety record did decline last year. The number of fires sparked by its equipment soared to 178, from 90 the year before and 39% above the five-year average.

Serious injuries suffered by employees jumped by 56% over the average. Five contractors working on its electric system died.

As a result of that performance, the utility’s parent company, Edison International, cut executive bonuses awarded for the 2024 year, it told California regulators in an April 1 report.

For Edison International employees, planned executive cash bonuses were cut by 5%, and executives at Southern California Edison saw their bonuses shrink by 3%, said Sergey Trakhtenberg, a compensation specialist for the company.

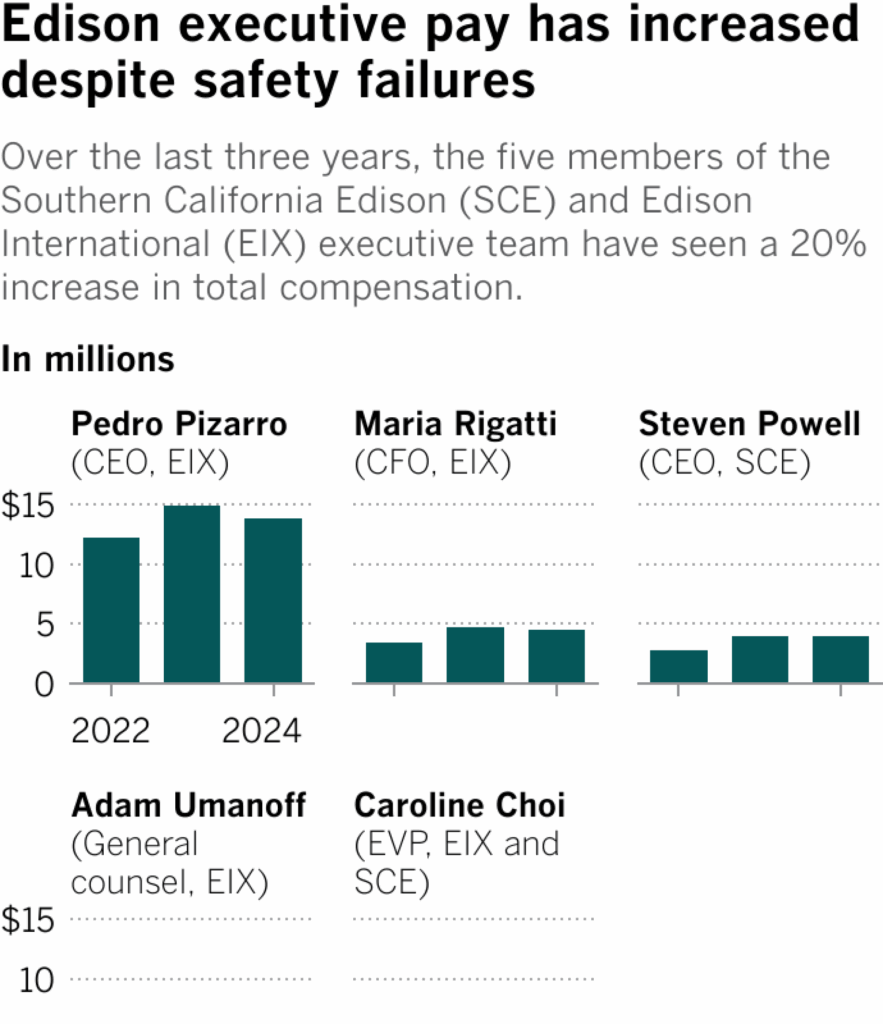

But cash bonuses for four of Edison’s top five executives actually rose last year, by as much as 17%, according to a separate March report by Edison to federal regulators. Their long-term bonuses of stock and options, which are far more valuable and not tied to safety, also rose.

Of the top five executives, only Pedro Pizarro, chief executive of Edison International, saw his cash bonus decline. He received a cash bonus of 128% of his salary rather than the planned 135% because of the safety failures, the company said, for total compensation including salary of $13.8 million.

The cash bonuses increased for the other top four executives despite the safety-related deductions because of how they performed on other responsibilities, said Trakhtenberg, Edison’s director of total rewards. He said bonuses would have been higher were it not for safety-related reductions.

“Compensation is structured to promote safety,” Trakhtenberg said, calling it “the main focus of the company.”

Consumer advocates say the fact that bonuses increased in spite of the decline in safety highlights a flaw in AB 1054, the 2019 law that reduced the liability of for-profit utility companies like Edison for damaging wildfires ignited by their equipment.

AB 1054 created a wildfire fund to pay for fire damages in an effort to ensure that utilities wouldn’t be rendered insolvent by having to bear billions of dollars in damage costs.

In return, the legislation said executive bonus plans for utilities should be “structured to promote safety as a priority and to ensure public safety and utility financial stability.”

“All these supposed accountability measures that were put into the bill are turning out to be toothless,” said Mark Toney, executive director of The Utility Reform Network, a consumer advocacy group in San Francisco.

“If executives aren’t feeling a significant reduction in salary when there is a significant increase in wildfire safety incidents,” Toney said, “then the incentive is gone.”

One of the executives who received an increased cash bonus was Adam Umanoff, Edison’s general counsel.

Umanoff was expected to get 85% of his $706,000 salary, or $600,000, as a cash bonus as his target at the year’s beginning. The deduction for safety failures reduced that bonus, Trakhtenberg said. But Umanoff’s performance on other goals “was significantly above target” and thus increased his cash bonus to 101% of his salary,

So despite the safety failures, Umanoff received a cash bonus of $717,000, or 19% higher than he was expected to receive.

“If you can just make it up somewhere else,” Toney said, “the incentive is gone.”

The utility recently told its investors that AB 1054 will protect it from potential liabilities of billions of dollars if its equipment is found to have sparked the Eaton fire on Jan. 7, resulting in 18 deaths and the destruction of thousands of homes and commercial buildings.

The cause of the blaze, which videos captured igniting under one of Edison’s transmission towers, is still under investigation. Pizarro has said the reenergization of an idle transmission line is now a leading theory of what sparked the deadly fire.

The 2019 legislation was passed in a matter of weeks to bolster the financial health of the state’s for-profit electric companies after the Camp fire in Butte County, which was caused by a Pacific Gas & Electric transmission line.

The wildfire destroyed the town of Paradise and killed 85 people, and the damages helped push PG&E into bankruptcy.

At the bill-signing ceremony, Gov. Gavin Newsom touted its language that said utilities could not access the money in a new state wildfire fund and cap their liabilities from a blaze caused by their equipment unless they tied executive compensation to their safety performance.

In April, Edison filed its mandatory annual safety performance metrics report with the Public Utilities Commission as it seeks approval to raise customer electric rates by more than 10% this year.

In the report, Edison said that because its safety record worsened in 2024 on certain key metrics, its executives took “a total deduction of 18 points” on a 100-point scale used in determining bonuses.

“Safety and compliance are foundational to SCE, and events such as employee fatalities or serious injuries to the public can result in meaningful deduction or full elimination” of executive incentive compensation, the company wrote.

Edison didn’t explain in the report what an 18-point deduction meant to executives in actual dollar terms, another point of frustration with consumer advocates trying to determine if executive compensation plans genuinely comply with AB 1054.

“Without seeing dollar figures, it is impossible to ascertain whether a utility’s incentive compensation plan is reasonable,” the Public Advocates Office at the state Public Utilities Commission wrote in a 2022 letter to wildfire safety regulators.

To try to determine how much the missed safety goals actually impacted the compensation of Edison executives last year, The Times looked at a separate federal securities report Edison filed for investors known as the proxy statement.

In that March report, Edison detailed how the majority of its compensation to executives is based on its profit and stock price appreciation, and not safety.

Safety helps determine about 50% of the cash bonuses paid to executives each year, the report said. But more valuable are the long-term incentive bonuses, which are paid in shares of stock and stock options and are based on earnings.

The Utility Reform Network, which is also known as TURN, pointed to those stock bonuses in a 2021 letter to regulators where it questioned whether Edison and the state’s other two big for-profit utilities were actually tying executive compensation to safety.

“Good financial performance does not necessarily mean that the utility prioritizes safety,” TURN staff wrote in the letter.

Trakhtenberg disagreed, saying the company’s “long-term incentives are focused on promoting financial stability.” A key part of that is the company’s ability “over the long term to safely deliver reliable, affordable power,” he said.

Trakhtenberg noted that the state Office of Energy Infrastructure Safety had approved the company’s executive compensation plan in October, saying it met the requirements of AB 1054, as well as every year since the agency was established in July 2021.

The Times asked the energy safety office if it audited the utilities’ compensation reports or tried to determine how much money Edison executives lost because of the safety failures.

Sandy Cooney, a spokesman for the agency, said that the office had “no statutory authority … to audit executive compensation structures.” He referred the reporter to Edison for information on how much executive compensation had actually declined in dollar amounts because of the missed safety goals.

A committee of Edison board members determines what goals will be tied to safety, Trakhtenberg said, and whether those goals have been met.

Even though five contractors died last year while working on Edison’s electrical system, the committee didn’t include contractor safety as a goal, according to the company’s documents.

And the committee said the company met its goal in protecting the public even though three people died from its equipment and there was a 27% increase in deaths and serious injuries among the public compared to the five-year average.

Trakhtenberg said most of the serious injuries happened to people committing theft or vandalism, which is why the committee said the goal had been met.

Edison has told regulators that if its equipment starts a catastrophic wildfire, the committee could decide to eliminate executives’ cash bonuses.

But the company’s documents show that it hasn’t eliminated or even reduced bonuses for the 2022 Fairview fire in Riverside County, which killed two people, destroyed 22 homes and burned 28,000 acres.

In 2023, investigators blamed Edison’s equipment for igniting the fire, saying one of its conductors came in contact with a telecommunications cable, creating sparks that fell into vegetation.

Trakhtenberg said the board’s compensation committee reviewed the circumstances of the fire that year and found that the company had acted “prudently” in maintaining its equipment. The committee decided not to reduce executive bonuses for the fire, he said.

In March, the Public Utilities Commission fined Edison $2.2 million for the fire, saying it had violated four safety regulations, including by failing to cooperate with investigators.

Trakhtenberg said the compensation committee would reconsider its decision not to penalize executives for the deadly fire at its next meeting.

TURN has repeatedly asked regulators not to approve Edison’s compensation plans, detailing how its committee has “undue discretion” in setting goals and then determining whether they have been met.

But the energy safety office has approved the plans anyway. Toney said he believes the responsibility for reviewing the compensation plans and utilities’ wildfire safety should be transferred back to the Public Utilities Commission, which had done the work until 2021.

The energy safety office has rules that make the review process less transparent than it is at the commission, he said.

“The whole process, we feel is rigged heavily in favor of utilities,” he said.